Holiday Price Action: A Sign of the Next Bull Market?

[ad_1]

2023 is coming to an end and 2024 is approaching, and the cryptocurrency market is once again recovering, reminiscent of the bull run of December 2020.

The ongoing recovery has brought renewed optimism and potential, leaving investors hoping for a major shift.

As of now, the market value of the digital asset space has surged from $831 billion to more than $1.8 trillion since the beginning of 2023, an increase of nearly $100 billion.

Because of the recent uptrend, it’s natural to start seeing similarities between the recent bull market’s holiday price action and the current market. However, is this similarity just a coincidence or are we witnessing the cyclical nature of the cryptocurrency market?

Antoni Trenchev, co-founder and managing partner of cryptocurrency lending company Nexo, believes that the ongoing price action reflects the holiday season of 2020-2021, which he marks as an ominous time before cryptocurrencies enter the mainstream. the last major bull market. He added:

“At the time, the market rally was more than just a seasonal price increase. Just months before Bitcoin’s April 2020 halving, and accompanied by a wave of enthusiasm for cryptocurrency exchange-traded funds (ETFs), this price increase boded well for crypto. Currency valuations will see unprecedented price increases.

Now, as the 2023-2024 festival season comes to a close, Trenchev believes we’re on the cusp of other exciting things.

“With early Santa Claus rallies already on the charts and Bitcoin halving expected in April 2024, we are optimistically positioned for another bull run and the bullish trend is just getting started,” Trenchev said.

The Case for a Cryptocurrency Bull Run

Zheng Jupiter, a partner at institutional asset management firm HashKey Capital, said that while there are certainly some holiday factors affecting the market’s continued growth – as was the case a few years ago – there are other peripheral factors to consider this time:

“We now have the upcoming launch of a spot BTC exchange-traded fund (ETF) and the upcoming 2024 halving event, as well as the rapid expansion of the Bitcoin ecosystem, including the introduction of new Layer 2 solutions and inscriptions. Additionally, the Fed’s stance has changed from Eagle A dovish shift also has a positive impact on risk assets.”

Ryan Lee, chief analyst at Bitget Research, further elaborated on Zheng’s story, arguing that while the parallels between the 2020-2021 bull run and the current cryptocurrency market scenario are certainly useful, this time, the market is being affected by various macro factors. Serious impact. Conditions include regulatory updates, technological advances and changing investor sentiment.

Ryan Lee pointed out that while the recent rebound was caused by specific circumstances such as the COVID-19 pandemic, which stimulated quantitative easing and institutional investment, this rebound is driven by inflation fluctuations, interest rate changes and geopolitical tensions.

Additionally, falling U.S. 10-year Treasury yields and falling financial indicators such as the U.S. Dollar Index (a measure of the U.S. dollar’s value relative to most important trading partners) have (most importantly) created a favorable environment for Bitcoin.

This trend has been reinforced by some upbeat economic data, with Lee noting that U.S. gross domestic product exceeded expectations, while the Personal Consumption Expenditures (PCE) price index, which measures consumer spending by U.S. households on goods and services, has exceeded expectations. .return exhibit Moderate, remaining relatively stable in 2023. Lee added:

“The probability that the Fed will maintain its current policy stance in December has increased to more than 80%, helping to alleviate growing capital market pressures due to the challenging macroeconomic environment this year.”

Could we see a cryptocurrency rebound in the coming weeks?

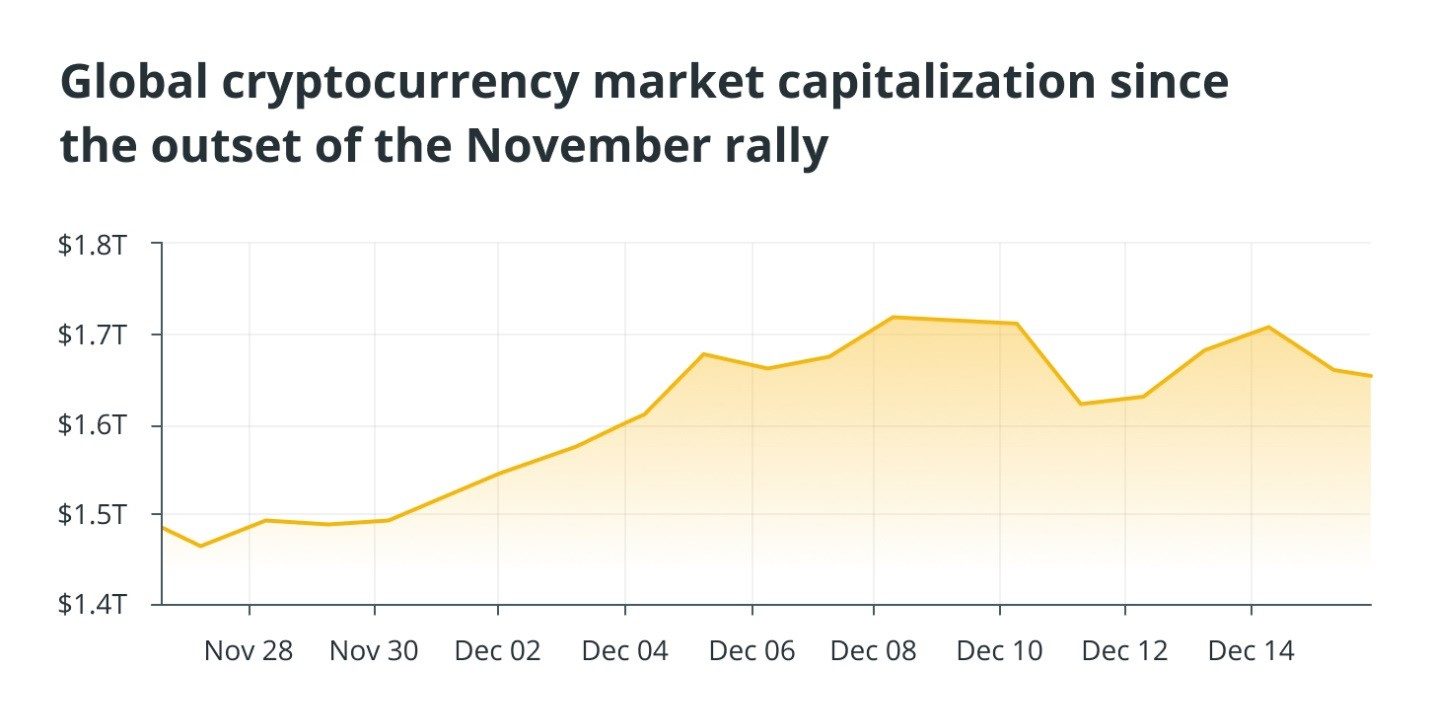

While continued price action is certainly promising, the market still seems unable to clear the $1.7 trillion threshold.

Zak Taher, CEO of MultiBank.io, the digital asset arm of MultiBank Group, said that his team does not expect prices to surge anytime soon, but given current market conditions, a significant recovery could occur: “While market movements may be affected in the short term, There are many different factors at play, including the greed index, market sentiment and speculation, but it is still a challenge to predict with certainty whether this recovery will develop into a full-blown bull market as we approach mid-year.”

Source: CoinGecko

Despite the uncertainty, Tah believes that growing institutional interest and acceptance will continue to play a key role in shaping next steps and bringing legitimacy and stability to the market, particularly in Europe and the Middle East.

Denis Petrovcic, co-founder and CEO of real estate asset tokenization infrastructure provider Blocksquare, also holds a similar view. He said that although Bitcoin’s recent price surge exceeded the $44,000 mark, coupled with people’s interest in Bitcoin The growing interest in ETFs may not be just a seasonal surge, and historical trends suggest this growth may not last.

Denis Petrovich said:

“Market optimism may face challenges as the global economic landscape changes, including potential policy changes in 2024.”

However, Lee remains optimistic about the short-term future of the industry, saying that ongoing policy changes, inflation rate adjustments, and geopolitical events may have an extremely positive impact on Bitcoin prices in the future.

Denis Petrovich concluded:

“It’s worth noting that forecasted changes in U.S. monetary policy could lower 10-year yields, which seems promising for risk assets like cryptocurrencies.”

Factors that could drive the next bull market

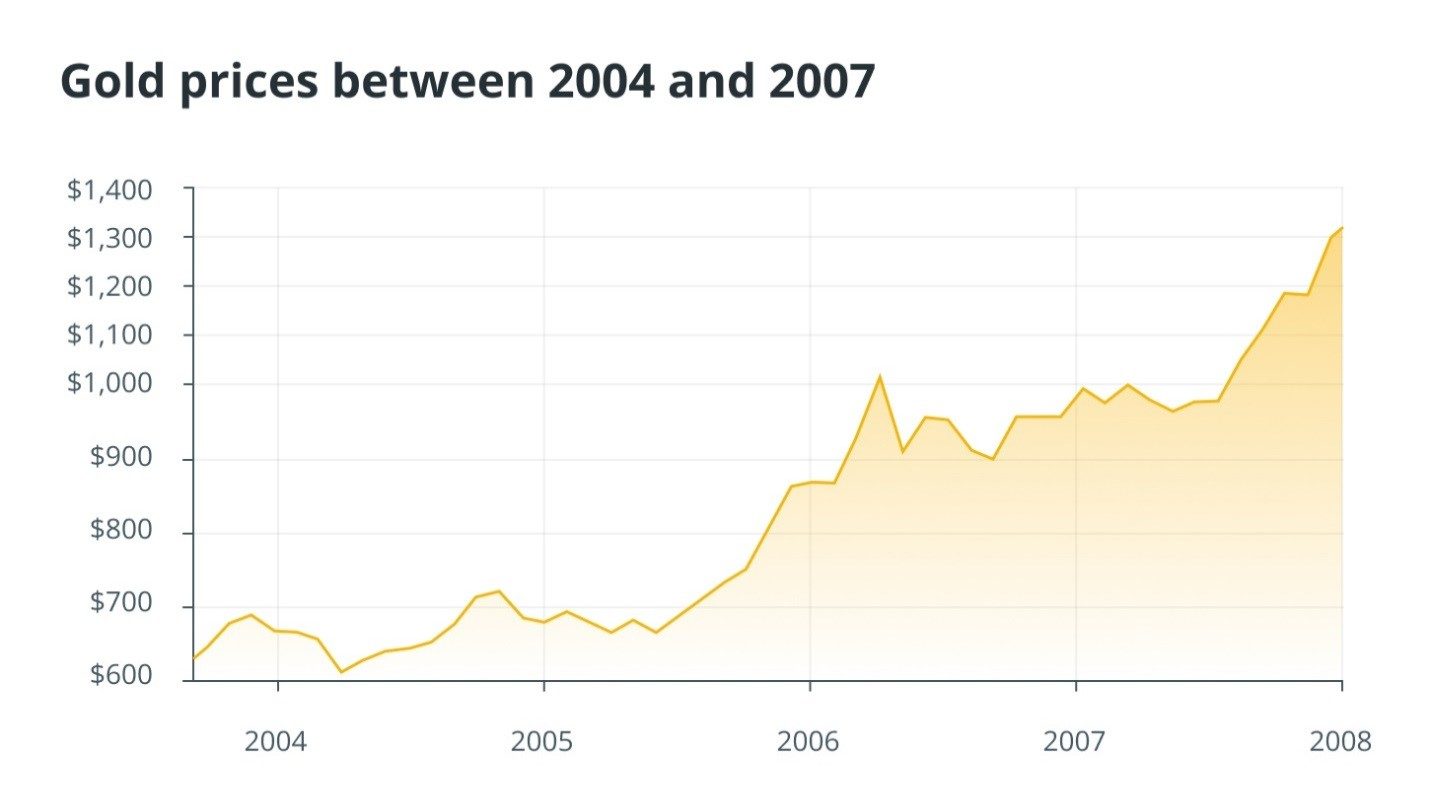

From January 5 to 10, 2024, the cryptocurrency market is waiting for the approval decision of the US BTC spot ETF. If approved, there could be an influx of money into the cryptocurrency market, similar to what was seen in 2004 when the first gold ETFs were approved. Additionally, the increasing likelihood of the Federal Reserve cutting interest rates in 2024 is another important factor to watch as it could have a significant impact on the market.

Source: Macro Trends

The next Bitcoin halving is scheduled to take place on May 9, 2024, and it is worth noting that the price of the digital asset has shown a pattern of peaking between 368 and 550 days after the halving event, and after that Bottomed between 779 and 914 days. This cyclical behavior is an important trend to watch as it plays a key role in driving investor sentiment.

Furthermore, China’s move to internationalize the yuan represents a major shift in global financial dynamics that could impact both traditional and digital currencies. Meanwhile, the cryptocurrency market is flexing its muscles, as evidenced by altcoins like ETH and SOL hitting 19-month highs, even as Bitcoin’s bull run shows signs of pausing.

Finally, in the broader context, Brazil’s economic growth consider The G20’s use of digital currencies for financial transactions reflects growing global interest in the potential of digital currencies.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to Cointelegraph