Pantera and VanEck prepare to invest in spot Bitcoin ETF if approved

[ad_1]

Four potential spot Bitcoin ETF issuers have disclosed initial seed capital of more than $10 million before the SEC decides on a bid.

VanEck surpassed BlackRock in direct investments in its spot Bitcoin ETF, according to a personal filing with the U.S. Securities and Exchange Commission (SEC).Van Eyck has sowing Its bid was $72.5 million.

Cryptocurrency investment firm Bitwise injects $500,000 into its Bitcoin (BTC) ETF, but also injects $200 million in cash expected If the SEC approves the application, it will come from Pantera Capital.

BlackRock and Fidelity injected $10 million and $20 million respectively into their BTC funds. These disclosures were made or fully confirmed in an amended Form S-1 filed with the SEC on January 8.

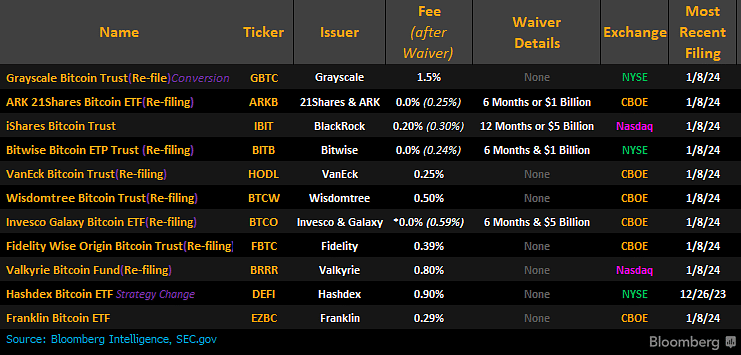

The updated filings, which include S-3 forms from companies such as Grayscale, also reveal the fees these issuers plan to charge, crypto.news reported. GBTC providers charge the highest fees at 1.5%, Shock Experts consider it far superior to its competitors.

Five firms, including Invesco Galaxy, will offer fee waivers, allowing investors to trade select Bitcoin ETF spot at a discounted cost for up to six months. Bitwise plans to charge the lowest fee of 0.24%, followed by ARK 21 Shares and BlackRock, which charge 0.25% and 0.3% respectively.

The documents may indicate that the market is about to decide whether to accept or reject a spot Bitcoin ETF, allowing U.S. investors to trade BTC through a regulated vehicle for the first time.

Reflecting its long-term vision and strong optimism for the spot BTC ETF, VanEck has committed 5% of its potential profits to support core Bitcoin developers. The company has donated $10,000 to the cause.