Ethereum ETF hype spreads to Ethereum Classic, bringing 50% gain

[ad_1]

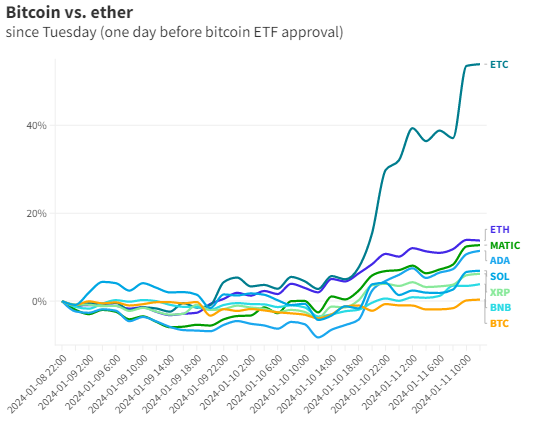

Bitcoin is still retreating from a 21-month high, while ETH prices are rising, shortly after the U.S. Securities and Exchange Commission (SEC) announced the launch of a spot ETF on Tuesday.

ETH has gained more than 16% during this period and is now easily among the 20 best-performing cryptocurrencies by market capitalization. Bitcoin is currently in second place, accounting for about half of the profits.

ETH 4-hour price chart | Source: Tradingview

Due to the SEC’s false announcement, the market sold the truth on the first day of the ETF’s launch, while also appearing to buy the rumors of the Ethereum ETF.

However, Ethereum Classic — the 25th-ranked Ethereum hard fork — is going through a special moment. ETC, the blockchain’s native token, has surged nearly 50% in the past day.

ETC 4-hour price chart | Source: Tradingview

There doesn’t seem to be any real rhythm or reason for ETC’s price to rise so quickly over time.

A lot of people explain Ethereum Classic is preparing for a hard fork later this month to better align the network’s EVM with Ethereum’s EVM. This can help inspire projects with the chain.

Meanwhile, as Ethereum transitions to proof-of-stake in late 2022, the network’s hashrate surges to all-time highs as former ETH miners seek other sources of income to operate mining rigs that utilize their GPUs.

Source: Tradingview

ETH rose from $2,200 to $2,685 this week. ETC rose from $20 to $30.

Even though the network only has about 30,000 transactions per day (which is the baseline for Bitcoin Cash), the majority of Ethereum Classic’s combined hashrate is still hampered.

In terms of scale, Litecoin currently handles over 500,000 transactions per day (driven by Network Inscription Brands), while Ethereum mainnet handles double that. bit infographic.

However, Ethereum Classic has less than 15% of the hash rate recorded by Ethereum prior to the merger.

ETHPoW is a hard fork launched by Ethereum in protest of the merger. It is designed to compete with Ethereum Classic. The current computing power is about 1/10 of Ethereum Classic.

In fact, before the SEC officially approved a Bitcoin spot exchange-traded fund (ETF), ETC had nothing to gain in the past year.

A more likely explanation is that traders want to get ahead of the next big crypto media story: The SEC’s approval of a spot Bitcoin ETF means the final green light for an Ethereum fund is delivered immediately.

Due to lack of liquidity in the market, ETC followed but eventually overtook ETH and took profits in the short term.

Grayscale offers exposure to the token through one of its trusts, and the company is now preparing to convert its $29 billion Bitcoin trust into an ETF.

Some fund issuers have said they may soon seek approval for other cryptocurrency ETFs, including XRP and SOL.

However, the percentage of fund issuers lining up to launch an Ethereum Classic ETF is very small. Even so, there is no shortage of strange things happening in the cryptocurrency space.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to Blockworks