Inflows into digital assets surge in first week of 2024

[ad_1]

The United States, Germany and Switzerland are the three countries driving the digital asset investment boom in early 2024.

In the first week of 2024, the cryptocurrency market saw inflows of up to $151 million.

Among them, Bitcoin, still the digital gold standard, attracted most of the capital flows with $113 million. Ethereum followed suit with a commendable inflow of $30 million.

Geographically, the United States leads the way, contributing 55% of total capital flows, equivalent to $84 million. Germany and Switzerland follow closely behind, accounting for 21% and 17% of inflows respectively. However, the continued inflow of funds into the cryptocurrency market highlights the growing global acceptance and investor confidence in digital asset investment products, especially in these three countries.

Talking about the reasons for the increase in cash flow, one of the biggest reasons is that the Bitcoin ETF Spot received approval from the U.S. Securities and Exchange Commission (SEC). In addition, the Grayscale v. SEC lawsuit has also galvanized investors, resulting in a significant increase in capital flows, which now total $2.3 billion, or 4.4% of total assets under management (AuM).

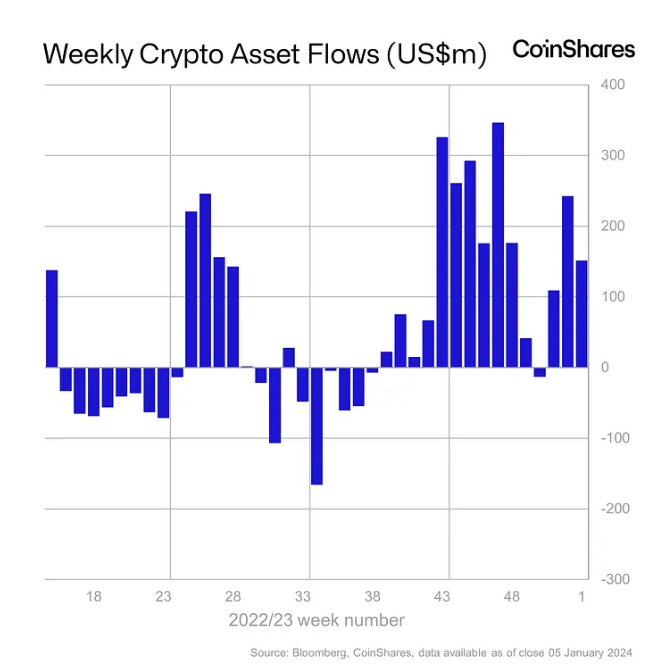

Money flows into the cryptocurrency market every week.

VIC encryption compilation

related news:

![]() A look back at the prominent trends in the crypto market in 2023

A look back at the prominent trends in the crypto market in 2023

![]() 2024 – An ideal year for massive airdrops in the cryptocurrency market

2024 – An ideal year for massive airdrops in the cryptocurrency market

![]() 3 Indicators DeFi Traders Should Monitor to Stay Ahead of the Bull Run

3 Indicators DeFi Traders Should Monitor to Stay Ahead of the Bull Run

![]() Mastering the Crypto World: Essential Insights for “Surviving” the Digital Asset Market

Mastering the Crypto World: Essential Insights for “Surviving” the Digital Asset Market