Bitcoin price drop sparks ‘buy the dip’ sentiment

[ad_1]

Data from Santiment shows that the number of mentions of “buy the dip” on social media has increased to a 22-month high. According to the blockchain analytics company, the number of mentions of the phrase on the social network has increased to 323 times, which is the highest level since March 25, 2022.

This development suggests that traders were initially highly optimistic about the chances of a quick market recovery.

Mentions “purchase Dip. Dip“ in psocial media flavor | Source: Santiment

Optimism surged following the Jan. 3 cryptocurrency market flash crash, suggesting traders are increasingly aware of opportunities at the current lower prices.

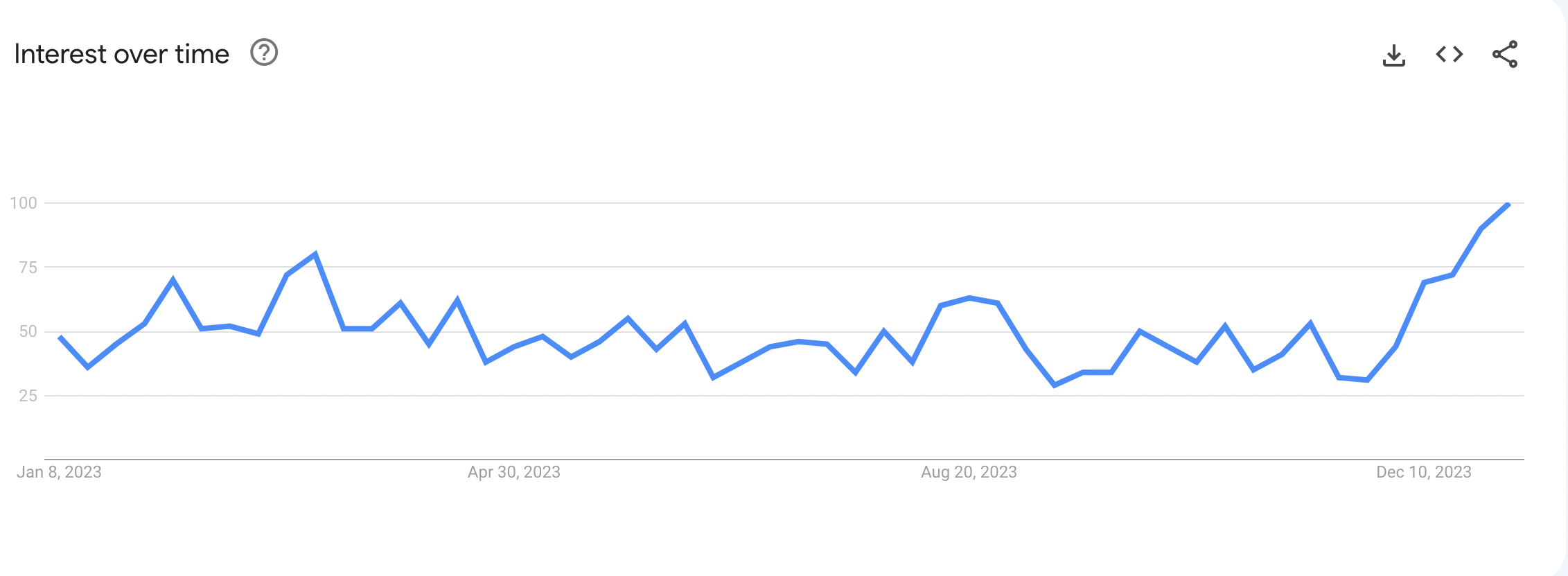

Data comes from Google Trends programme User interest in the term “buy the dip” has been on the rise since late November 2023.

Google Trends is a tool that uses real-time data to analyze the popularity of Google search terms.

User interest in the search term “buy dip” | Source: Google Trends

The chart above shows that people have searched for the term “buy the dip” over the past 6 weeks, driven by market trends and occasional price drops.

People on X (formerly Twitter) are the most optimistic about a quick price recovery, with some analysts suggesting call Instead of “looking for reasons to sell,” market participants should “buy the dip.”

Another post from user X Dust on January 3 show “Price action on longer time frames is leading to a bigger rally,” adding that it was a “buy the dip situation.”

Increased calls to buy the dip provide opportunities for patient traders. However, it is also known to flag deeper corrections.

For example, during the 2021 bull market, calls to buy the dip surged, followed by further price corrections.

However, the Crypto Fear and Greed Index remains in the “greedy” zone, according to Alternative.me. Although the index fell from 73 points last week to 72 points on January 5, this shows that traders are still optimistic that the market will continue its upward trend.

Cryptocurrency Fear and Greed Index | Source: Alternative.me

price Bitcoin Decline boosts “buy” sentiment Dip. Dip“

Calls to buy the dip increased after Bitcoin prices plunged on January 3, falling as much as 9% from $45,510 to $41,000, a level last seen in December 2023 that nearly wiped out Gone were all profits realized since January 1st.

The price drop has wiped out many leveraged positions, with more than $700 million in long positions liquidated in 24 hours.

The market-wide correction comes as a report from digital financial services platform Matrixport withdraws its recent prediction that the U.S. Securities and Exchange Commission (SEC) could approve the first spot Bitcoin ETF in January 2024.

Matrixport believes that the SEC will reject all spot Bitcoin ETFs in January and that such approval will not come before the second quarter of this year.

As of this writing, Bitcoin is trading at $44,231, up 3.2% in the past 24 hours, according to CoinMarketCap.

The long lower shadow on the January 3 candle points to bulls buying heavily at the lows of $41,000.

price chart Bitcoin/Tether Daily | Source: Trading view

All major moving averages are pointing upwards, which means the bullish momentum is not over yet. Bulls are currently focused on a return to the $45,000 level and turning it into support. If successful, they will eye the next major resistance level at $50,000.

On the other hand, bears may continue to take profits, creating selling pressure that drags Bitcoin towards $42,000 and then $40,000.

Meanwhile, market participants are anxiously awaiting the SEC’s decision on a Bitcoin spot ETF and how the leading cryptocurrency by market capitalization and the overall crypto market will react.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to Cointelegraph