China launches new blue chip index

[ad_1]

©Reuters

©Reuters According to Lanya

Investing.com – China’s stock exchange has launched an additional blue-chip index as part of the country’s plans for a strategically important listing.

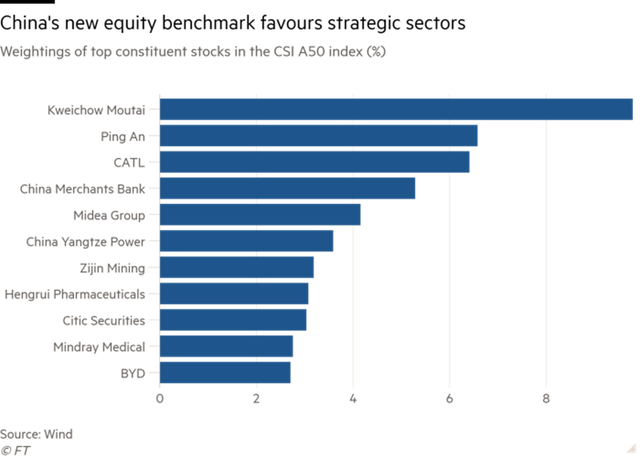

As a result, the CSI A50 Index was launched on Tuesday (January 2) to promote the creation of investment products that bring greater weighting to sectors such as renewable energy and manufacturing. Safety.

The launch of the new index comes amid a prolonged slump in China’s stock market, which has led to record foreign capital outflows and caused the Shanghai and Shenzhen-listed CSI 300 Index to fall more than 11% in 2023 amid disappointing economic growth. .

The Shanghai and Shenzhen stock exchanges said this week they would ensure index providers “enrich their stock index product portfolio to reflect changes in China’s economic structure.”

Top stocks in the CSI A50 Index include Kweichow Moutai, the world’s largest listed alcohol company by market capitalization, battery company CATL New Energy Technology Co., Ltd., chipmaker Semiconductor Manufacturing International Corp. and Jiangsu Hengrui Pharmaceuticals.

The index’s diversified focus contrasts with existing indices, which represent new drivers of economic growth.

Analysts said foreign and institutional investors in China tend to focus on the CSI 300 Index, which favors financial stocks, while individual investors typically focus on the index, which is financial and industrial-oriented.

Jason Lui, head of East Asia strategy at BNP Paribas, said: “In recent years, we have seen rapid growth in some industries that are not necessarily reflected in the index. Individuals and foreign investors tend to follow.” We can think of the CSI A50 Index as a built-in A blue chip index with appropriate sector diversification. “

Records on the China Securities Regulatory Commission website show that 10 fund management companies have registered to establish new index tracking ETFs.

Zhang Qi, an analyst at Haitong Securities, said: “This new index is quite diversified and very representative.” The highlight is the inclusion of new stocks related to the energy sector, which shows the direction of China’s new economy. “

“In the past, foreign investors were used to tracking the CSI 300 Index. Now these funds have new choices.” said Hai, a fund manager at a foreign asset management company headquartered in Shanghai.

But investors say there is no guarantee the CSI A50 index – which has fallen 2.6% since its launch – will pose a serious challenge to a stock index currently dominated by financial media. China has been paying attention for decades.

“The next step for us is to see how much flow these products tracking the CSI A50 Index actually generate. It’s too early to tell, but we think there are now more options in the market for investors to Being able to express more diverse views,” said strategist Jason Lui.