Survey: Bitcoin ETF approval may increase investment by non-crypto users

[ad_1]

A recent report from Security.org showed that U.S. cryptocurrency holdings increased by 10% year-over-year, with 46% optimistic about the potential positive impact of the approval of a Bitcoin ETF in 2024.

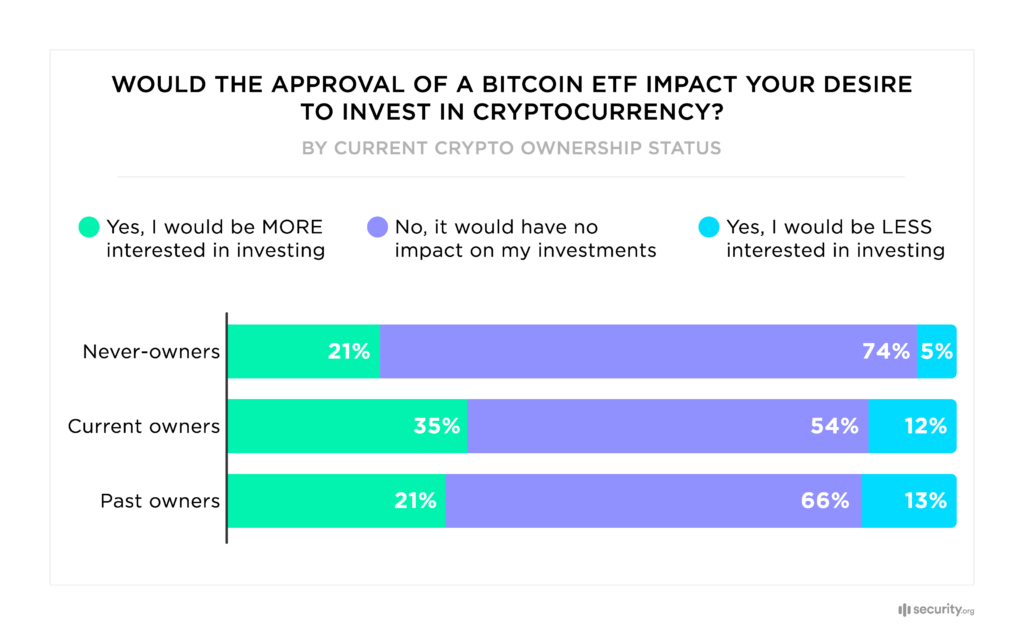

According to the survey of 1,500 Americans, 40% currently own cryptocurrencies, and of those who are not yet involved in cryptocurrencies, 15% express interest in purchasing in the coming year. Additionally, 21% said they would be more inclined to invest in a spot Bitcoin ETF if it were approved.

Respondents expressed optimism about the impact of Bitcoin ETF approval in 2024, with 46% believing it would have a positive impact on the blockchain industry. Currently, there are 13 active spot Bitcoin ETF applications awaiting a decision from the U.S. Securities and Exchange Commission (SEC), with deadlines scheduled for January 15th at the earliest. Major players in the financial sector including BlackRock, Fidelity and Franklin Templeton are among the contenders.

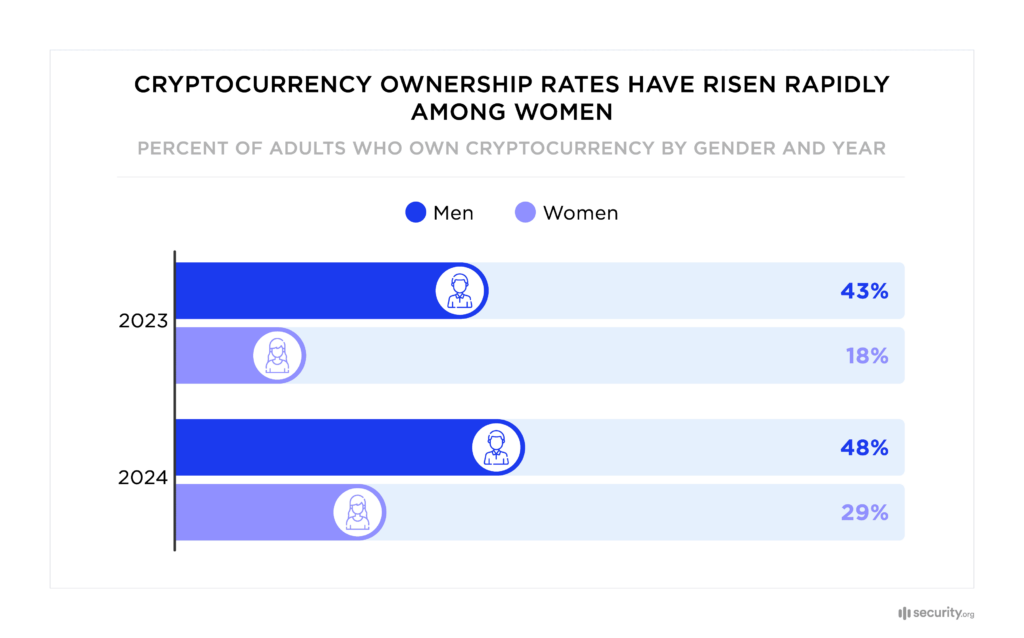

The survey revealed that 63% of existing cryptocurrency owners plan to purchase more digital assets in the next year, primarily Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Cardano (ADA). While traditionally dominated by young men, the cryptocurrency ownership landscape is growing, with female participants increasing from 18% to 29%. This shift may be attributed to the increasing visibility of women in blockchain development and cryptocurrency investment, with figures such as Laura Shin, Cathie Wood, Cynthia Lummis, and Hester Peirce.

Blockchain intel firm Chainaanalysis highlighted North America’s prominence, saying it is the world’s largest cryptocurrency market, accounting for 24.4% of global trading activity.