Arbitrum and Polygon: Are the Tier 2 tides changing?

[ad_1]

Polygon (MATIC) was once considered one of the most popular Layer 2 (L2) networks. Recently, however, the newly launched L2 Arbitrum (ARB) network has emerged as a strong competitor.

Compare the volume and TVL of Polygon and Arbitrum

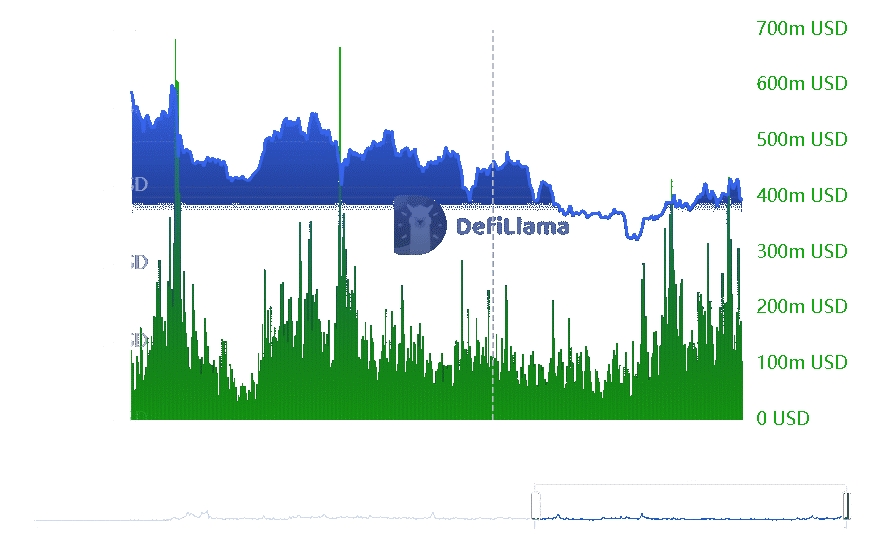

Quality trajectory analysis of Polygon on DefiLlama show Trending upward at the time of writing. By the end of December, trading volume reached its second-highest level of the year, at approximately $435 million.

The highest transaction volume in 2023 was in March, reaching approximately $669 million. Notably, Polygon’s sales surpassed $1 billion only once in 2021, reaching over $2 billion. As of this writing, its trading volume is approximately $106 million.

source:Defilama

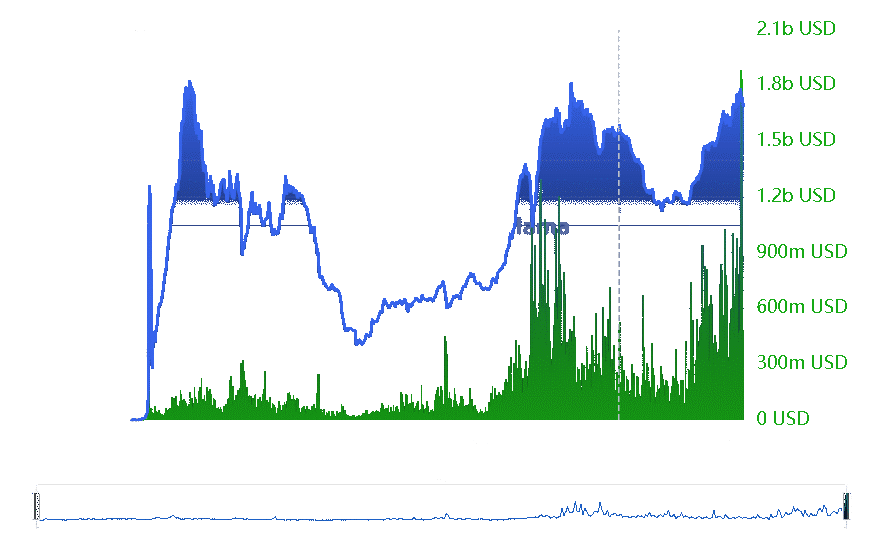

In terms of total value locked (TVL), Polygon has generally weakened in recent weeks, with TVL currently at approximately $845 million. In comparison, Arbitrum’s TVL is over $2 billion and has been trending upward over the past few weeks.

Arbitrum’s trading volume exceeded $405 million in the past 24 hours. It is worth noting that in the new year, Arbitrum’s transaction volume exceeded $1.8 billion twice.

source:Defilama

Discussion about L2

Based on analyzed data L2 beatAs of this writing, Arbitrum is the dominant Layer 2 (L2) network.

During this period, Arbitrum held nearly 50% of the market share, with a total value locked (TVL) of over $9.8 billion.

In comparison, Polygon, ranked 12th, has a relatively small capitalization of $111 million and a market share of less than 1%.

The data highlights a major shift in the L2 landscape, marking other networks surpassing Polygon.

These alternative L2 networks not only produce higher capacity, but also attract a larger user base, as evidenced by their growing market share.

medium sizeATIC follows market trends as ARB splits

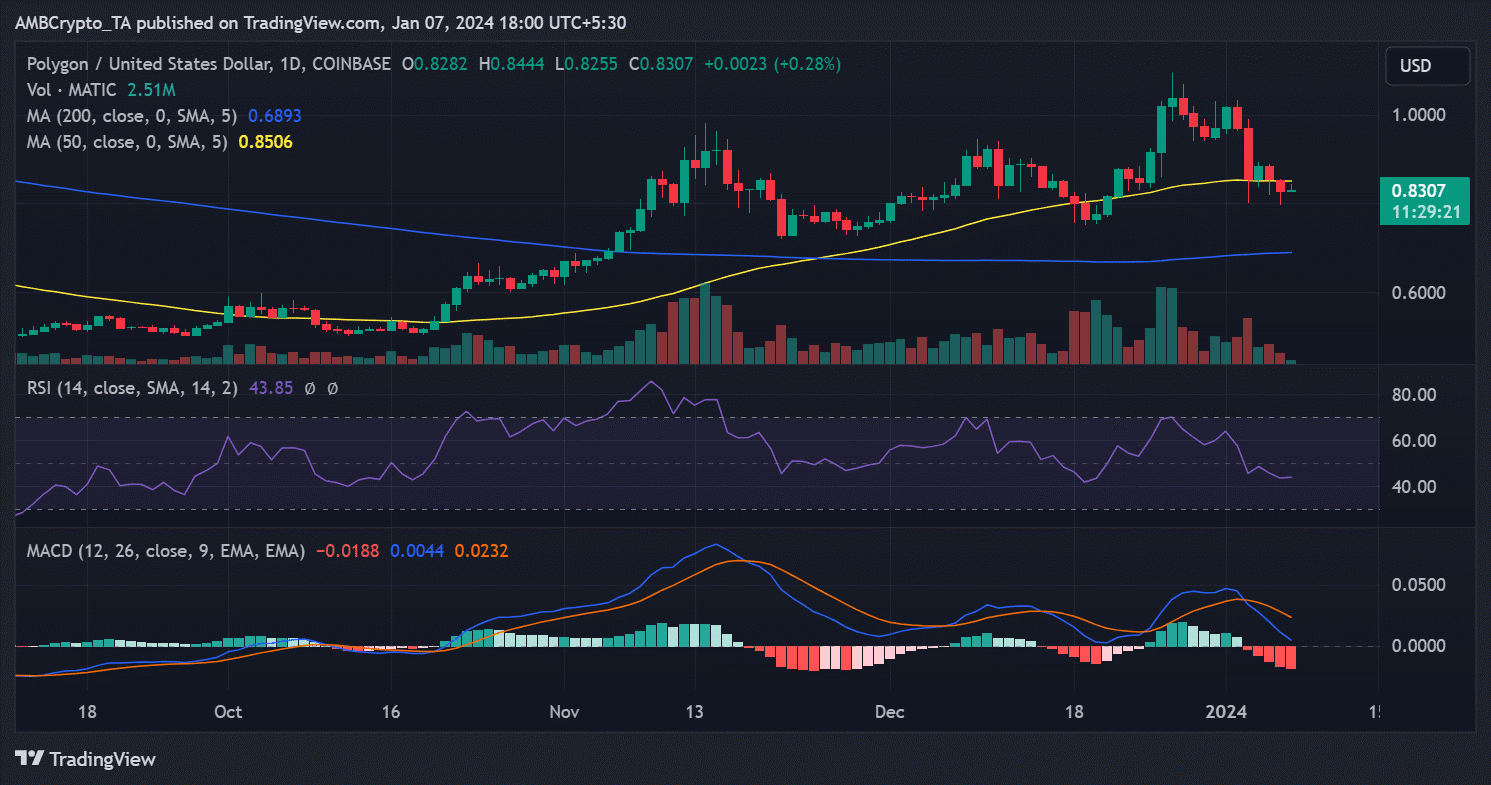

Check out Polygon’s daily time frame chart showing the impact of recent market volatility on MATIC’s price.

On January 3, Polygon fell sharply by 11.8% and has struggled to recover since then. Before the incident, it was trading at around $1, but as of this writing, it has fallen to around $0.77.

source: Trading View

In contrast, Arbitrum exhibits a different trend during market crashes. Arbitrum rose more than 8% despite the general market downturn. However, it has faced a decline recently, with a drop of more than 2% on January 5 and a drop of more than 10%.

As of this writing, it is up over 6.6% over the past week and is trading around $1.64.

source: Trading View

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to AMBCrypto