Today’s currency price, January 12: Bitcoin peaked at $49,000 and was sold off, altcoins rose sharply due to sideways trading in U.S. stocks

[ad_1]

Bitcoin went on to hit a new high of $49,000, its highest level since December 2021, before facing a sell-off.

BTC Price Chart – 1 Day | Source: TradingView

US stocks

U.S. stocks were almost flat on Thursday (January 11), with the latest inflation data reflecting an increase in consumer prices in December 2023.

As of late trading, the Nasdaq Composite Index was trading sideways, closing at 14,970.19 points; the Dow Jones Index rose slightly by 15.29 points (equivalent to 0.04%) to 37,711.02 points; the S&P 500 Index fell back 0.07% to 4,780.24 points. Earlier in the session, the S&P 500 briefly hovered above its all-time closing high of 4,796.56.

The December 2023 CPI consumer price index report was slightly higher than forecast. Specifically, the CPI rose by 0.3% in December 2023, a year-on-year increase of 3.4%, which was higher than the expected increase of 0.2% in December 2023, a year-on-year increase of 3.2%. last year.

However, the core consumer price index, which excludes food and energy prices, was in line with forecasts and suggested inflationary pressures persisted but were cooling. Data released on Thursday suggested interest rate cuts may be slower in the future.

Jon Maier, Chief Investment Officer, Global. Markets may need to face the possibility of volatility as the Federal Reserve may maintain or strengthen its tightening monetary policy stance to combat these inflationary pressures. “

Yields initially rose after the CPI data was released, with the 10-year Treasury yield hitting a high of 4.068% before falling to 3.98%.

Sam Stovall, chief investment strategist at CFRA, said Thursday’s market moves were driven in part by strong expectations around the timing of the Fed’s interest rate cuts, as well as concerns about this quarter’s profit report.

This week kicks off the fourth-quarter 2023 earnings season, with Bank of America, Wells Fargo and JPMorgan Chase set to report results on January 12.

Oil prices rose nearly 1% on Thursday (January 11) after Iran seized an oil tanker off the coast of Oman, increasing the risk of escalating conflicts in the Middle East.

As of the end of the trading day, the WTI oil contract rose 65 cents (equivalent to 0.91%) to $72.02 per barrel. The Brent crude oil contract rose 61 cents (equivalent to 0.79%) to $77.41 per barrel.

Both oil contracts were up more than $2 a barrel early in the session, but fell back on a sudden rise in U.S. inflation and reports that China was importing less from Saudi Arabia.

Bitcoin and altcoins

Bitcoin price hit an intraday low of $45,644 on the Bitstamp exchange.

The largest crypto asset by market capitalization rose from less than $46,000 to over $47,000 early yesterday, before accelerating its gains, reaching as high as $49,042 as the spot Bitcoin ETF officially began trading. It later gave up all its gains and fell below $46,000.

After a period of intense volatility, BTC has maintained modest gains over the past 24 hours and is currently trading around $46,000.

BTC Price Chart – 4 Hours | Source: TradingView

The cryptocurrency market often reacts strongly to news events, and the recently approved Bitcoin ETF is no exception. It is worth noting that the newly launched Bitcoin spot ETF is in high demand, with a total trading volume of $2.3 billion.

If you include the Grayscale Bitcoin Trust (GBTC) and the Bitcoin Strategy ETF (BITO), this number increases to $4.6 billion.

At first, the ETF approval didn’t seem like a half-truth, but the largest cryptocurrency subsequently suffered a serious downturn.

The altcoin market continues to grow as the Bitcoin ETF officially enters trading.

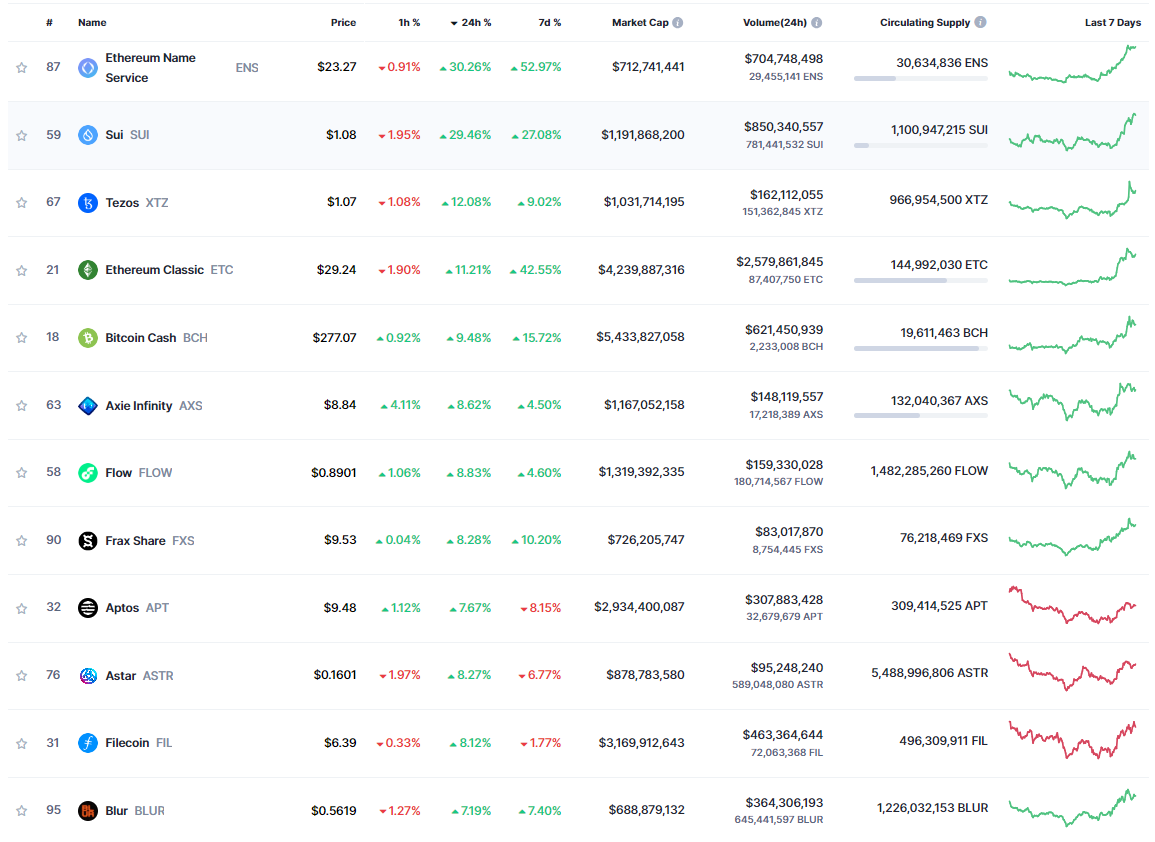

Leading the way are Ethereum Name Service (ENS) and Sui (SUI), two projects that have seen a sudden 30% increase in the past 24 hours.

On the seven-day time frame, ENS rebounded by more than 50%, while Sui managed to erase the previous week’s losses.

Tezos (XTZ) and Ethereum Classic (ETC) also benefited from overall market gains, with XTZ up 13% and ETC up 12% in the short term.

Other projects such as Bitcoin Cash (BCH), Axie Infinity (AXS), Flow (FLOW), Frax Share (FXS), Aptos (APT), Astar (ASTR), Filecoin (FIL), Blur (BLUR), Mina (MINA ), eCash (XEC), Maker (MKR), The Graph (GRT), FTX Token (FTT)… increased from 4-9%.

Source: Coinmarketcap

Ethereum (ETH) continues to gain investor attention as it continues to hit new highs in 2024. The second-largest asset by market capitalization has reached $2,689, its highest level since May 2022, and is now back around $2,600.

ETH Price Chart – 1 Day | Source: TradingView

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

Bitcoin Magazine