Stablecoin storm: market chaos, Gemini GUSD plummets 93%

[ad_1]

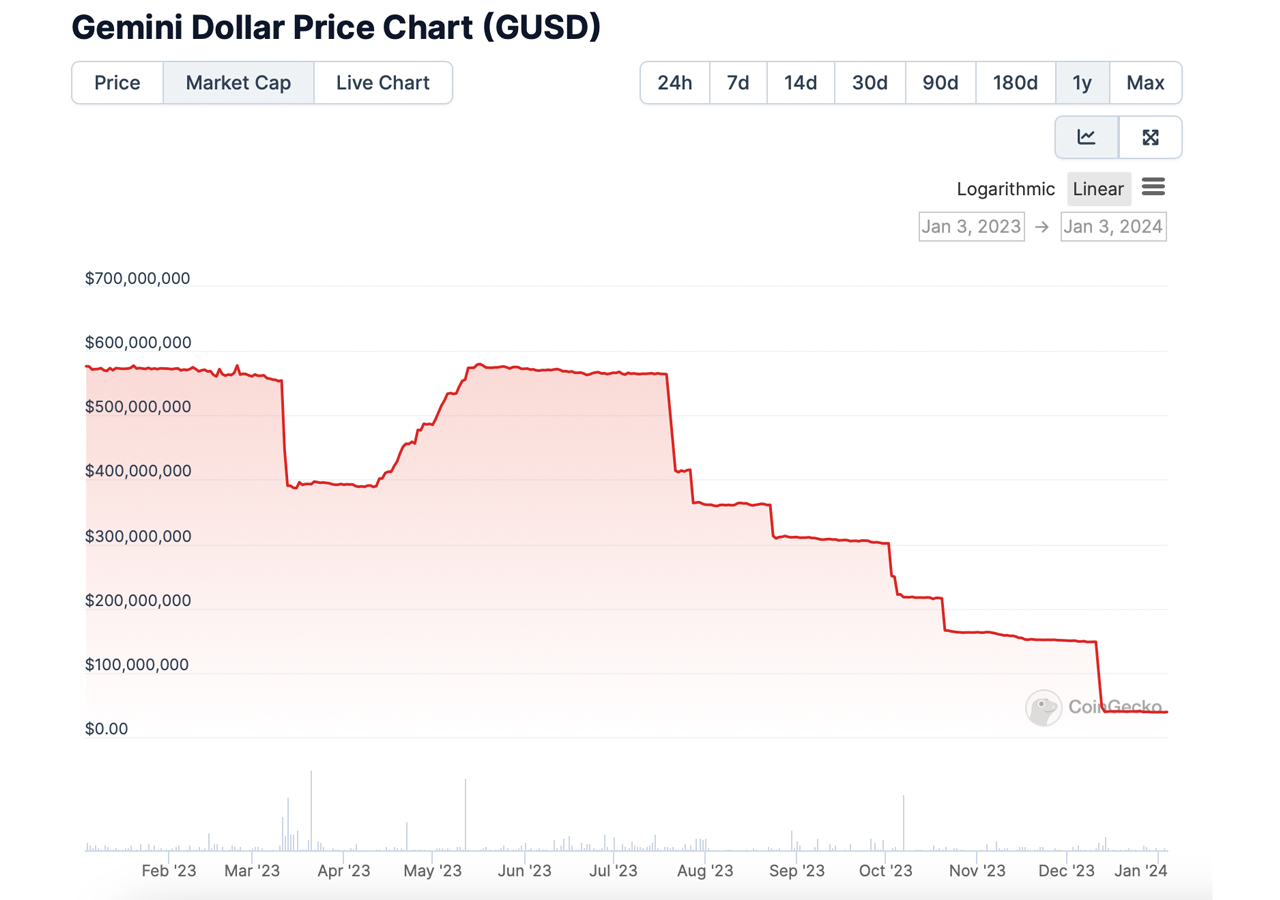

As of June 2023, Gemini’s stablecoin GUSD ranks as the ninth largest stablecoin by market value. During the same period, it received an A grade from Bluechip, an independent not-for-profit stablecoin rating company. However, the report noted that GUSD “is not widely used in the cryptocurrency market and therefore lacks significant liquidity on exchanges.” At the time, GUSD’s market capitalization was approximately $564.86 million, but has now plummeted 93.1% to $38.93 million.

To illustrate its size, Gemini’s stablecoin currently accounts for only 0.0423% of USDT’s massive $95.2 billion market capitalization. Furthermore, GUSD’s global trading volume in the past day barely exceeded $1 million, lower than USDT’s $52.51 billion. As a result, GUSD’s ranking dropped from the 9th largest stablecoin to the 24th and is currently ranked 667th out of 12,000 crypto assets. While the main exchange for GUSD is Gemini, it is also traded on Coinbase and Curve.

GUSD’s market capitalization. Source: TradingView

This year has also seen the decline of another stablecoin, Paxos’ Pax Dollar (USDP), which had a market capitalization of $1 billion as of the end of June. The current market value of USDP has dropped to US$369 million, a drop of 63% or a loss of US$631 million. Despite this decline, USDP has maintained its position as the ninth-largest stablecoin by market valuation, although it was ranked seventh in June 2023. The decline of BUSD issued by Paxos was expected, but the subsequent decline of USDP was unexpected.

However, Paxos recently received approval from the NYDFS and plans to expand its stablecoin operations on Solana. In comparison, the global trading volume of stablecoins is only $3.87 million, a figure that is significantly inferior to giants such as USDC, which had a trading volume of $9.49 billion in the past day. Magic Internet Money (MIM), another fiat-backed digital currency created by Defi project Abracadabra Money, has exited the stablecoin system. Before Terra’s collapse, MIM ranked as the sixth largest stablecoin.

Currently, MIM has fallen to 21st place, and its market value has plummeted from US$2.81 billion in April 2022 to US$51 million today. Earlier this year, especially around the end of February, MIM’s market capitalization was already twice its current size before experiencing a significant decline. MIM has a trading volume of approximately $309,079, and its activity is significantly lower even compared to its smaller trading volume. Currently, MIM is most actively traded on Trader Joe, with other well-known platforms including Camelot and Uniswap V3, mainly related to Wraped Avalanche (WAVAX).

GUSD, USDP and MIM have fallen sharply over the past 12 months, triggering a sense of uncertainty in the market. After Terra’s UST value evaporated, MIM began a downward flywheel, and the downturn of GUSD and USDP followed in 2023. UST’s failure shook the industry. The crypto industry and even USDC experienced the collapse in value that occurred in March 2023 when Silicon Valley Bank collapsed. With these tumultuous memories in mind, the stablecoin market appears to be at a crossroads. While things look cautiously optimistic in the stablecoin space, no one knows what this wave will bring.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Itadori

According to Bitcoin News