Coin Prices Today January 9: Bitcoin Tops $47,000, Altcoins in the Green, Wall Street Gains as Deadline to Approval of Bitcoin ETF Spot Deliveries Approaches

[ad_1]

Bitcoin surpassed the $47,000 mark for the first time since April 2022 as the deadline for the U.S. Securities and Exchange Commission (SEC) to approve a spot Bitcoin ETF approaches.

BTC Price Chart – 1 Day | Source: TradingView

US stocks

U.S. stocks rose on Monday (January 8), boosted by technology stocks, as Wall Street tried to recover from a difficult week last week.

As of the close of the trading day, the S&P 500 index rose 1.41% to 4,763.54 points, and the Nasdaq Composite Index rose 2.2% to 14,843.77 points, marking the index’s best rising period since November 14, 2023. The Dow Jones index rose 216.9 points (equivalent to 0.58%) to 37,683.01 points.

Investors are buying low on technology stocks, which fell 4% last week as yields fell on Monday. Nvidia shares surged 6.4% to reach ATH levels, and Amazon shares rose nearly 2.7%, supporting gains in the Nasdaq Composite Index.

Alphabet shares rose 2.3%. Apple shares rose 2.4% after Evercore ISI advised clients to buy during last week’s decline. The VanEck Semiconductor ETF (SMH) rose 3.5% to have its best trading day since November 2023.

At the same time, the U.S. 10-year Treasury yield fell 3 basis points to 4.012%.

After part of Alaska Airlines’ fuselage was damaged, dozens of Boeing 737 Max 9 aircraft were temporarily grounded for inspection. Boeing’s stock price fell 8%, which had a negative impact on the rise of the Dow Jones Index.

Wall Street just suffered its first weekly loss in ten weeks as big tech stocks like Apple underperformed and U.S. government bond yields rose. The Dow gained 0.59% last week, while the S&P 500 fell 1.52%. The Nasdaq Composite recorded its worst week since September 2023, falling 3.25%.

This week, investors are likely to get clearer information from the Federal Reserve on its roadmap for rate cuts. The December CPI consumer price index is expected to be released on January 11, followed by the PPI producer price index on January 12. The data will show whether the central bank’s efforts to reduce inflation to its 2% target are being achieved.

Gold prices fell to their lowest level in three weeks on Monday (January 8) as bond yields rose. This comes as expectations that the Federal Reserve will soon cut interest rates are fading and investors are awaiting U.S. inflation data for clearer information.

As of the end of the trading day, the spot gold contract fell 0.9% to $2,027.63 per ounce, having hit the lowest level since December 18, 2023 at the beginning of the session. Gold futures contracts fell 0.8% to $2,034.1 an ounce.

WTI oil prices fell more than 4% on Monday (January 8) after Saudi Arabia cut oil prices, triggering concerns about oversupply and weak demand in the market.

As of the end of the trading day, the WTI crude oil contract fell by US$3.04 (equivalent to 4.12%) to US$70.77 per barrel. The Brent crude oil contract fell by US$2.64 (equivalent to 3.35%) to US$76.12 per barrel.

The sell-off comes after Saudi Arabia slashed the price of Arabian Light crude oil it supplies to Asian customers by $2 a barrel.

Bitcoin and altcoins

Starting at $44,000 on January 8, Bitcoin has quickly risen by more than 6.5% in the past 24 hours and has gained 177% in the past 12 months, hitting its highest level since the beginning of the year at $47,284.

Bitcoin’s gains come as the market awaits approval from the U.S. Securities and Exchange Commission (SEC) of one or more of 14 pending applications for spot Bitcoin ETF products. Bloomberg analysts expect a decision as early as January 10.

The last time Bitcoin traded above $47,000 was nearly 20 months ago, on April 3, 2022, when the major asset peaked at $47,458 before falling into a prolonged bear market that saw the price fall to as low as $15,600.

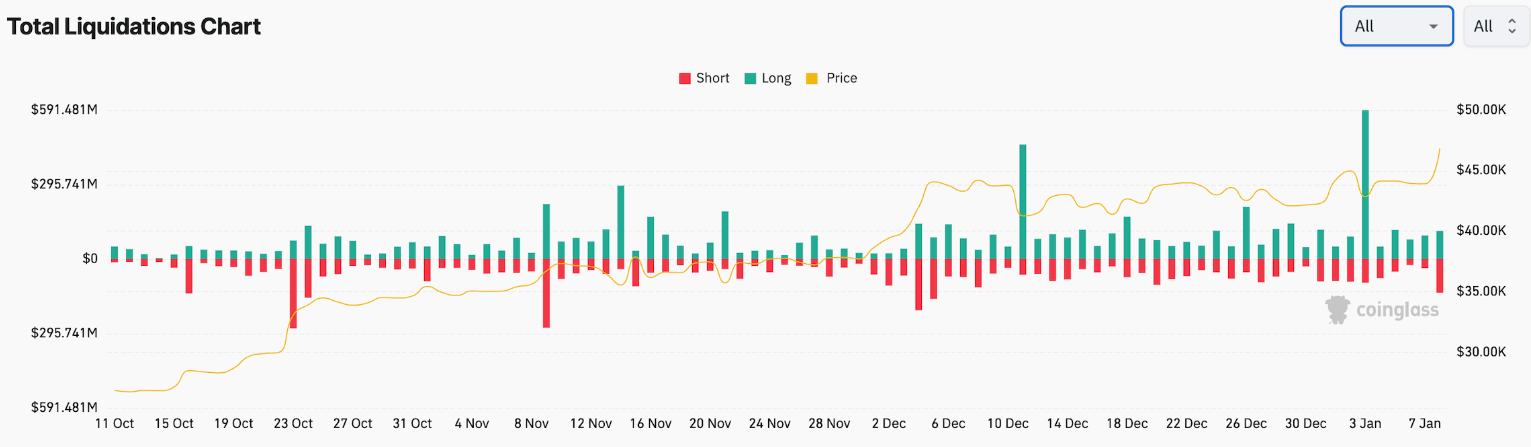

Trader and Analyst Jin Flagged Turning the “21 EMA” into support, BTC added that the leading cryptocurrency is heading towards $48,000, while popular X user Byzantine General noted that “a lot of shorts have just been liquidated” as the price quickly moved towards $47,000.

Coinglass data shows that Bitcoin short liquidation volume reached $76 million that day and is still growing. Market-wide short liquidation amount reached $112 million.

Cryptocurrency Liquidation Chart | Source: Coinglass

Many market participants expect the bullish price action to continue with the news of a Bitcoin spot ETF being approved.

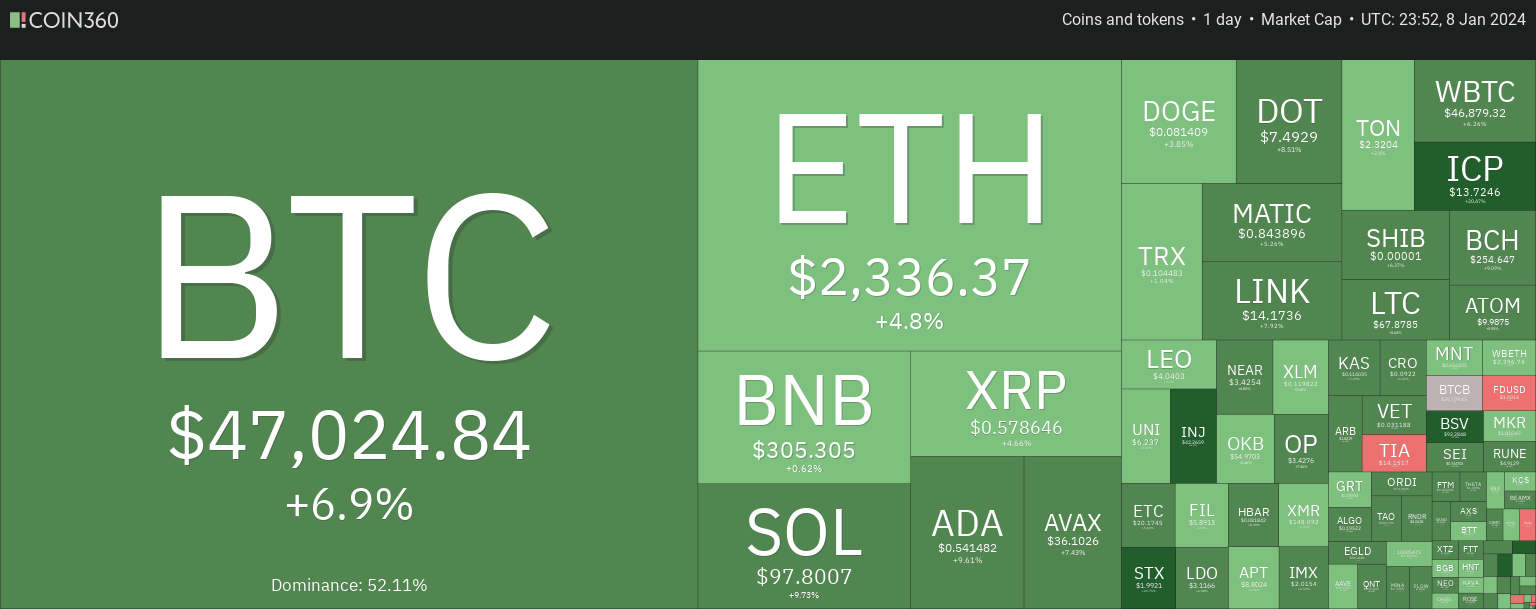

Altcoins are in the green as Bitcoin surges past $47,000 amid spot ETF hype.

Many of the big projects in the top 100 recorded double-digit profits.

Internet Computer (ICP), Stacks (STX), and Bitcoin SV (BSV) were the three best-performing coins on the day, rallying over 20%.

Bonk (BONK), Injective (INJ), WOO Network (WOO), Astar (ASTR), Render (RNDR), Mina (MINA), ORDI (ORDI), eCash (XEC), Terra Classic (LUNC), Sei (SEI )), Solana (SOL), Algorand (ALGO), Cardano (ADA), Bitcoin Cash (BCH)… all increased by more than 10% compared with the previous 24 hours.

Source: Coin360

After a period of adjustment, Ethereum (ETH) successfully broke through the $2,300 mark yesterday, rising more than 5%. The largest proof-of-stake smart contract project on the market is currently trading at around $2,330.

ETH Price Chart – 1 Day | Source: TradingView

The “Today’s Coin Price” column will update market dynamics at 9:00 every day, and readers are sincerely invited to pay attention.

See the online coin price list here: https://tapchibitcoin.io/bang-gia

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

Bitcoin Magazine