Do the December FOMC meeting minutes hint that the Fed may cut interest rates in 2024?

[ad_1]

©Reuters.

©Reuters. According to Donghai

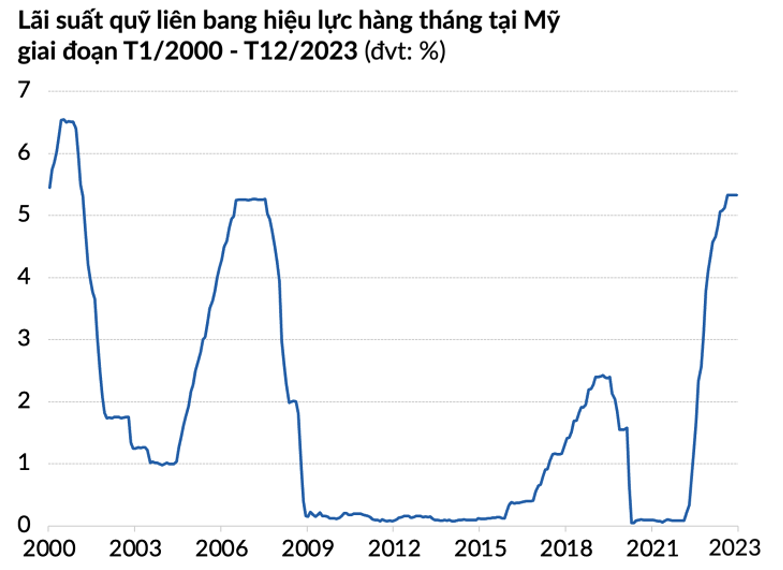

Investing.com – At its last meeting of 2023, the Federal Reserve’s policy-making body, the Federal Open Market Committee (FOMC), decided to keep interest rates unchanged in a range of 5.25 – 5.5%. Committee members said they expected to cut interest rates by 75 basis points (bps) in 2024.

However, the new meeting minutes released on January 3 did not reveal much about when or how the Fed will begin cutting interest rates. CNBC.

“In discussing the policy outlook, FOMC members noted that interest rates may have peaked at or near a peak in the current tightening cycle, although they noted that the actual policy path would depend on economic developments,” the minutes showed.

Federal Open Market Committee members noted progress in the fight to control prices. Supply chain factors that drove up inflation last year appear to have eased, they said.

Additionally, officials cited positive developments in the labor market. While emphasizing that the Fed still has a lot of work to do, they said the labor market is gradually returning to balance.

The dot plot shows FOMC members’ expectations that the Fed will cut interest rates over the next three years, bringing interbank borrowing costs closer to the long-term level of 2%. Specifically, they plan to cut interest rates at least three times in 2024, four more times in 2025, and finally three more times in 2026.

In their forecasts, most FOMC members’ base case scenario suggests that the federal funds rate will be lower by the end of 2024.

However, the minutes of the December meeting highlighted “unusual uncertainty” about the policy roadmap. Many members said the Fed may need to keep interest rates high if inflation does not continue to cool, while others pointed to the possibility of further rate increases based on actual conditions.

“Overall, FOMC members believed that the Fed should continue to act cautiously and rely on data to make future monetary policy decisions. Members once again emphasized that monetary policy should remain restrictive for some time,” the minutes said. Until inflation falls significantly back to the Fed’s target level.

Despite cautious comments from Fed officials, markets still expect the Fed to cut interest rates sharply in 2024. Investors predict the Fed will cut interest rates six times, with each cut by 25 basis points. Accordingly, the federal funds rate will fall to 3.75-4% at the end of the year.

The minutes noted that “obvious progress” had been made in combating inflation. The personal consumption expenditures price index for the past six months even showed that inflation has fallen below the Fed’s 2% target.

However, the minutes also noted that progress across departments was “uneven.” Prices of energy and core consumer goods have dropped significantly, but core service costs remain high.

Also at the December meeting, officials mentioned reducing Treasury holdings on the balance sheet. So far, the Fed has reduced the size of its balance sheet by $1.2 trillion.