ETH is expected to grow at least 340% by 2024

[ad_1]

Highly followed analysts and traders believe ETH’s price could hit five figures this year.

According to analyst Credible Crypto, his minimum price target for ETH in 2024 is $10,000, which is 343% above the current threshold.

Meanwhile, the top price target for 2024 is $20,000, which would represent an increase of approximately 786% from current values.

Credible Crypto has looked at ETH price action on the lower timeframe, saying that although the leading altcoin by market capitalization bottomed around $2,100 earlier this week, further pullbacks are still possible. There will be another pullback to $2,160 before challenging the $2,400 resistance.

“The liquidation wick is thought to have finally bottomed out, but at least in the short term, we think we may see a minor pullback and more range-bound action before getting ready for the next move higher.”

source: Trusted Cryptocurrency/X

Credible Crypto’s bullish stance on ETH comes as blockchain analytics platform Santiment notes that Ethereum whales are accumulating rapidly.

According to Santiment data, the top 150 self-service wallets currently hold 56.25 million ETH, a record high. At the same time, exchange wallets held 9.46 million ETH, the lowest level since June 2018.

Santiment revealed that the top 150 whales, in terms of exchange and non-exchange wallets, currently hold 65.71 million ETH, an all-time high.

Additionally, holding altcoins in self-custodial wallets and reducing holdings on exchanges means the intention to sell is almost non-existent.

source: Emotion/X

Sellers need a break

This is evident in the price action of ETH. As of this writing, ETH is trading at $2,261 as a result of the events that occurred on January 3rd. But as accumulation increases, the coin may retest the $2,444 resistance.

If ETH touches and breaks this resistance, the price is likely to break above the $2,500 mark. In the long run, many predictions say this price will surprise many people.

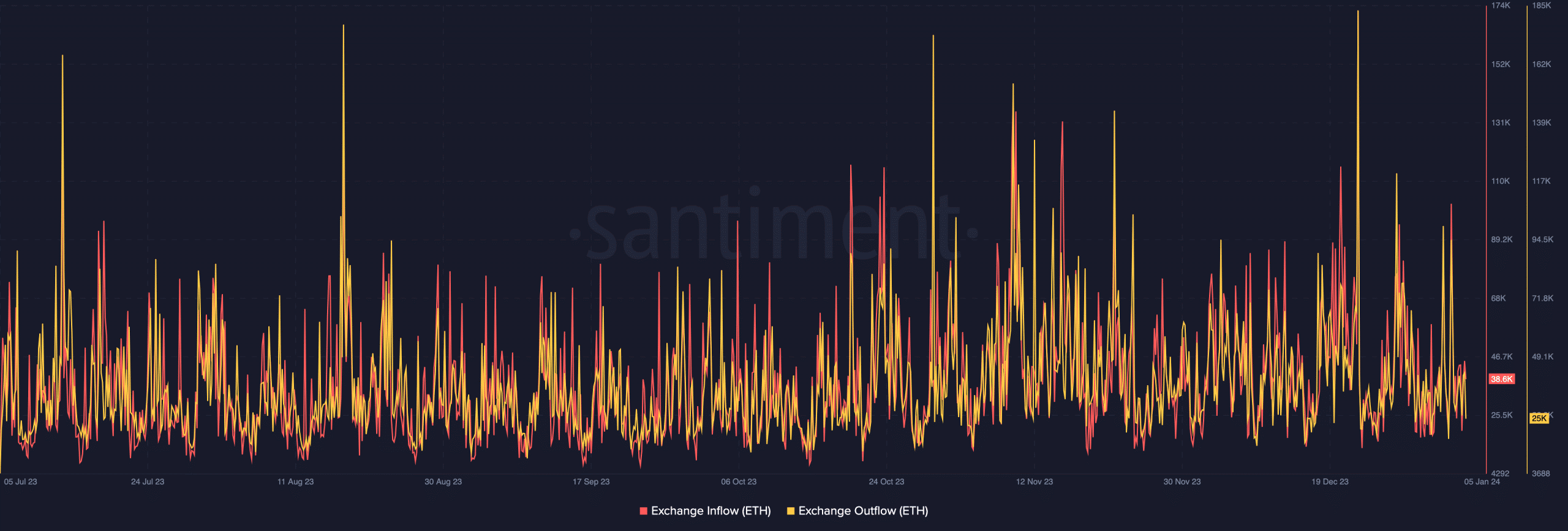

But the expected recovery may not happen in the short term. This is due to inflows and outflows from the exchange. As of this writing, ETH flow into the exchange is 36,000. On the other hand, the cash flow out of the exchange is 25,000.

The recent selling pressure ETH has faced is why inflows far outweigh outflows. In order for ETH to start moving towards $2,500, the selling pressure must decrease.

source: Ethereum

ETH is unstable but has a bright future

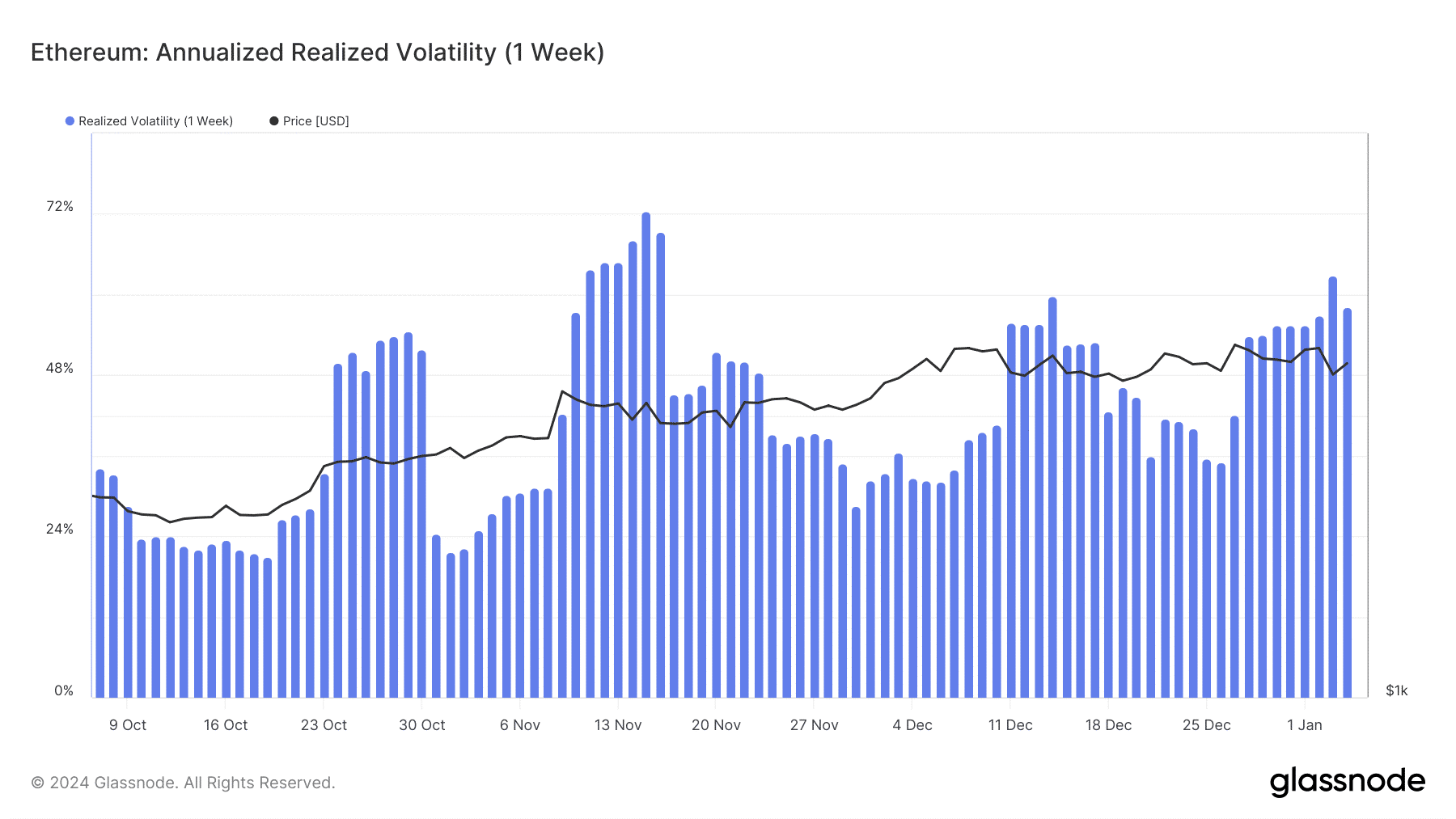

As with transaction flow, Ethereum’s seven-day realized volatility suggests that buying the currency in the short term may be risky. Realized volatility shows the standard deviation of returns compared to the market average return.

Volatility is real when values are lower programme A low-risk period for this market. As a measure of returns over a specific period, the 58.18% reading suggests that price volatility may be severe at the moment.

Therefore, traders pursuing short-term profits may want to temporarily postpone opening long or short contracts. If they do, they may regret it.

source: glass node

However, in the medium to long term, Ethereum looks promising. This has been confirmed by the status of the exponential moving average (EMA) shown on the daily chart.

As of this writing, the 50 EMA (blue) has crossed the 200 EMA (yellow). For those planning to hold ETH, this position is considered bullish. If the position remains unchanged, ETH could rise by 50% and cross the $3,000 mark in a few months.

Another indicator to consider is supertrend. At the time of writing, the Super Trend indicator is trading below the ETH price. This confirms the bearish trend initially mentioned.

But as highlighted before, regardless of whether the RSI is falling or not, this trend does not mean that traders can open short positions.

source: Trading view

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to AZCoin News