Bitcoin price on track to top $50,000 as spot BTC ETF enters final stages of approval race

[ad_1]

Bitcoin spot ETF applicants are engaged in a fee war, offering competitive prices to attract funds. Bitwise Invest currently offers a minimum fee of 0.24%. The grayscale setting charges a maximum fee of 1.5%.

While market participants expect the U.S. Securities and Exchange Commission (SEC) to approve a spot Bitcoin ETF before the January 10 deadline, the Chamber of Digital Commerce founder believes the regulator may delay a decision on the securities offering.

SEC expected to make decision on spot Bitcoin ETF on Tuesday or Wednesday

Bloomberg ETF analyst James Seyyfart pointed out that the SEC issued an opinion on the issuer’s revised S-1 filing.

The redacted filing shows a competitive fee war between the issuers, with Bitwise Invest offering the lowest (0.24%) and Grayscale Investments offering the highest (1.5%).

While the SEC expects more amendments on Tuesday, Seifert doesn’t necessarily see this as a sign of U.S. financial regulators dragging their feet.

According to Perianne, founder and CEO of the Digital Chamber of Commerce, this is a sign that the SEC is delaying the decision on a Bitcoin spot ETF. tweet Recently in X.

Fox Business News reporter Eleanor Terret explain She spoke with issuers who have received additional comments from regulators on their S-1 filings, and the SEC has not yet announced changes to its plans.

Terret shared a list of issuers preparing to launch physical Bitcoin ETFs after receiving approval this week, including Grayscale, Ark/21Shares, Blackrock, BitWise, VanEck, WisdomTree, Invesco, Fidelity, Valkyrie and Franklin.

According to Bitcoin Magazine, U.S. Securities and Exchange Commission Commissioner Gary Gensler recently informed investors of the risks associated with investing in cryptocurrencies.

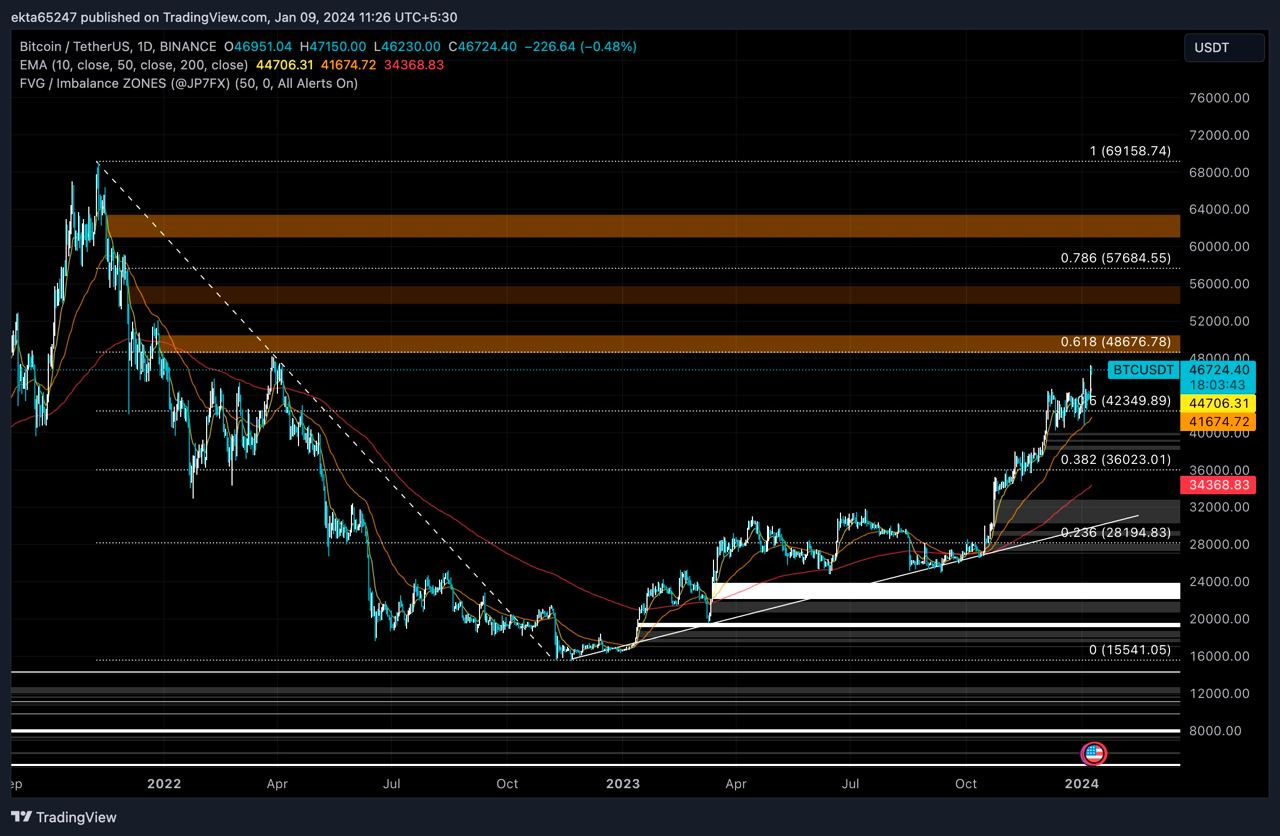

Technical Analysis: Bitcoin price could rise to $50,000

Bitcoin prices reached a high of $47,200 on Monday as anticipation grew for the SEC’s decision on a spot Bitcoin ETF. Market participants believe approval is imminent, and although most experts believe it is already priced in, Bitcoin prices have risen nearly 6% over the past week as the January 10 deadline approaches.

In January 2024, Bitcoin price remained above $42,000 and the asset was rising towards the psychologically important level of $50,000. The last time BTC price was above this level was in December 2021.

Bitcoin may face resistance at $48,600 – the 61.8% Fibonacci retracement level of the Nov. 21-Nov. 22 drop. Once BTC price breaks this resistance, it may rise to the upper limit of the fair value gap at $50,583, as shown in the chart below.

BTC Price Chart 1 Day | Source: TradingView

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to FXStreet