Pro Research: Wall Street digs deep into PayPal prospects

[ad_1]

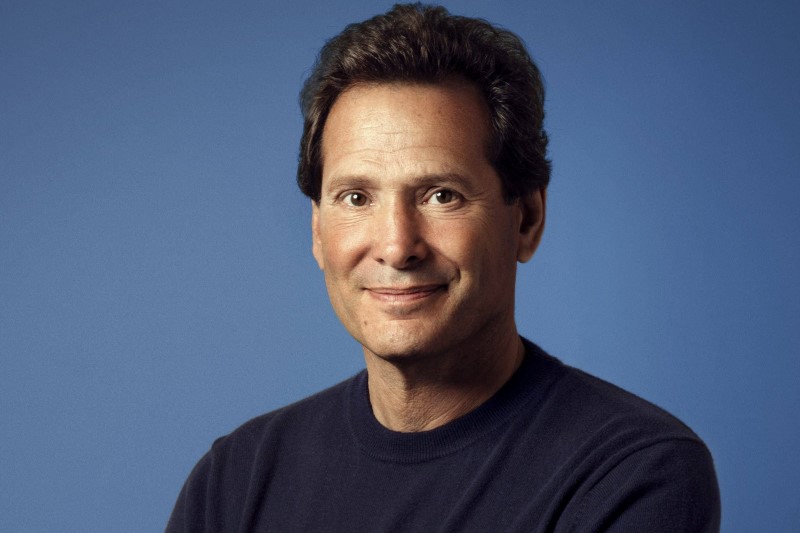

© PayPal PR

© PayPal PR Explore expert insights from Wall Street with this upcoming ProResearch article subscriber investment expert. Enhance your investing strategies with ProPicks, our latest offering that outperforms the S&P 500 by up to 700%.This Cyber Monday, get up to 60% off, plus an extra 10% off a 2-year subscription with code Study 23, limited to the first 500 quick registrants. To ensure continued access to valuable content like this, step up your investing game with InvestingPro.

In a world where digital transactions continue to reshape the business landscape, PayPal (NASDAQ: ) Holdings, Inc. (NASDAQ: PYPL ) stands out as an industry giant. The company, known for its robust technology platform that powers digital and mobile payments, was recently the subject of analysis by BTIG, LLC, which downgraded the stock to “neutral” from “buy.” This article aims to integrate various perspectives and provide a comprehensive overview of PayPal’s position in the market.

Company Profile

PayPal’s global reach and its important role in facilitating online payments for consumers and merchants are well known. The company currently has more than 430 million active customers, operates in more than 200 markets, and has continued to grow its user base since its last report. Its two-sided network model continues to provide fertile ground for increasing average revenue per user (ARPU) through the launch of new products and services.

Performance and market trends

The digital payments segment of U.S. e-commerce is growing strongly, which bodes well for PayPal’s revenue prospects. However, BTIG expressed concerns about ongoing margin pressure as the company’s volume mix shifts from branded to non-branded deals, particularly as Braintree volume growth results in lower margins. This change is expected to continue to impact operating margins and lead to a reduction in 2023 operating margin expansion guidance. The company expects trading margins to decline by approximately 190 basis points in fiscal 2024 before stabilizing in fiscal 2025.

PayPal stock has been a subject of debate and currently trades at about 10.7 times earnings, below its historical average. The recent share price of $58.45 suggests the company faces a balance of risks and structural earnings headwinds.

Management and Strategy

Under the leadership of CEO Alex Chriss, PayPal is undergoing a strategic transformation. The company is committed to reducing non-transaction costs while focusing on operating the company as a growing entity with marginal cumulative revenue growth potential and greater operating efficiencies. PayPal is transforming into a platform-centric business, consolidating and monetizing data assets, particularly around payment processes, and driving growth for small and medium-sized businesses.

Despite BTIG’s downgrade, there are still cost-saving opportunities that could contribute to earnings per share growth, but trading margin growth is more important at the moment. Management expects negative trading margin growth in 4QFY23, but expects more clarity in FY24, with further cost savings exceeding the approximately $1.9 billion identified in FY23.

Financial Metrics and Forecasts

Analysts have given mixed estimates for PayPal’s earnings per share, reflecting consensus expectations for growth. Revenue growth is expected to be approximately 7.5% in FY23 and approximately 8.5% in FY24. Adjusted earnings per share are expected to grow by approximately 21% in FY23 and approximately 10% in FY24. Potential catalysts include M&A announcements, e-commerce acceleration, accelerated acquisition programs or major partnership wins. In the bullish scenario, margins could expand 100 basis points year over year, Venmo could continue its pre-pandemic growth rate, and trading margins could stabilize.

competitive landscape

In the highly competitive payments industry, PayPal continues to maintain its position. The company is gaining market share in e-commerce volume through sustained user frequency of active accounts. Margins are also expected to expand through continued cost controls. Part of the strategy is the launch of higher-margin services such as risk-as-a-service and FX-as-a-service, as well as international expansion and moves to cater to small and medium-sized businesses. Braintree’s growth is now putting pressure on margins.

Legal and external factors

There has been skepticism about using customer purchasing data for advertising campaigns due to potential regulatory scrutiny and conflicts of interest. Additionally, the company’s approach to expanding financial services has been questioned, with some analysts preferring partnerships rather than in-house growth to minimize risk. Adverse currency fluctuations and financing costs could have a greater-than-expected impact on earnings per share.

bear box

Is PayPal’s growth sustainable in a changing market?

Some investors worry about PayPal’s ability to maintain growth, especially as it faces a shift toward unbranded transaction volumes that could erode trading profits. Significant investment is required to improve fundamentals and adapt to market changes, which could result in downward earnings per share revisions. In addition, recent changes in CEO and strategic direction have added an additional layer of uncertainty to medium-term financial expectations. Braintree ~32% FXN’s continued growth will likely continue to put pressure on margins, while a significant slowdown in e-commerce during the economic downturn could negatively impact the company.

Can PayPal overcome margin pressure?

Despite various measures to offset margin pressures, such as PPCP’s scale and cost-saving initiatives, pessimism has persisted in the near term. The adjustment period under new management may not bring significant changes in the short term, and corporate pricing and new management plans need to be clearer.

cow case

Will new leadership push PayPal forward?

The arrival of CEO Alex Chriss has sparked optimism. His focus on allocating resources to high-growth areas and his commitment to greater transparency could reinvigorate PayPal’s growth trajectory and performance. The integration of data assets and PayPal’s strategy of driving small business adoption of payment solutions are seen as potential catalysts for improvement.

Is PayPal’s valuation an opportunity for investors?

Some analysts say PayPal’s current valuation is historically attractive and presents an opportunity for investors. The company’s efforts to drive growth for its brand, top-margin TPV Technology, and launch new, higher-margin services could lead to a recovery in results and stock returns.

SWOT analysis

strength:

– Strong brand awareness and global scale.

– Diversified revenue sources and growing non-branded sales.

– Strategic focus is on high-margin services and international expansion.

weakness:

– Trading profits were diluted as unbranded and Braintree sales grew.

– Requires significant investment to improve fundamentals.

– Regulatory uncertainty around the use of data for advertising campaigns.

Chance:

– Expansion into the SME market and international regions.

– Potential for operating leverage through cost-saving initiatives.

– Leverage data assets to improve consumer and merchant experiences.

threaten:

– Competitive pressures in the digital payments industry.

– Risks related to foreign exchange fluctuations and financing costs.

– Implementation risks associated with new product launches and strategic changes.

analyst goals

– Morgan Stanley & Company. LLC: Overweight; $118.00 (Nov 2, 2023).

– JPMorgan Securities LLC: Overweight; $80.00 (Nov 2, 2023).

– RBC Capital Markets: Outstanding; $70.00 (November 2, 2023).

– BMO Capital Markets: Outstanding; $90.00 (November 3, 2023).

– Barclays Capital: Overweight; $88.00 (October 12, 2023).

– Oppenheimer & Co.: Performance; no specific target (January 4, 2024).

– BTIG, LLC: Neutral; no specific target (January 5, 2024).

The time range of this analysis is from September 2023 to January 2024.

This article was created and translated with the help of artificial intelligence and reviewed by an editor. For more information, please see our terms and conditions.