Pro Research: Wall Street digs deep into AMD’s potential and pitfalls

[ad_1]

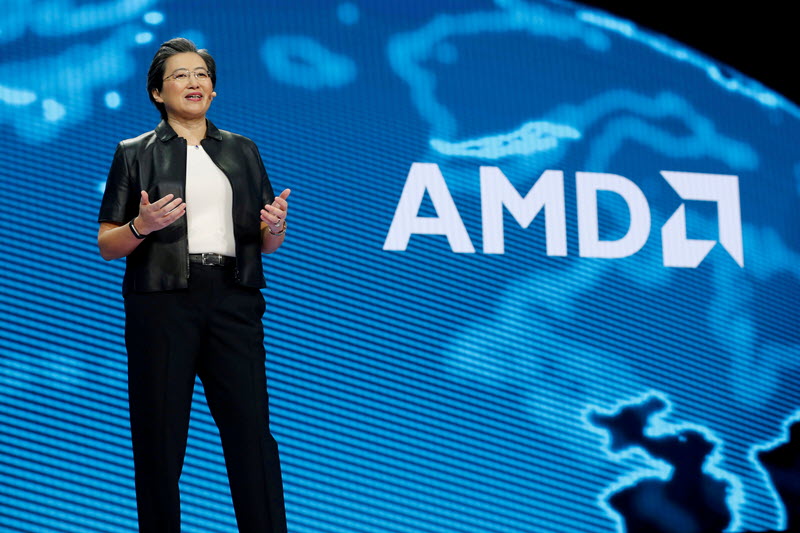

© Reuters

© Reuters Explore expert insights from Wall Street with this upcoming ProResearch article subscriber investment expert. Enhance your investing strategies with ProPicks, our latest offering that outperforms the S&P 500 by up to 700%.This New Year, enjoy up to 50% off, plus an additional 15% off a 2-year subscription with code Study 24, limited to the first 500 quick registrants. To ensure continued access to valuable content like this, step up your investing game with InvestingPro.

Advanced Micro Devices (AMD (NASDAQ:AMD)) has become a topic of interest to Wall Street analysts due to its diverse product segments and the dynamic nature of the semiconductor industry. Amid a volatile market trend and competitive landscape, AMD has overcome challenges and opportunities, particularly in areas such as data center growth, artificial intelligence acceleration and PC market dynamics.

Performance in different markets

AMD has demonstrated resilience and adaptability in the semiconductor market. The company’s discrete graphics market share, especially in desktop computers, grew to 10.9% year over year, demonstrating its strength in the field. However, the company’s data center revenue was flat quarterly at $40 million, down 11% year-over-year, highlighting the need for a strategic pivot to sustain growth and maintain competitive advantage.

Detailed analysis of product segments

The company’s product portfolio is very broad, with CPUs and GPUs forming the backbone of its products. AMD EPYC Gen 4 server processors have achieved significant growth, and AI Instinct products are expected to double sequentially to US$400 million by the fourth quarter of 2023, with the ambitious goal of reaching US$2 billion by 2024. The Ryzen 7000 series has successfully accelerated. On the other hand, the gaming and embedded fields are expected to face decline in the future.

competitive landscape

AMD is competing against industry giants like Intel Corp (NASDAQ: ) and Nvidia Corp (NASDAQ: NVDA ). While AMD has gained share in the server processor market, the risks associated with securing leading foundry capabilities and integrating recently acquired infrastructure businesses pose challenges.

Market trends and legal environment

The semiconductor industry is very sensitive to market trends and regulatory changes. AMD’s results were impacted by growth in the data center infrastructure and consumer computing markets. The company’s strategic acquisitions and emphasis on the artificial intelligence and gaming markets are consistent with broader industry trends, but its reliance on these markets also creates vulnerability to changes in legal demands and pressures.

Customer base and management

AMD’s diverse customer base includes data center operators, PC manufacturers and gamers. Company leadership is focused on driving innovation, increasing market share and diversifying products to effectively serve its broad customer base.

strategy and external factors

AMD’s strategy revolves around leveraging its strong product portfolio, particularly artificial intelligence and data center services, to drive growth. The company’s upcoming products, including the MI300, are critical to its strategy. However, external factors such as competition, market dependence and capacity constraints may affect the company’s performance.

Analyst Outlook and Reasoning

Analysts are optimistic about AMD, citing its differentiated product portfolio and strong influence on the growth of artificial intelligence infrastructure as key drivers. Expected continued server market share growth and a strong product portfolio support the bullish case. In contrast, the pessimistic scenario revolves around competition, integration risks, and challenges in ensuring minting capacity.

bear box

What challenges might AMD face in ensuring market growth?

AMD’s growth trajectory isn’t without its hurdles. The company’s reliance on growth in data center infrastructure and consumer computing markets can be a double-edged sword. While these markets provide a platform for expansion, any slowdown could adversely affect AMD’s revenue stream. Additionally, competition in the emerging artificial intelligence space is intensifying, with incumbents such as Nvidia gaining a strong foothold. The market is further complicated by risks associated with the merger of recently acquired infrastructure businesses, such as Xilinx, and challenges in securing sufficient leading foundry capacity. Suitable for AMD. These factors could limit AMD’s ability to maintain growth momentum and increase market share, particularly in the high-risk artificial intelligence and data center markets.

Will AMD’s competition in the AI and data center markets hinder its success?

AMD’s success in the artificial intelligence and data center markets is not guaranteed given the intense competition it faces. The company’s AI Instinct product, despite its growth potential, is entering a market dominated by Nvidia, which has established a significant presence in the AI acceleration space. This competitive landscape raises questions about AMD’s ability to carve out significant market share and achieve its ambitious revenue goals. In the data center sector, while AMD continues to gain market share in server processors, the presence of strong competitors such as Intel poses a continuing threat. After the market normalizes, Intel’s potential aggressive pricing strategy may pose risks to AMD’s profit margins and market position. Long-term risks include the possibility of Intel regaining its competitive advantage and reversing AMD’s market share gains.

cow case

How does AMD’s product innovation drive market share and revenue growth?

AMD’s innovative product portfolio is the basis of its bullish case. The company’s EPYC Gen 4 server processors have seen impressive growth, and its AI Instinct product is expected to see significant revenue growth. These innovations provide AMD with a performance-per-watt advantage and are expected to drive continued server market share growth. The new MI300X is attractive in the field of artificial intelligence infrastructure and will contribute significantly to revenue starting in 2024. AMD’s ability to execute on expected metrics and the strong product pipeline of its operations, including MI300, which is expected to accelerate in 2024, position the company for good growth in 2024. Data centers and other key areas.

What strategic advantages can AMD leverage to succeed in the future?

AMD’s strategic advantage lies in its strong leverage to grow its AI infrastructure and strong product portfolio. The company’s differentiated products, such as the MI300X, are gaining traction and are expected to drive significant revenue growth. AMD anticipates that the cyclical recovery in the consumer PC and gaming segments may create additional headwinds. The company’s continued market share gains in the server/cloud segment of the CPU space, along with expected strong double-digit growth in data center revenue, further strengthen the bullish case. AMD has multiple generations of architecture serving the AI and gaming markets and is well-positioned to capitalize on market trends and customer needs.

SWOT analysis

strength:

– Diverse and creative product portfolio.

– Has a strong market position in CPU and GPU areas.

– Expanding influence in the artificial intelligence and data center markets.

weakness:

– Competition from established players such as Intel and Nvidia.

– Integration risks arising from recent acquisitions.

– Depends on the growth of specific markets.

Chance:

-Expand into the fields of artificial intelligence and machine learning.

– Potential to increase server processor market share.

– Upcoming products such as MI300.

threaten:

– Market saturation and aggressive pricing by competitors.

– Competitors are likely to advance more technologically than AMD.

– Fluctuating demand for PCs and game consoles.

analyst goals

– BMO Capital Markets: Outperform rating as of November 30, 2023, with $140.00 price target.

– Roth MKM: Buy rating, $125.00 price target as of November 13, 2023.

– Piper Sandler: Overweight rating, $165.00 price target as of January 4, 2024.

– Wells Fargo Securities: Overweight rating, $130.00 price target, effective November 1, 2023.

– Wedbush: Outperform rating as of November 1, 2023, with $130.00 price target.

– UBS: Buy rating, price target $135.00, effective November 1, 2023.

– Stifel: Buy rating, price target $145.00, effective November 1, 2023.

– Wolfe: Outperform rating as of November 1, 2023, with $150.00 price target.

– Northland Capital Markets: As of November 1, 2023, price target is $130.00.

– Jefferies: Buy rating, price target $130.00, effective November 1, 2023.

– Goldman Sachs (NYSE:): Buy rating as of November 1, 2023, with a price target of $125.00.

– Deutsche Bank: Maintain rating with price target of $110.00, effective November 1, 2023.

– BofA Global Research: Neutral rating, $120.00 price target as of November 1, 2023.

– Morgan Stanley: Overweight rating as of November 1, 2023, with price target of $128.00.

– JP Morgan: Neutral rating, $115.00 price target as of November 1, 2023.

To sum up, the analysis time span is from October to January 2024, providing a comprehensive understanding of AMD’s position in the semiconductor industry.

More information about InvestingPro

As Advanced Micro Devices, Inc. AMD (AMD) continues to navigate the highly competitive semiconductor space, key financial indicators and expert analysis can provide valuable insights into the company’s performance and potential. According to InvestingPro, AMD has a market capitalization of $218.61 billion, reflecting the company’s important position in the industry. Despite a slight revenue decline of -3.14% in the 12 months to Q3 2023, the company’s gross margin remained strong at 50.32%, demonstrating effective cost management and a solid business.

InvestingPro Tips highlights the high quality of AMD’s earnings, with free cash flow exceeding net profit, indicating that healthy financial conditions support AMD’s operations and growth strategy. Additionally, analysts predict the company will be profitable this year, bolstering confidence in its financial prospects. Given the rapid growth of the semiconductor industry and the importance of the AI and data center markets, it is critical that AMD can maintain high profitability and earnings quality.

Additional InvestingPro Tips are available for investors who want a deeper understanding of AMD’s financials and strategic positioning.Special New Year promotion, get up to 50% off your subscription, use coupon code for additional discounts Study 24 With an additional 15% off a 2-year subscription to InvestingPro+, there’s never been a better time to get tons of expert insights. exhibit, InvestingPro lists 17 additional tips for AMD, providing comprehensive analysis that can inform investment decisions and strategies.

This article was created and translated with the help of artificial intelligence and reviewed by an editor. For more information, please see our terms and conditions.