Bitcoin Traders Expect Bitcoin Breakout, Bulls Hold on to $44,000 Ahead of ETFs

[ad_1]

Bitcoin ended the first week of 2024 hovering around $44,000 as multiple new volatility catalysts emerged.

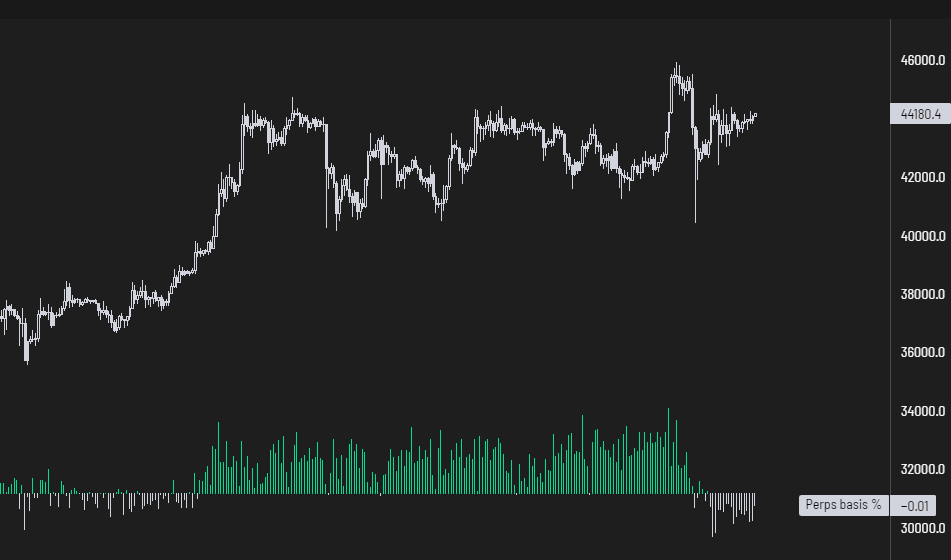

BTC Price Chart 4 Hours | Source: Trading View

this Trader BItcoin expected to end move limit

Data from TradingView shows that the volatility of BTC price performance narrowed over the weekend.

Markets remain concerned that BTC may react to the approval or rejection of the first U.S. Bitcoin spot exchange-traded fund (ETF) – expected to launch on October 10.

This significant event is widely expected to deal a temporary blow to bulls, pushing prices back down in a “half-real” event, according to reports. Others, conversely, see it as an opportunity to suddenly raise prices, challenging key psychological levels.

Regardless of which direction this trend takes, indicators are still pointing to a breakout of the tight intraday range.

These include the Bollinger Bands volatility indicator, which is currently narrowing on the daily timeframe, becoming a classic precursor to range expansion.

Trader and commentator Matthew Hyland say To subscribers on X (formerly Twitter):

“Bollinger Bands tighten further heading into ETF week.”

BTC chart and Bollinger Bands data | Source: Matthew Hyland/X

Fellow Trader Daan Crypto Trades Add to “Spot spreads” are active again in the Bitcoin market, with derivatives traders appearing cautious about going long or short following last week’s rapid liquidations.

Source: Daan Cryptocurrency Exchange

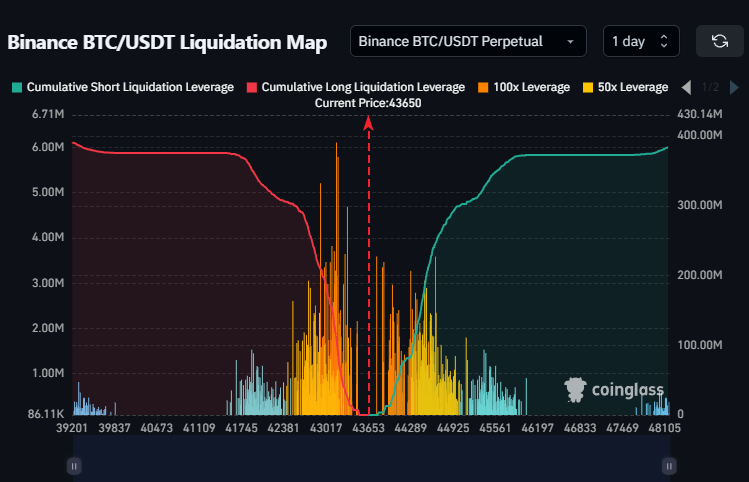

He continued: “The longer we linger in this price range, the more stops/closing positions are formed above and below the price.” Additionally, there is a BTC/USDT liquidity heat map for the world’s largest The exchange Binance has leverage.

BTC/USDT liquidation data | Source: Daan Cryptocurrency Exchange

Bitcoin ETF overshadows US CPI, PPI data

While attention remains focused on ETFs, macroeconomic headwinds await.

The data provide an indication of the state of U.S. inflation, with consumer price index and producer price index data for December due out in the coming days.

Cryptocurrencies and risk assets have traditionally been the source of short-term volatility, and this data release looks set to show inflation continuing to fall.

According to reports, the main outcome of the meeting – the Fed’s “pivot” to interest rate policy – is not currently expected to appear at the next dedicated meeting at the end of the month.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to Cointelegraph