Bitcoin Giants: Who Holds the Most Bitcoin?

[ad_1]

Digging deeper into who holds a lot of Bitcoin can provide insight into the impact all of these entities have on the overall market.

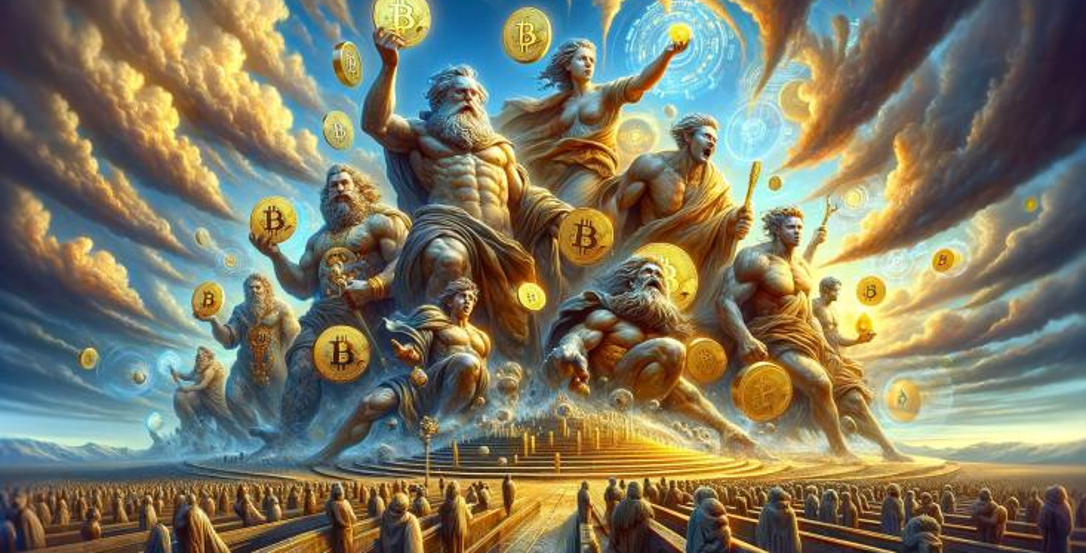

listed company

Publicly traded companies have become important players in the Bitcoin ecosystem. Holding Bitcoin affects the performance of its stocks and the broader cryptocurrency market.

micro strategy

Chief among them is MicroStrategy. The company holds 189,150 BTC (approximately $8.32 billion). This number represents approximately 0.901% of the total Bitcoin supply of 21 million.

In late 2023 and early 2024, BTC rose strongly, reaching as high as $45,000. The growth of BTC has helped MicroStrategy get back on track and become profitable after a dismal 2023. In addition to gains from rising Bitcoin prices, MicroStrategy’s Bitcoin pooling strategy has led to activity in the company’s stock (MSTR: NADQ) – share prices tend to mirror market movements in the cryptocurrency.

![]() MicroStrategy continues to collect Bitcoin in an attempt to usurp the US government’s BTC holdings

MicroStrategy continues to collect Bitcoin in an attempt to usurp the US government’s BTC holdings

Tesla Inc.

Number two on the list is Tesla Inc., an electric vehicle and clean energy company. The company currently holds 10,725 BTC, worth approximately $471.54 million. The company’s investment in Bitcoin, disclosed in early 2021, was a major endorsement of Bitcoin’s potential as a store of value, bridging the gap between the cryptocurrency market and traditional finance.

Since then, Tesla (TSLA:NADQ) shares have been influenced by Bitcoin price movements, reflecting the investment’s connection to market valuations.

Coinbase Global Corporation

The next name is Coinbase Global, Inc. The exchange holds 9,000 BTC worth approximately $395.7 million. As a major player in the cryptocurrency trading industry, Coinbase (COIN: NADQ) stock is a balance sheet asset and a strategic alignment with its core business. The company’s stock performance is closely tied to the health of the cryptocurrency market, with Bitcoin price being the main driver.

Galaxy Digital Holdings

Galaxy Digital Holdings, a commercial bank focused on digital assets and blockchain, holds 8,100 BTC, or $356.13 million. Galaxy Digital (BRPHF:OTCMKTS) stock reflects its deep involvement in the cryptocurrency space, with Bitcoin’s performance directly affecting its valuation.

Bullock Corporation

Block Corporation (formerly Square, Inc.) is a financial services and mobile payments company that holds 8,027 Bitcoins worth approximately $352.92 million. Block’s (SQ: NYSE) investment underscores its commitment to integrating cryptocurrencies into the broader payments ecosystem. The company’s Bitcoin holdings and its growth in the cryptocurrency space have had a significant impact on the stock’s performance.

List of publicly traded companies holding Bitcoin. source: Buy Bitcoin Globally

=> As can be seen, the choice of market-leading financial firms to invest in Bitcoin underscores a broader trend of institutional acceptance of cryptocurrencies. Additionally, large institutional holdings of large amounts of Bitcoin also indicate a strategic bet on Bitcoin’s long-term value proposition. This trend reflects growing confidence in Bitcoin as an asset class.

Private Enterprise

Several private companies have accumulated large amounts of Bitcoin, reflecting a strategic shift toward digital assets.

Notably, these investments are driven by a number of factors, including belief in Bitcoin’s long-term value, its potential as a hedge against inflation, and the growing desire to be part of the digital economy.

- mt.Gox: Originally a major Bitcoin exchange, Mt. Gox currently holds approximately 200,000 BTC (0.952% of the total Bitcoin supply), worth approximately $8.79 billion. However, the amount of BTC in Mt. Gox’s holdings are largely due to historical convention and have been the focus of legal and financial discussions after a notorious hack forced the exchange to declare bankruptcy.

- block one: This software company specializing in high-performance blockchain technology holds 140,000 BTC, worth approximately $6.16 billion, accounting for 0.667% of the total Bitcoin supply. This investment reflects Block.one’s strong commitment to the blockchain ecosystem and its belief in Bitcoin as the reserve asset of the future.

- TEDA Holdings Co., Ltd.: The company holds 55,000 BTC worth approximately $2.42 billion, accounting for 0.262% of the total supply. The stake demonstrates Tether’s strategic position in the cryptocurrency market, balancing its stablecoin activities with a significant investment in Bitcoin.

- Tezos Foundation: Tezos holds 17,500 BTC, worth approximately $769.41 million, accounting for 0.083% of the total Bitcoin supply.

- Shiling Holding Group: The asset management firm specializing in alternative investments holds 10,000 BTC worth approximately $439.67 million, accounting for 0.048% of the total Bitcoin supply. The investment in Bitcoin is part of a wider strategy to diversify its portfolio.

List of private companies holding Bitcoin. source: Buy Bitcoin Globally

=> Although the reasons for private companies to invest in Bitcoin vary, they all reflect a belief in the digital transformation of finance and Bitcoin’s role as an important foundational asset in this transformation.

But these private holdings are important because they signal increasing institutional adoption of Bitcoin. At the same time, it contributes to the overall stability and maturity of the market, and shapes investor psychology, reinforcing the perception of Bitcoin as a viable and valuable asset class.

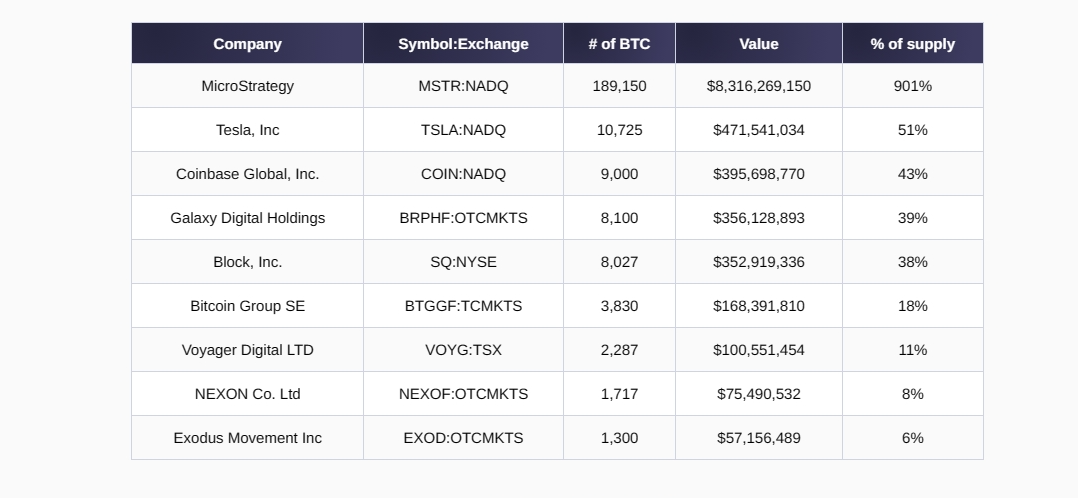

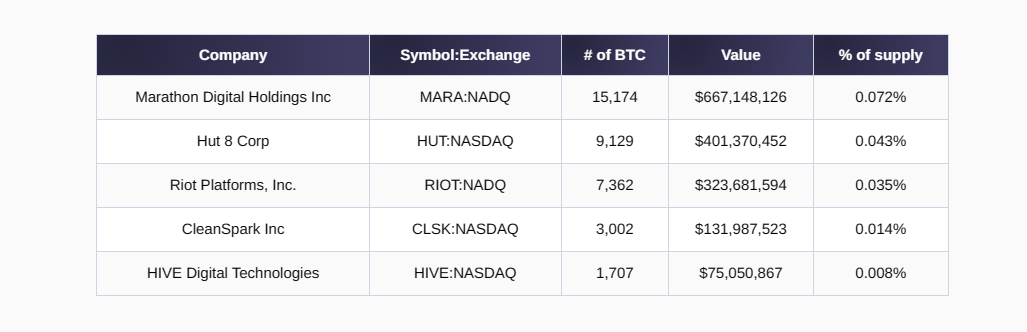

Bitcoin Mining Company

Miners play an important role in the Bitcoin ecosystem in terms of network security and influencing the market through Bitcoin reserves.

- marathonA leading company in the Bitcoin mining industry, holding approximately 15,174 Bitcoins worth $667.15 million. This represents 0.072% of the total Bitcoin supply. Marathon’s strategy of accumulating Bitcoin rather than selling coins to maintain operations reflects a long-term investment perspective and belief in Bitcoin’s value.

- Cabin 8 A total of 9,129 BTC are held, worth approximately US$401.37 million, accounting for 0.043% of the total supply of Bitcoin.

- Anti-riot platform It holds 7,362 BTC, worth approximately $323.68 million, accounting for 0.035% of the total Bitcoin supply. Riot’s strategy shows optimism for Bitcoin and a focus on increasing its mining operations.

List of Bitcoin Mining Companies. source: Buy Bitcoin Globally

=> There is a balance between extraction and reserve accumulation. On the one hand, miners must sell a portion of their mined Bitcoins to cover operating costs, including electricity, hardware maintenance, and expansion.

On the other hand, holding mined Bitcoins can be seen as a vote of confidence in the future value of the cryptocurrency. This strategy not only affects the supply side of Bitcoin, but also reflects miners’ views on market trends.

Additionally, these assets play an important role in the security and robustness of the Bitcoin network. By reinvesting profits into expanding mining operations, these companies help maintain high hash rates, which is important for network security.

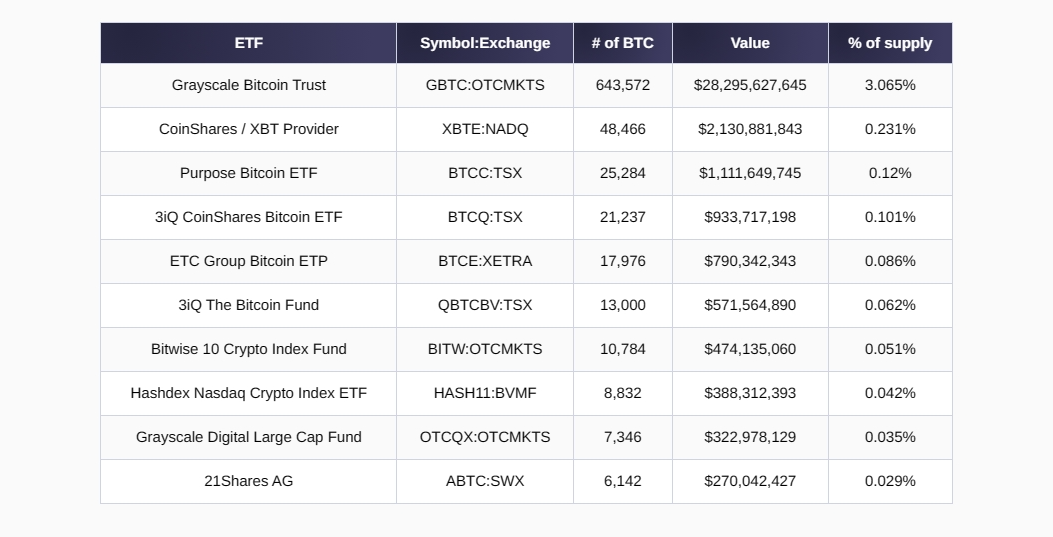

ETF funds

Exchange-traded funds (ETFs) are an important tool in financial markets, bridging the gap between traditional investment mechanisms and innovative digital assets like Bitcoin.

Well-known Bitcoin ETFs have accumulated large amounts of Bitcoin and play an important role in the cryptocurrency market, including Grayscale Bitcoin Trust (holds 643,572 BTC, worth approximately $28.3 billion, accounting for 3,065% of the total Bitcoin supply), CoinShares/XBT Provider, Purpose Bitcoin ETF…

![]() Why do Wall Street financial giants issue Bitcoin spot ETFs?

Why do Wall Street financial giants issue Bitcoin spot ETFs?

ETF List. source: Buy Bitcoin Globally

These ETFs increase market access and allow more investors to participate in Bitcoin investments. In addition, they provide Bitcoin exposure through traditional investment platforms to enhance liquidity. This liquidity is important because it helps reduce volatility, making Bitcoin a more accessible and potentially more stable investment option.

Additionally, the presence of Bitcoin in ETFs affects investor behavior by providing a regulated and familiar avenue for investment. This can boost investor confidence and attract more institutional and retail investors into the Bitcoin market.

On January 10 this year, the SEC will make a decision on whether to approve a Bitcoin ETF spot. If the fund is approved, there is likely to be significant market volatility. At the same time, it will open up new capital inflows into the cryptocurrency market, further enhancing liquidity and potentially stabilizing Bitcoin prices. Additionally, approval would signal regulatory acceptance, potentially paving the way for wider adoption of Bitcoin and other cryptocurrencies.

![]() Take a look at the 20 active Bitcoin ETF spot funds around the world, with a total value of up to $4.16 billion

Take a look at the 20 active Bitcoin ETF spot funds around the world, with a total value of up to $4.16 billion

get conclusion

Through strategic investments and large stakeholdings, the public company highlights Bitcoin’s increasing integration into traditional financial frameworks, influencing market dynamics and real estate sentiment.

On the private company side, while the number of holdings pales in comparison to public companies, these companies still hold a significant position, enhancing Bitcoin’s long-term value.

By maintaining large reserves of Bitcoin, miners help stabilize the supply side of the market and enhance the security and robustness of the Bitcoin network. This is important for its sustainable operations and reputation.

Additionally, countries are beginning to venture into Bitcoin holdings, signaling a paradigm shift that reflects growing acceptance of Bitcoin as a viable asset class at the government level and has the potential to influence legal opinions around the world.

ETFs have become an important mechanism to enhance market access and liquidity for Bitcoin. They bridge the gap between traditional finance and the growing cryptocurrency industry, helping to stabilize markets and shape investor behavior.

Going forward, the influence of these entities has the potential to accelerate Bitcoin’s trajectory toward greater institutionalization and mainstream adoption. Bitcoin’s growing integration with traditional financial assets heralds a new future in which Bitcoin transcends its role as a speculative asset and becomes a fundamental element of a diversified investment portfolio.

This evolution points to an increasingly complex and integrated financial ecosystem in which digital assets such as Bitcoin coexist with traditional financial instruments, offering a wide range of investment opportunities and risk management strategies.

VIC encryption compilation

related news:

![]() The correlation between USDT stablecoin circulating supply and Bitcoin price performance

The correlation between USDT stablecoin circulating supply and Bitcoin price performance

![]() Revealing the profits Bitcoin miners are reaping from the BRC-20 craze

Revealing the profits Bitcoin miners are reaping from the BRC-20 craze

![]() Bitcoin whales continue to accumulate stocks, showing confidence in market’s upward momentum

Bitcoin whales continue to accumulate stocks, showing confidence in market’s upward momentum