Today’s currency prices January 5: Bitcoin recovers strongly, altcoins prosper, and Wall Street continues to be red

[ad_1]

Bitcoin recovered to around $44,000, erasing nearly all losses from the previous day’s sharp pullback, but the asset continues to face selling pressure.

BTC Price Chart – 1 Day | Source: TradingView

US stocks

The Nasdaq Composite Index fell for the fifth consecutive trading day on Thursday (January 4), its longest losing streak since October 2022.

As of the end of the trading day, the Nasdaq Composite Index fell 0.56%. The index has fallen nearly 4% since the close on December 27, 2023. The S&P 500 fell 0.3%, recording its fourth consecutive loss. Meanwhile, the Dow Jones edged up 10.15 points (equivalent to 0.03%).

Large-cap technology stocks such as Apple have underperformed at the start of the year, with high valuations and uncertainty over when the Federal Reserve will start cutting interest rates, leading investors to worry that the market has become too optimistic.

Apple shares have fallen more than 5% this week and dropped more than 1% on Thursday after Piper Sandler downgraded its credit rating, two days after Barclays also downgraded Apple.

Wall Street’s recent performance contrasts sharply with the market’s performance as 2023 ends. The S&P 500 closed 2023 up more than 24%, its best weekly gain since 2004.

However, Steven Wieting, Citi’s head of global wealth investment strategy, doesn’t think the recent decline will have much lasting impact on the market.

In fact, Wieting believes the S&P 500 could end the year up around 5,000 points, which would imply a 6% gain from that level.

Wednesday’s Job Openings and Labor Turnover Survey (JOLTS) results also caught traders’ attention. The job vacancy rate for unemployed workers remained at 1.4 times in November, compared with an average of 0.7 times since December 2000, according to the Bureau of Labor Statistics.

“The job vacancy rate for unemployed workers is almost back to pre-pandemic levels, but it’s still high,” said Jessica Rabe, co-founder of DataTrek Research.

“The JOLTS data may cause Fed Chairman Jerome Powell and the Federal Open Market Committee to pause consideration of possible rate cuts this year,” Rabe added. As the U.S. labor market continues to cool, demand for labor continues to outpace available labor supply.

Gold prices rebounded from a two-week low on Thursday (January 4) as a weaker U.S. dollar boosted investor demand.

As of the end of the trading day, the spot gold contract rose slightly by nearly 0.1% to $2,041.59 per ounce, hitting the lowest level since December 21, 2023 on January 3. Gold futures contracts rose 0.3% to $2,049.3 an ounce.

Oil prices fell on Thursday (January 4), almost erasing previous gains, as U.S. gasoline and distillate inventories rose sharply last week, overshadowing forecasts for a sharp decline in crude oil inventories.

As of the end of the trading day, the WTI oil contract fell 51 cents (equivalent to 0.7%) to $72.19 per barrel. The Brent crude oil contract fell 66 cents (equivalent to 0.84%) to $77.59 per barrel.

Bitcoin and altcoins

Bitcoin price rose back above $44,000, hitting a local peak of $44,729, as optimism over the prospect of the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF offset concerns earlier in the day. Matrixport previously released a report.

This morning, however, selling pressure continued on the market-leading asset, pulling the price back to around $42,450 before a slight recovery towards the $43,600 area.

BTC Price Chart – 4 Hours | Source: TradingView

Digital asset management firm Matrixport predicted yesterday that the U.S. Securities and Exchange Commission may reject all Bitcoin ETF proposals this month. After the news came out, BTC immediately plummeted 7%.

But analysts who closely follow the SEC’s dealings with Bitcoin ETF applicants, including BlackRock, Fidelity and Grayscale, have denied these reports and stressed that the first Bitcoin ETF is likely to be approved next week.

The market appears to have been soothed by these reassurances, with Bitcoin now almost fully recovering yesterday’s losses.

For better or worse, price action suggests that BTC positions are closely correlated with spot Bitcoin ETFs, at least for now.

Therefore, if approved, the Bitcoin Spot ETF would allow financial institutions and traditional investors to gain exposure to Bitcoin without holding any cryptocurrency. Analysts estimate that this tool could attract $14 trillion worth of assets to Bitcoin.

Eric Risley, managing partner of digital asset advisory firm Architect Partners, said the approval of a Bitcoin ETF would be a game changer and “legitimize Bitcoin.”

Hopes tied to the approval of a spot Bitcoin ETF have pushed the asset further on its nearly three-month rally. Since October, the world’s leading cryptocurrency has gained 64.77% from $26,750.

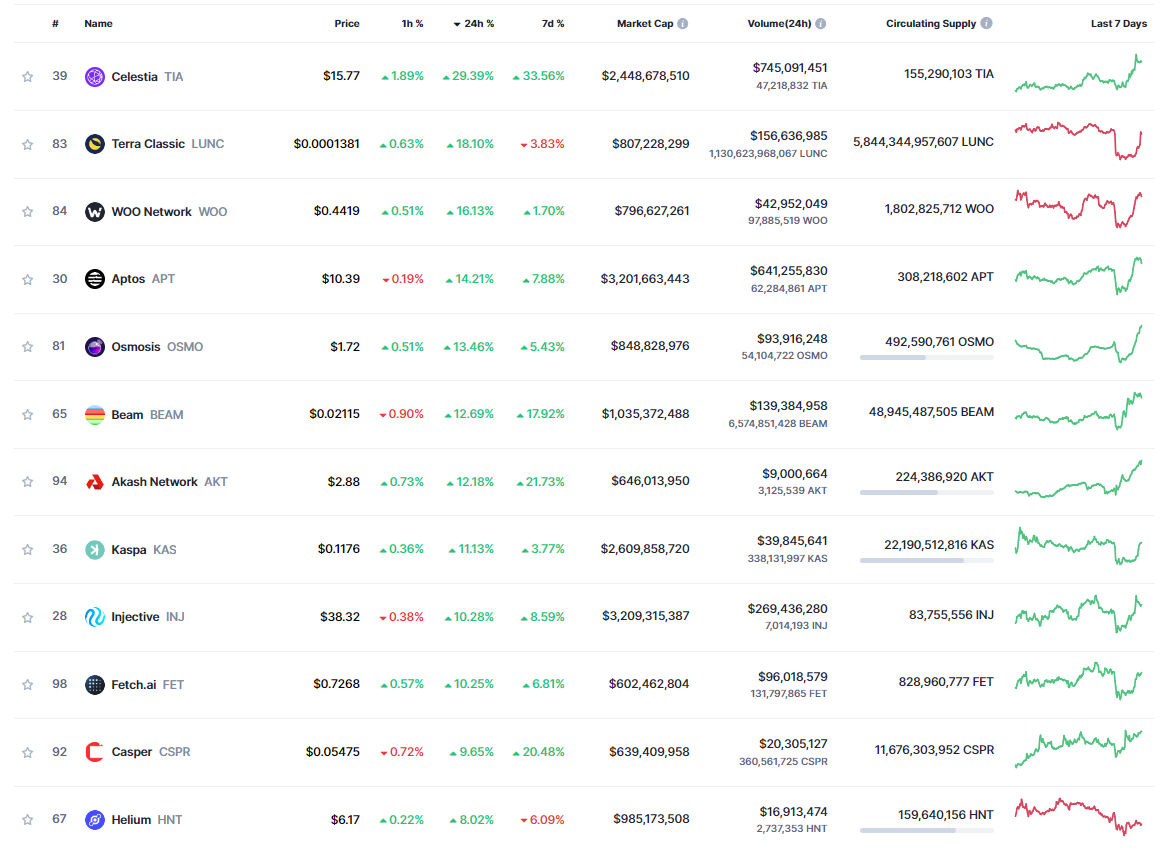

On the altcoin front, the market rebounded strongly as Bitcoin returned above the $44,000 area.

Celestia (TIA) is the best performing project over the past 24 hours. The token, a platform built using the Cosmos SDK that supports custom blockchain builds, has rebounded by nearly 30%, reaching a new peak price of $16.8.

Other projects in the top 100 include Terra Classic (LUNC), WOO Network (WOO), Osmosis (OSMO), Aptos (APT), Beam (BEAM), Akash Network (AKT), Kaspa (KAS), Injective (INJ) , Fetch.ai (FET) grew by more than 10% at the same time.

Source: Coinmarketcap

After a brief plunge the previous day, Ethereum (ETH) has returned and is approaching the $2,300 mark. However, the market then continued to face selling pressure, pulling the price of the market’s second-largest asset by market capitalization to around $2,240.

ETH Price Chart – 4 Hours | Source: TradingView

The “Today’s Coin Price” column will update market dynamics at 9:00 every day, and readers are sincerely invited to pay attention.

See the online coin price list here: https://tapchibitcoin.io/bang-gia

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

Bitcoin Magazine