Bitcoin ETF is about to be launched, how will the Bitcoin price trend?

[ad_1]

On January 3, the price of Bitcoin (BTC) fell sharply, erasing nearly two weeks of previous price gains.

However, the price has recovered its losses and is back near its previous highs.

Bitcoin consolidates above resistance

Technical analysis on the weekly time frame shows that BTC price has been in an upward trend since the beginning of 2023. This rise accelerated after the weekly relative strength index entered overbought territory (green).

RSI is a momentum indicator that traders use to assess whether the market is overbought or oversold and whether assets are accumulating or selling. Readings above 50 and sloping upward suggest bulls still have the advantage, while readings below 50 suggest the opposite.

Interestingly, the same signal emerged regarding price movement and the RSI indicator during the last bull cycle (yellow).

Currently, Bitcoin price is trading above key Fibonacci retracement levels and horizontal resistance.

BTC/USDT Weekly Chart | Source: TradingView

Speculation is rampant about the approval of a potential spot BTC ETF. The U.S. Securities and Exchange Commission (SEC) will make a decision on the ETF between January 8 and 10. Coinbase is ready to act as an electronic intermediary between stock exchanges and currency markets once the ETF is approved.

However, more than 60% of financial advisors do not expect the SEC to approve ETFs. This is in stark contrast to cryptocurrency enthusiasts, nearly 90% of whom believe ETF approval is imminent.

Is Bitcoin ETF Approved?

Eric Balchunas, senior ETF analyst at Bloomberg believe BTC ETF will be approved. He tweeted:

“This means we will see leaks/rumors of SEC verbal approval within the next 72 hours, which is true. We will see a 19b-4 refiling before the SEC announces it, but it is not 100% official.”

Cryptocurrency Analyst Scott Melk Announce Issuers know that ETFs are getting approved, so they are preparing for it.

Caitlin Cook exhibit A very interesting topic. She said that while cryptocurrency enthusiasts are optimistic about the potential of ETF approval, they significantly underestimate the long-term impact it could have.

Although the opinions of cryptocurrency enthusiasts vary, most investors want a simple and safe method. While some may find crypto ETFs boring, they attract meaningful investors and mark the beginning of a broader trend.

BTC Price Prediction: What to Expect Before ETFs?

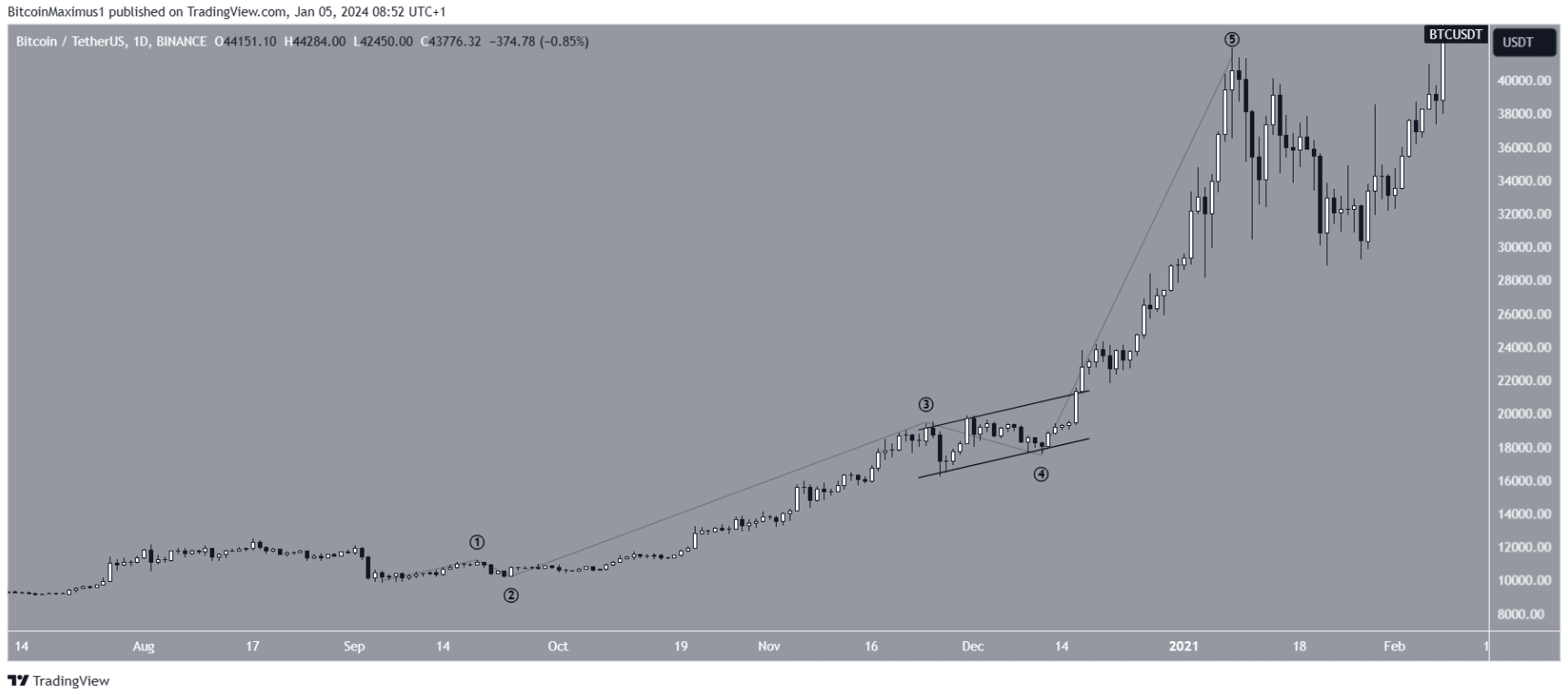

Unlike weekly analysis, technical analysis on the daily time frame offers a complex outlook due to price movements, Elliott Wave Counts, and RSI.

Technical analysts use Elliott Wave Theory to determine trend direction by studying long-term price patterns and investor psychology.

The most likely wave count indicates that price has completed the fourth wave of a five-wave up move. Wave 4 has the shape of an ascending parallel channel. This is a flat-running adjustment structure that is usually followed by a significant upward movement.

However, the daily RSI has formed a bearish divergence, which is a sign of weakness. Bitcoin’s decline occurred after this divergence, so a bearish signal may have come into play.

If BTC price breaks out of this channel, it could rise by 15% to the next resistance level at $50,800. The external Fib retracement of wave 4 at 2.61 creates this resistance.

BTC/USDT Daily Chart | Source: TradingView

A very interesting fractal emerged in November 2020. Among them, Bitcoin price completed a similar fourth wave in an ascending parallel channel before breaking out leading to a parabolic rally.

Interestingly, as mentioned in part one, this happened after the weekly RSI entered overbought territory.

BTC/USDT Daily Chart | Source: TradingView

Despite this bullish forecast, a breakout of this channel would mean that the price is still correcting. This could lead to a 14% drop in price to the nearest support at $37,800.

You can check coin prices here.

Disclaimer: This article is for reference only and does not constitute investment advice. Investors should research carefully before making a decision. We are not responsible for your investment decisions.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter: https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

SN_noor

According to Beincrypto