Thorchain dominates cross-chain transaction volume, how does RUNE price react?

[ad_1]

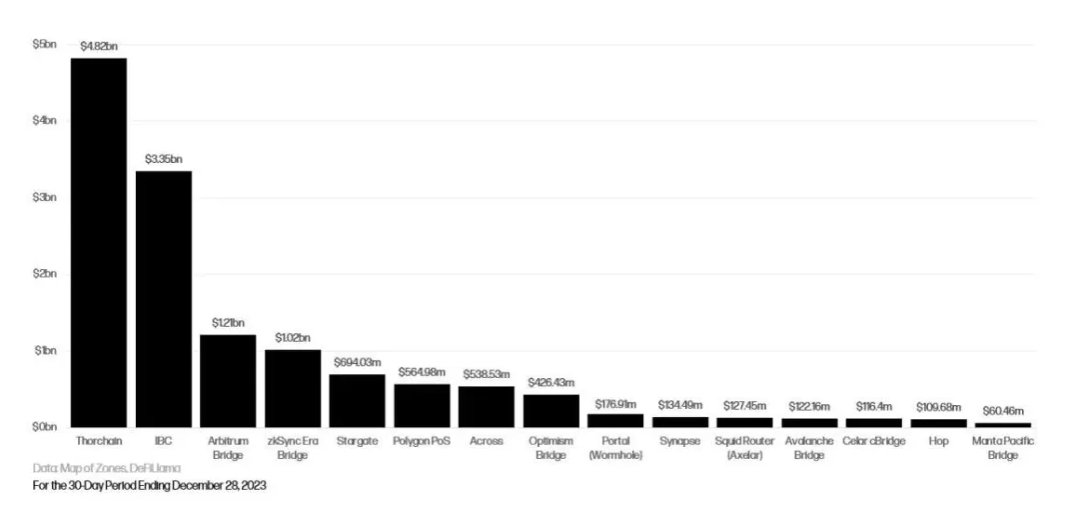

On-chain data shows that cross-chain liquidity network Thorchain has become a leader in cross-chain remittances, surpassing other competitors in transaction volume and transaction activity.

Thorchain transaction volume increases significantly

Quote data Bullion, a user of Galaxy Research, had a transaction volume of US$3.35 billion during the same period. .

Among second-tier bridges, Arbitrum Bridge leads the way with cross-chain transaction volume of $1.21 billion. Other projects, such as Polygon POS and Stargate, handled $564 million and $694 million respectively.

Cross-chain transaction volume comparison | Source: Galaxy Research

Thorchain’s surge in transaction volume and liquidity highlights the protocol’s growing importance in the broader decentralized finance (DeFi) space. Its unique features and innovative solutions make it the preferred destination for cross-chain asset transfers.

At its core, Thorchain is able to facilitate cross-chain asset exchange in a convenient, trustless and non-custodial manner. Therefore, similar to popular decentralized exchanges such as Uniswap, Thorchain allows users to retain control of their funds without relying on intermediaries.

Thread swapping technology seems to be attracting the attention of Thorchain users. This feature allows users to exchange with almost no slippage even if liquidity is not high. Technically speaking, the lower the liquidity, the greater the price slippage. Therefore, low or zero slippage gives Thorchain a major advantage over other cross-chain exchanges.

In addition to trading, Thorchain also integrates other DeFi solutions, including lending. The platform now supports trustless asset lending without liquidity or interest rate risk, unlike traditional lending protocols including Aave.

Can RUNE reach a new peak in 2024?

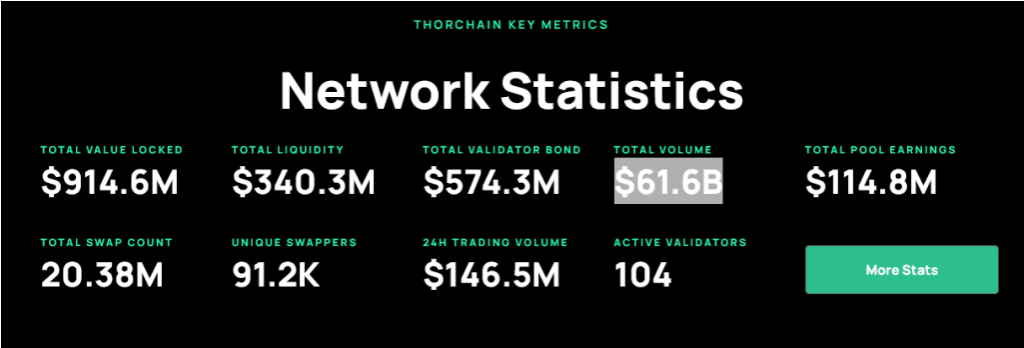

Together, these outstanding features have contributed to Thorchain’s growing transaction volume, further solidifying its position in the resurgent DeFi space. According to DeFiLlama, Thorchain have The total asset value locked (TVL) is approximately $322 million.

Meanwhile, the platform claims to have more than 91,000 swap participants. The protocol’s cumulative transaction volume has exceeded $61 billion.

Network Statistics | Source: Thorchain

As DeFi begins to recover from the crash in 2022, the platform’s native token RUNE also benefits. Looking at RUNE’s daily chart, it’s up about 5x from its 2023 bottom.

RUNE Price Chart – 1 Day | Source: TradingView

Despite the sharp decline on January 3, RUNE remains resilient. The price trend is within a bullish flag pattern. Any break above $6.50 and local resistance is likely to spur demand, pushing RUNE above $7.30 towards new 2024 highs.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Stronger

Bitcoin Magazine