Deribit sees interest in $50,000 Bitcoin call options

[ad_1]

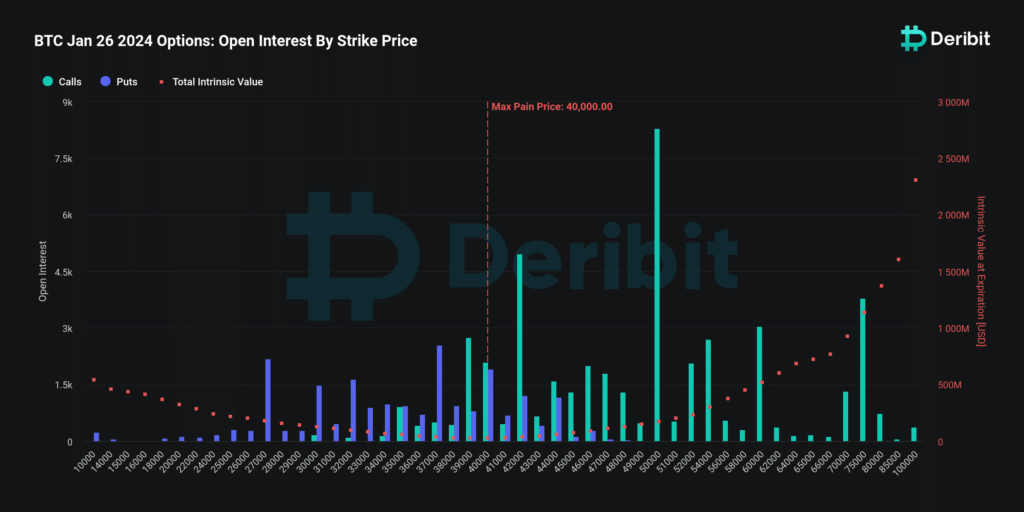

In response to Bitcoin’s recent price swings, the options market has shown activity, especially call options set to expire on January 26 with a strike price of $50,000.

according to Derived dataMore than 8,300 contracts, worth $376 million, are open at this strike price, indicating expectations for a potential rise in Bitcoin’s value.

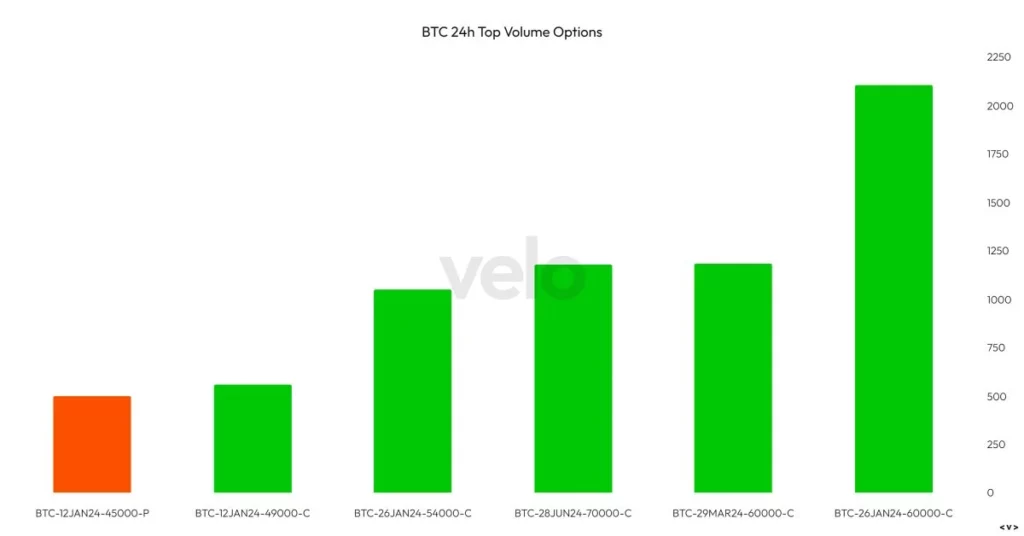

Across all expirations on Deribit, there are over 21,800 call option contracts at $50,000, with a total notional value of $926 million. also, speed data Highlighting the trend of higher strike prices, especially the $60,000 expiration on January 26th.

High-leverage trading allows traders to control positions with less capital, amplifying profits and exacerbating losses. Recent market volatility has resulted in over $147 million in Bitcoin (BTC) positions being liquidated, primarily affecting longs.

In the past 24 hours, the cryptocurrency market has experienced a total of $642 million in liquidations on centralized exchanges, highlighting the importance of risk management in this situation. Bitcoin price retraced more than 6% to fall below $43,000 after hitting a year-to-date high of $45,800.