Circle files for U.S. initial public offering

[ad_1]

USDC issuer Circle is again trying to go public after its SPAC deal with Concord Acquisition collapsed in late 2022.

According to a report on January 11, stablecoin operator Circle has filed a confidential S-1 form with the U.S. Securities and Exchange Commission (SEC) Press release Seen by crypto.news. The draft signals Circle’s intention to go public and issue shares through an initial public offering (IPO).

The number of shares Circle intends to offer and the price range for those shares had not been disclosed at press time.

The filing is Circle’s second attempt to go public, but also the company’s first direct IPO. Previously in 2021, the stablecoin company announced a special purpose acquisition company (SPAC) agreement with a publicly traded company called Concord Acquisition, which was founded by veteran investment banker Bob Diamond during the bull market that same year Founded.

The stablecoin provider plans to double its market capitalization to over $9 billion through a merger with Diamond-owned Concord.

Although Circle filed an S-4 with the SEC at the time, the deal eventually fell apart in late 2022/early 2023. Circle CEO Jeremy Allaire said the move was terminated because his company did not meet the SEC’s eligibility period. When a company seeks authorization to sell new shares, it files an S-4 document.

At that time, Allaire famous “The wait for approval is extremely long,” citing Gary Gensler’s delayed SEC feedback. However, the CEO also insisted that Circle’s plans to go public have not changed.

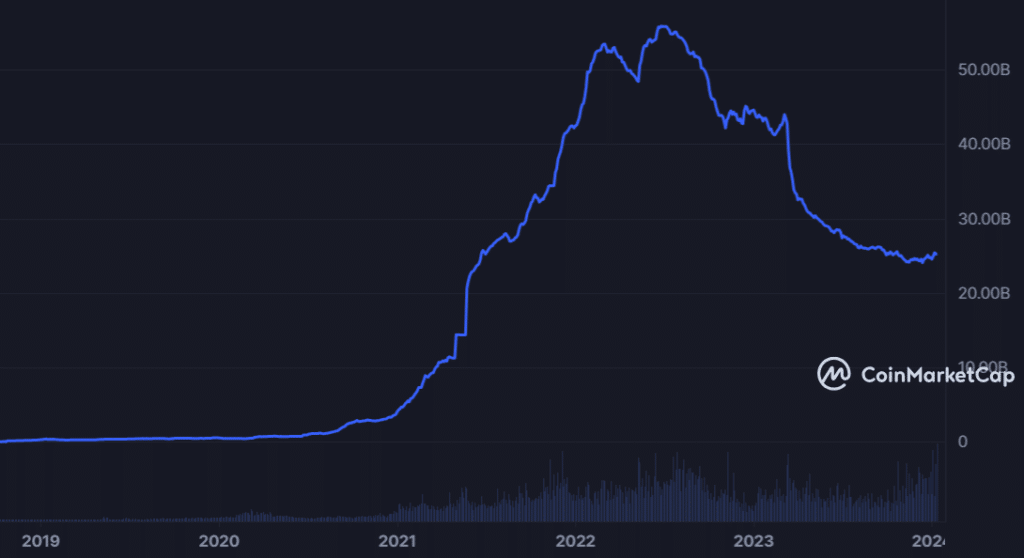

The USD Coin (USDC) token is the second largest stablecoin in the cryptocurrency space, making Circle the second largest operator after Tether. USDC is pegged to the U.S. dollar and has a market capitalization of over $25 billion. While this figure places Circle’s product among the top 10 cryptocurrencies globally, USDC’s market capitalization has fallen by nearly 50% over the past year.

Additionally, the coin experienced turmoil in the first quarter of 2023 following a series of bank runs and a U.S. banking crisis involving several large financial institutions such as Silicon Valley Bank. More than a year later, Circle is expanding across Europe, targeting key licenses to grow its market share.