SOLid Returns – Solana’s Hopes for 2024 Hing on These Forecasts

[ad_1]

This time last year, popular smart contract network Solana was grappling with perhaps its biggest challenge yet.

FTX, one of the world’s largest exchanges at the time, collapsed, causing a domino effect on entities facing the impact of the bankrupt platform. The Solana ecosystem is one of them.

Although not directly related to FTX, SOL is widely endorsed by exchange co-founder Sam Bankman-Fried (SBF). Critics claim that SBF’s activities were partially responsible for previous increases in the token’s price.

In addition, FTX also invests heavily in blockchain-based projects.

Little did Solana’s supporters know that the association would come back to haunt them for a long time to come.

decrease then increase again

In the days following the incident, the native token SOL fell to all-time lows. From an all-time high of $259 a year ago, the asset has fallen below $9 by the end of 2022.

Additionally, users, funds, and projects began to leave the network.

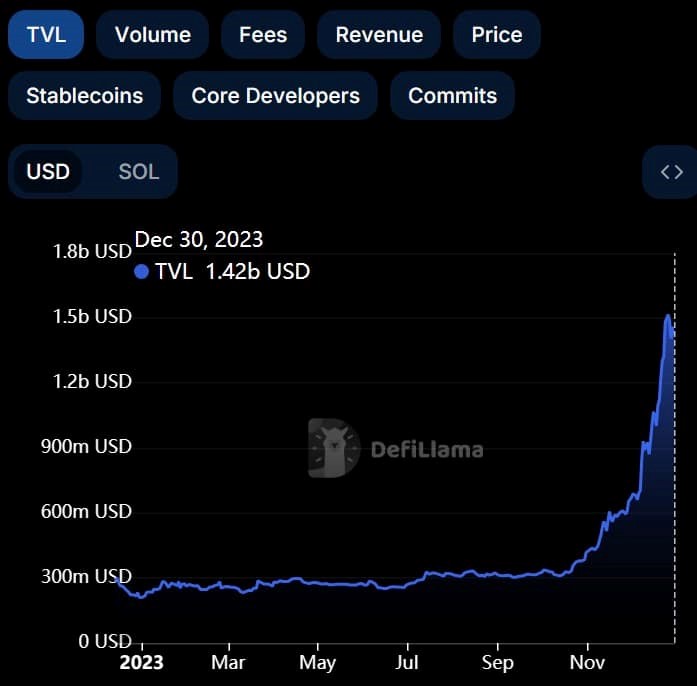

According to data DefilamaFrom the first week of November, when the problems began, to the end of 2022, $769 million worth of liquidity was withdrawn from Solana.

The project was once considered an Ethereum killer, but sentiment surrounding the project is at an all-time low.

But like all good things, all bad things must come to an end!

By 2023, Solana completed the best comeback in cryptocurrency history.

If you believed in SOL’s long-term prospects amid the FUD a year ago and resisted the temptation to sell, congratulations! Read this article and your SOL assets will increase 7 times.

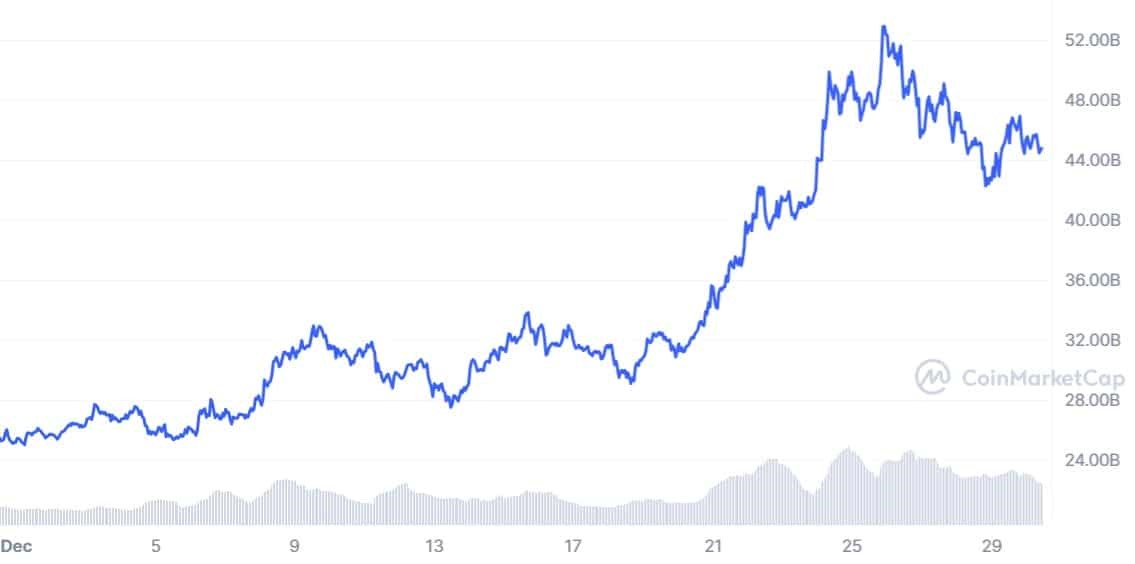

Most of the gains came from the year-end pickup, as shown below. As of this writing, greater market optimism, combined with Solana’s achievements, has pushed SOL’s market capitalization to $44.83 billion, the fifth-largest among all major electronic currencies.

source:CoinMarketCap

The surge in SOL prices has also pushed up the dollar investment capital value of various projects on Solana. As of this writing, TVL stands at $1.42 billion, reversing all losses incurred after the FTX crash.

source:Defilama

What’s the reason behind this change?

Nearly all analysts praise Solana’s fundamental strengths as the key to a turnaround. Rahul Maradiya, co-founder and global CEO of CIFDAQ, a Dubai blockchain ecosystem, said:

“Solana has a vibrant developer community designed to take advantage of its inherent scalability. In particular, its transaction speed lends itself to many use cases.”

This view is echoed by Jeff Owens, co-founder of Layer 1 blockchain Haven 1, who believes:

“Solana is fast, cheap, and appears to have solved the reliability issues that plagued the chain in 2021, which seems to indicate Solana is here to stay.”

In fact, Solana himself praised the developer community for their hard work in turning the situation around. Austin Federa, director of strategy at the Solana Foundation, said in a statement shared via email:

“FTX’s demise was a heavy blow to the industry, but the network is where it is today entirely due to Solana’s resilience and ability to build a global community. The Solana community got back to work in the midst of a bear market, and one year later, we’re witnessing that determination and the pinnacle of effort.”

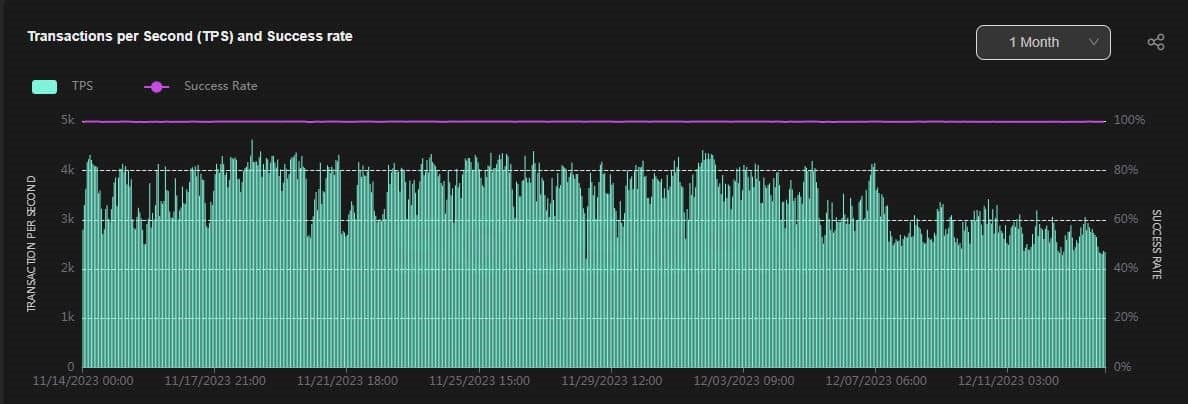

On the surface, these arguments make sense. As of this writing, Solana is one of the fastest performing blockchains, processing an average of 3,500 transactions per second (TPS) over the past month, according to Solscan.

In theory, Solana can handle 50,000-65,000 TPS, which is consistent with the payment giants in the Web2 world. In comparison, Ethereum, a much larger smart contract network, get Average 10-13 TPS per year.

source:sol scan

Additionally, Solana offers extremely low transaction fees compared to Ethereum.

Based on SOL’s market capitalization at the time of writing, the average transaction fee paid by Solana users in the past era was 0.00003304 SOL, or $0.002 USD. Ethereum, on the other hand, charges an average of 48 gwei (or $2.19) to verify transactions.

Clearly, Solana has never lost sight of its fundamental advantages of cost-effectiveness and speed, which are important characteristics of any worthwhile blockchain.

Such network advantages will be of great help in attracting decentralized applications (dApps) in various fields such as finance, games, and NFT.

This is exactly why many ecosystem developers join the network and contribute to its growth.

time has passed

During the relatively calm bear market, Solana focused on forging high-profile partnerships with Web2 giants.

Arguably the most important of these is the partnership with payments giant Visa. The partnership involves extending its stablecoin payment capabilities to the Solana chain.

The development has been widely hailed by the Solana community as major TradFi players focus on the payments network for the first time.

Although Visa used Ethereum in its pilot project, it decided to add support for Solana due to high transaction throughput and low cost.

Visa recognized Solana’s strategic advantages when announcing the partnership.

Additionally, Solana announced the integration of its native payments solution, Solana Pay, with the popular e-commerce company Shopify.

The integration allows merchants and entrepreneurs to bypass the high transaction fees typically associated with Web2-based third-party payment processors.

Solana’s technical capabilities have also been recognized by peers in the Web3 community. Leading stablecoin issuance protocol MakerDAO has considered using Solana instead of Ethereum for its upcoming independent blockchain.

Maker co-founder Rune Christensen praised Solana’s technical capabilities, claiming that the PoS network will remain best suited to meet Maker’s specific needs.

Rune Christensen also said that the strong developer ecosystem was the main reason why they chose Solana.

Fire Dancer Launches

It’s no secret that Solana has had its share of outages and network issues. In fact, co-founder Anatoly Ykovenko call In one of his previous interviews, the network shutdown was “Solana’s curse.”

Solana suffered its first major network outage in February 2023, which lasted nearly 20 hours. However, the network has maintained 100% uptime since then.

However, even these one-time issues may be a thing of the past when Firedancer, Solana’s upcoming authentication app, goes live. Firedancer is an alternative to current natively developed clients, developed by third parties.

Solana operator Austin Federa commented:

“At Foundation, we look forward to launching FireDancer, a new authentication client for the Solana network. Deploying a second authentication client will further improve network resiliency and reliability.”

As of this writing, a beta version of Firedancer has been launched, with mainnet expected to launch in the first half of 2024.

Solana finally goes crazy

During the height of FTX’s negative impact, Solana launched its dog-themed BONK token. The stated purpose of memecoin is to shift focus away from the “toxic Alameda token economy.”

While the attribute initially succeeded in injecting positivity into SOL, it quickly became irrelevant. However, the show actually begins much later.

The year-end bull run and improving sentiment in the Solana ecosystem had an impact on memecoin.

BONK’s market value soared from US$10 million in mid-October to US$1.29 billion on December 17, bringing 106 times returns to holders.

The surge has propelled BONK to become the third-largest meme coin on the market, according to CoinMarketCap data.

source:CoinMarketCap

Unlike some other memecoins that lack utility, BONK has use cases within the Solana ecosystem, including using the token to pay for NFTs.

What’s next for Solana?

With Solana coming to an end in 2023, the next question on Solana enthusiasts’ minds will be: What happens in 2024?

According to the well-known “Ethereum Killer” story, it may be looking for a good night’s sleep. Most experts rule out the possibility of Solana replacing Ethereum anytime soon.

Stefan Rust, CEO of independent economic data aggregator Truflation, said:

“I don’t think Solana is the killer of Ethereum. There is so much momentum and strong leadership behind the Ethereum network that Ethereum is no longer built solely on ETH. Additionally, Ethereum’s liquidity advantage will be difficult to match.”

However, Solana supporters still have a lot to look forward to. Looking ahead to 2024, SOL will be among the top 5 cryptocurrencies by market capitalization.

Johnny Gabriele, director of decentralized finance at Web3 native incubation studio CryptoOracle, made a bold prediction:

“At the top of this bull market, Coinmarketcap would have said: 1. Bitcoin 2. Ethereum 3. Solana. I believe one day these three coins will live in harmony.”

Rahul Maradiya also acknowledged the possibility of Solana entering the top 5:

“As Solana continues to rise, BNB will likely find itself in ongoing troubles related to Binance. BNB does not need to crash for Solana to rise. Instead, the two sides are just moving in opposite directions.”

Focus on challenges

Perhaps the biggest obstacle to achieving these goals comes from regulators.

Keep in mind that the U.S. Securities and Exchange Commission (SEC) labeled SOL, along with several other major cryptocurrencies, as securities in its lawsuit with Binance earlier this year.

Overall, this year’s legal crackdown has caused significant harm to those targeted. No matter how strong the fundamentals appear to be, ultimately it comes down to compliance and legality.

Second, FTX received court approval to liquidate recovered cryptocurrencies and pay creditors who have been patiently waiting for funds since the platform’s collapse last year.

The problem is that this could put significant downward pressure on SOL.

It is understood that SOL is the largest holding company of FTX Report Recently published by CoinGecko. At a price of approximately 55.8 million, it is equivalent to nearly 13% of the asset’s circulating supply.

If all SOL assets are dumped on the market, the price of SOL could be at risk of falling to levels not seen since last year’s exchange crash.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to AMBCrypto