Today’s currency price, January 6: Bitcoin continues to hold on to $44,000, altcoins are on full fire, Wall Street breaks 9 consecutive weeks of gains

[ad_1]

Bitcoin continues to fluctuate wildly, back near $44,000 after plunging earlier yesterday.

BTC Price Chart – 1 Day | Source: TradingView

US stocks

The S&P 500 index rose slightly after the U.S. jobs report on Friday (January 5) was stronger than expected. However, all three major indexes ended their nine consecutive weeks of gains.

As of the close of the trading day, the S&P 500 Index rose 0.18% to 4,697.24 points, the Nasdaq Composite Index rose 0.09% to 14,524.07 points, and the Dow Jones Index rose 25.77 points (equivalent to 0.07 points) to 37,466.11 points.

All three major stock indexes recorded their first weekly decline in 10 weeks, with the Nasdaq Composite Index falling the most, reaching 3.25%, its worst week since September 2023. The S&P 500 and Dow Jones fell 1.52% and 0.59% respectively.

U.S. stocks were mixed on Friday as investors assessed upcoming economic data to determine if and when the Federal Reserve will begin cutting interest rates.

The U.S. economy created more jobs than expected in December 2023, adding 216,000 jobs, higher than the 170,000 jobs predicted by economists who participated in a Dow Jones survey last month. The unemployment rate held steady at 3.7%, another sign that the labor market remains strong.

The above report drove U.S. Treasury yields higher, with the 10-year Treasury yield reaching a maximum of 4.103%.

A strong labor market means the Fed may delay the first rate cut that investors have been predicting. Ahead of Friday’s release of solid economic data, investors hope the Federal Reserve will begin cutting interest rates as early as March 2024 and cut interest rates six times in 2024. These expectations need to be recalibrated.

Although the ISM Services Index in December 2023 showed that overall business activity was still growing, the 50.6% figure was nearly 2 percentage points lower than the 52.5% forecast by Dow Jones and the 52.7% in November 2023. This indicator exceeds 50%, marking the threshold for economic growth.

U.S. stocks soared in late 2023 as investors predicted the Federal Reserve would shift to looser monetary policy. The S&P 500’s weekly gains through the end of the year were its longest consecutive winning streak in nearly 20 years, pushing the index’s total gain for the year to 24%.

Another factor affecting the market in the new year is the cooling of large technology stocks such as Apple, whose credit rating was downgraded by two research firms this week. Apple shares have fallen 5.9% since the beginning of the week.

Meanwhile, oil prices rose on Friday (January 5) as US Secretary of State Antony Blinken prepared to visit the Middle East in an attempt to prevent the Israel-Gaza conflict from expanding.

As of late trading, the Brent crude oil contract rose $1.42 (equivalent to 1.83%) to $79.01 per barrel. The WTI crude oil contract rose by $1.78 (equivalent to 2.47%) to $73.97 per barrel.

Bitcoin and altcoins

Bitcoin’s current price range is between $43,116 and $45,922, indicating an active environment. Trading volume also remained stable at $32.79 billion, with a market capitalization of $857 billion.

Oscillators provide an overview of Bitcoin and potential changes. The Relative Strength Index (RSI) is at 55 and the Commodity Channel Index (CCI) is at 48, both showing a balance of power between buyers and sellers. However, the momentum at 1,273 is biased towards the bullish side, while the MACD line near 660 points to a bearish outlook, indicating mixed sentiment among traders.

Bitcoin Price Chart – 4 Hours | Source: TradingView

The moving average (MA) for the 10- to 200-day period depicts a consistent uptrend. Consistency between different time frames indicates strong underlying price momentum, indicating a positive outlook for the future.

Yesterday, the market continued to show strong fluctuations. After plunging and hitting a local bottom at $42,450, Bitcoin has continued to rebound and is now back in the area just below $44,000.

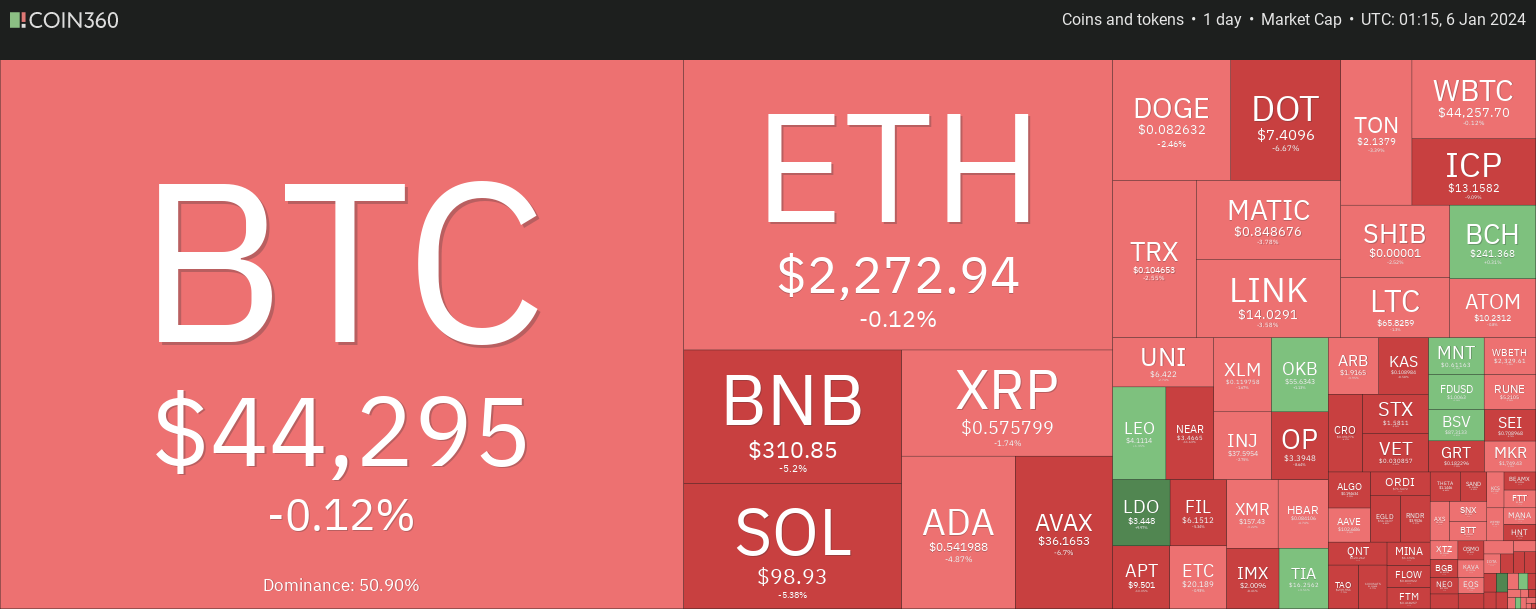

The altcoin market was hot yesterday, with multiple projects recording double-digit declines at the same time.

Terra Classic (LUNC), NEAR Protocol (NEAR), Astar (ASTR), Internet Computer (ICP), Render (RNDR), Pancakeswap (CAKE), Aptos (APT) were the worst performing major altcoins by value in 2019 Losses exceeded 10% in the past 24 hours.

Other projects such as Optimism (OP), Beam (BEAM), WOO Network (WOO), ImmutableX (IMX), Mina (MINA), Stacks (STX), Kaspa (KAS), ORDI (ORDI), Blur (BLUR), The Graph (GRT), Fantom (FTM), MultiversX (EGLD), Theta Network (THETA), Quant (QNT), Polkadot (DOT), Avalanche (AVAX), Bonk (BONK), Helium (HNT)… reduced from 5 – 8%.

Source: Coin360

After the plunge on January 3, Ethereum has stabilized above the $2,200 mark. However, despite their efforts, bulls have been unable to push the price back above the $2,300 area, with the second-largest asset by market capitalization currently trading around $2,256, almost unchanged from 24 hours ago.

ETH Price Chart – 1 Day | Source: TradingView

The “Today’s Coin Price” column will update market dynamics at 9:00 every day, and readers are sincerely invited to pay attention.

See the online coin price list here: https://tapchibitcoin.io/bang-gia

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

Bitcoin Magazine