Why is ETH the top altcoin for Q1 2024?

[ad_1]

As Michaël van de Poppe recently revealed, ETH could be one of the best-performing coins in the first quarter of this year. Founder of MN Trading notes The altcoin will outperform Bitcoin in the first quarter.

However, this is not the main reason why he believes ETH will come out ahead.

Instead, he focused on ETF filings related to Bitcoin and ETH. Defending his view, the analyst said that bullish sentiment on the Ethereum spot ETF will have a positive impact.

van de Poppe did not specifically mention the impact that spot Bitcoin ETFs may have on ETH. Furthermore, he said:

“My thesis is that ETH is likely to outperform Bitcoin in the coming period, which is why I want to allocate more funds to ETH. The Ethereum ETF delivering as soon as the Bitcoin ETF is approved is one of the reasons.”

Is Bitcoin season over?

However, it is worth mentioning that the U.S. Securities and Exchange Commission (SEC) has postponed a decision on the Ethereum ETF until May, while many analysts believe that a decision in favor of Bitcoin will be made in January.

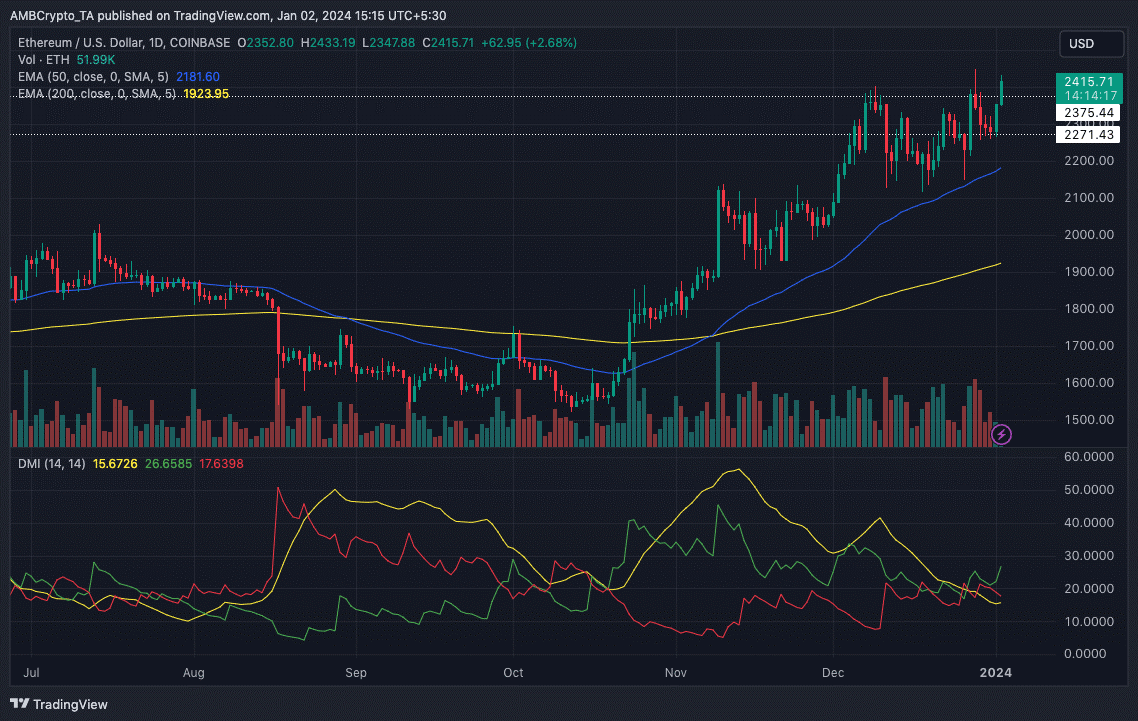

As of this writing, ETH is trading at $2,372, marking an optimistic start to the year. Signs on the daily chart suggest buyers could take advantage of seller exhaustion at $2,272.

This also helped the price break above the $2,375 resistance.

In terms of mid- to long-term potential, the exponential moving average (EMA) suggests that ETH may be undervalued. As of this writing, the EMA 50 (blue) has broken above the EMA 200 (yellow).

This position suggests that a major uptrend may develop much later.

Some time ago, many analysts considered the possibility of ETH hitting $2,500. At the time of writing, this altcoin is showing signs of getting closer to that point. However, the Average Directional Index (ADX) needs to point higher to confirm the trend.

Currently ADX (yellow) is 15.67. If the index reaches 25 or above, it could support +DMI (green) gains and help ETH reach $2,500 in the short term.

Source: TradingView

ETH always comes first

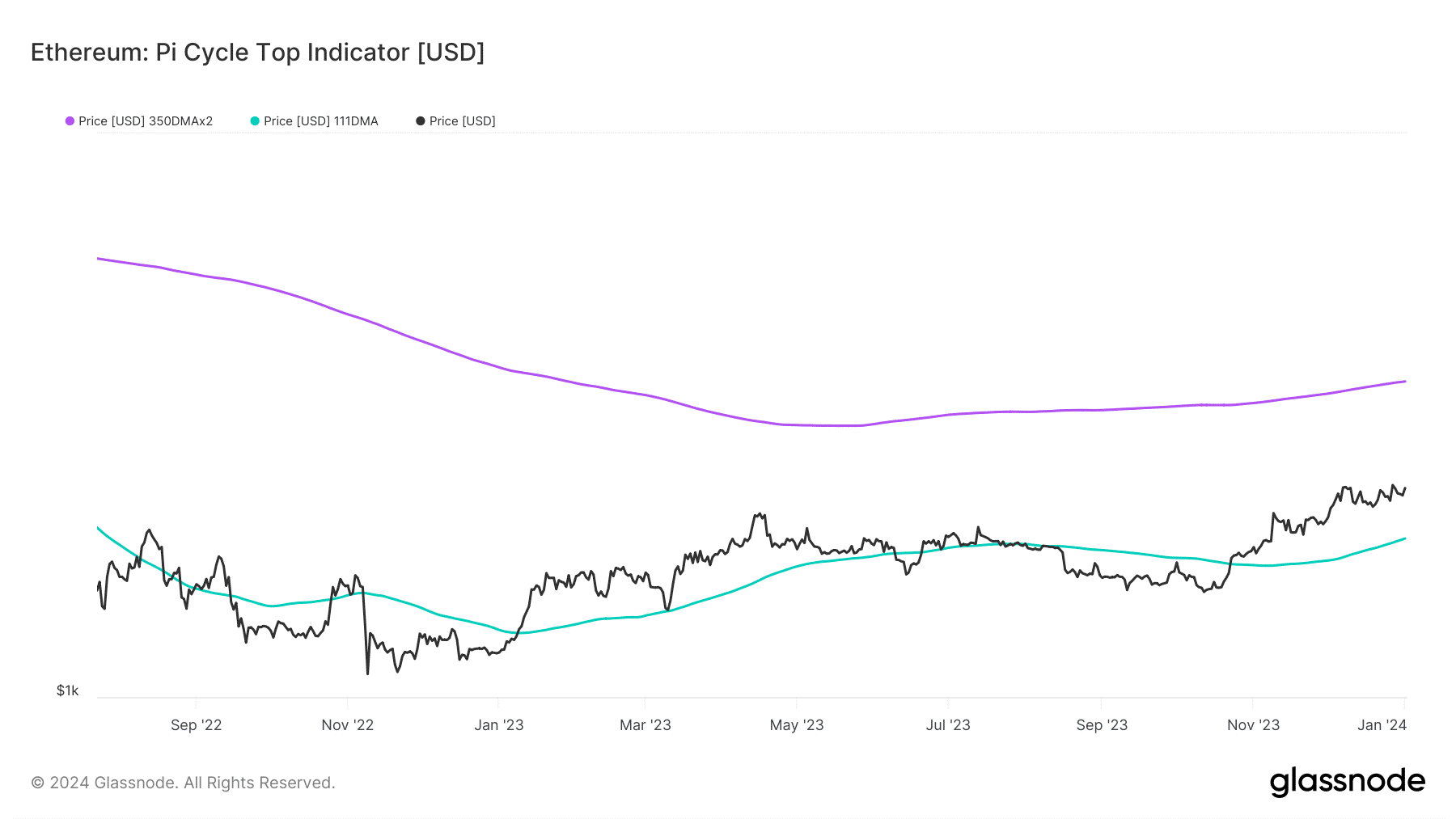

Another indicator reflecting the potential of ETH is Pi Cycle Top. Pi Cycle Top shows when a cryptocurrency is significantly overheating. In this case, SMA 111 (blue) reaches SMA 350 (purple).

However, Glassnode data analysis shows that SMA 111 is well below SMA 350. This means that ETH has not reached its peak yet.

Source: Glassnode

A deeper review of the data shows the SMA 111 price at $1,921 at the time of writing. The SMA 350, on the other hand, costs $3,631. This means that if all goes well, ETH has the potential to reach $3,631 within a few months.

But if this high is not reached, then $1,921 is a good support level. In addition to Ethereum, van de Poppe also suggested that people look at Chainlink (LINK), Arbitrum (ARB) and Optimism (OP).

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to AMBCrypto