Bitcoin holders’ behavior shows split in market sentiment

[ad_1]

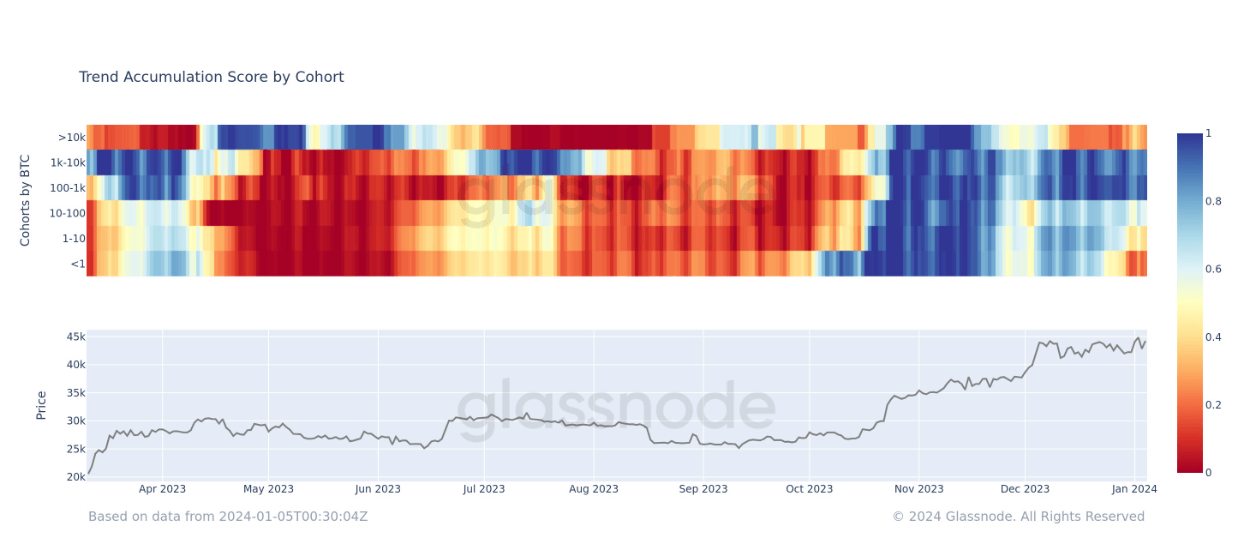

An in-depth analysis of the cumulative trend score details the different behaviors of the digital asset market, segmented mainly by wallet group. The compilation of this indicator is driven by the size of the entity and the number of tokens acquired during a specific time period, providing a profound indicator of cumulative strength. A score close to 1 indicates that the participant is actively accumulating, while a score close to 0 indicates that the participant is distributing.

Recent data shows a shift in the direction of allocations among entities holding less than 1 Bitcoin, a trend that has continued as of December 25. Likewise, the pool of Bitcoin holders holds 1-10 BTC, and the cumulative trend among these people is a downward trend with scores fluctuating around 0.5, a change from previous habits. However, holders of 10-100 Bitcoin still show a slight accumulation trend, albeit at reduced relative strength.

Interestingly, the groups holding 100-1000 and 1000-10,000 Bitcoins are currently in the active accumulation phase, while the distribution trend of large-scale holders or “whales” (holding more than 10,000 Bitcoins) remains stable. pattern since December.

This analysis of distribution and accumulation trends (excluding exchanges and miners) provides insights into current digital asset market dynamics, highlighting the different strategies of different wallet groups.

Source: Glassnode

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Anne

According to Cryptoslate