LINK supply hits low on CEX – is it time for price to recover?

[ad_1]

Chainlink (LINK) prices have fallen more than 12% over the past week amid speculation that the U.S. Securities and Exchange Commission (SEC) has rejected a Bitcoin spot exchange-traded fund (ETF). However, the coin’s on-chain indicators paint a positive picture for LINK’s price recovery this week.

A reduction in Chainlink exchange supply and an increase in the total number of wallet addresses may help LINK erase some of its weekly losses and begin to recover.

LINK on-chain indicators support bullish sentiment

The altcoin’s supply on exchanges has hit a six-month low, accounting for 8.46% of LINK’s total supply, according to Santiment data. The exchange traffic indicator is consistent with a decrease in exchange supply, as it shows exchanges experiencing LINK outflows in early January.

Typically, a reduction in exchange supply is interpreted as a reduction in selling pressure on the asset. Therefore, this on-chain indicator supports the recovery thesis.

supply association Exchanges as a percentage of total supply | Source: Santiment

The 30-day Market Value to Real Value (MVRV) indicator provides the basis for the bullish outlook expressed by on-chain indicators. The MVRV ratio helps determine the average profit or loss for investors who purchased LINK over the past month.

Based on Chainlink’s history, falling below the zero line is an opportunity zone for the asset. Currently, LINK’s 30-day MVRV is -10.63%, as shown on Santiment. As a result, 10.63% of investors who purchased LINK in the past 30 days suffered unrealized losses. This supports asset recovery as traders generally do not lose money.

MVRV rates and prices | Source: Santiment

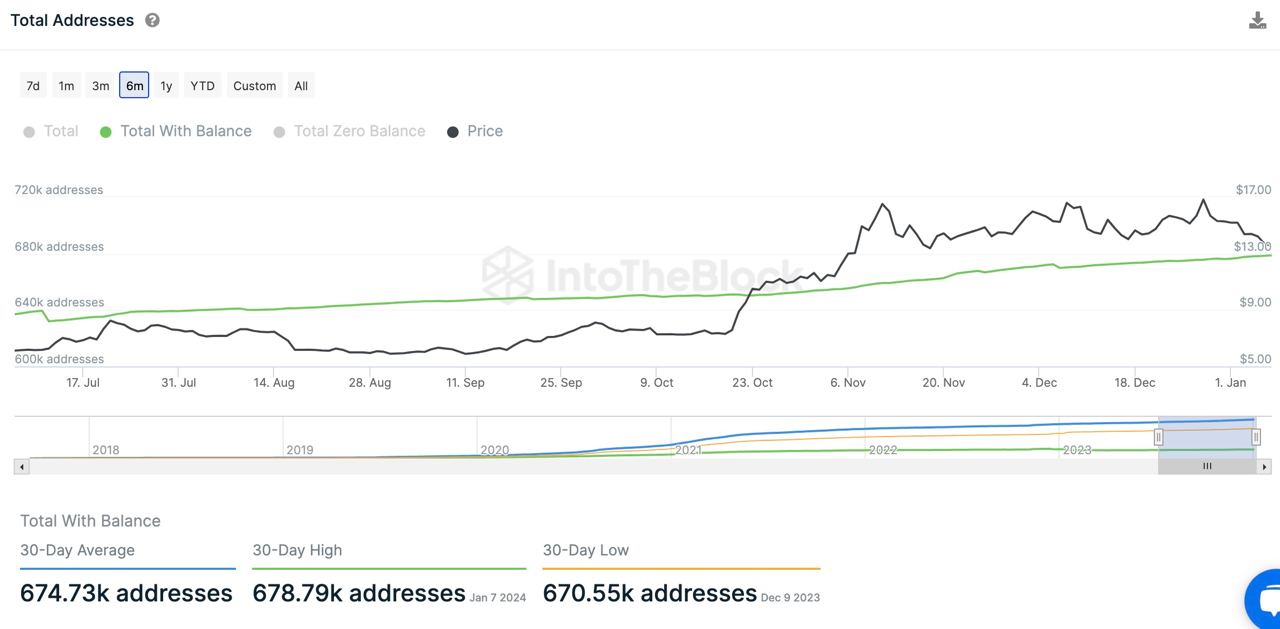

The total number of LINK addresses with balances has increased by nearly 7% in the past 6 months. This indicator shows the growing demand for LINK among market participants and the relevance of this altcoin among traders. As seen on IntoTheBlock, the number of balanced LINK addresses increased from 637,030 to 678,790 in the 6-month time frame.

Total number of Chainlink addresses with balance | Source: IntoTheBlock

price association Prepare for recovery

LINK price is currently in an uptrend that started on September 11th. The price is above the 200-day exponential moving average (EMA) at $10.98. The two 10-day and 50-day EMAs at $14.17 and $14.37 respectively are expected to act as immediate resistance during the LINK price uptrend.

LINK held above the key 38.2% Fib retracement level of $13.1, which was formed during the rise from September low of $5.75 to December high of $17.6, as seen in the chart below.

On the bright side, Chainlink could target the 23.6% Fibonacci retracement level at $14.84, which is close to the psychologically important level of $15.

LINK/USDT Chart 1 day | Source: Tradingview

In the bearish scenario, a daily candle close below the aforementioned 38.2% Fib retracement level at $13.1 could invalidate the LINK price recovery thesis.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to FXStreet