Coinbase shares drop 20% in new year amid Bitcoin price swings

[ad_1]

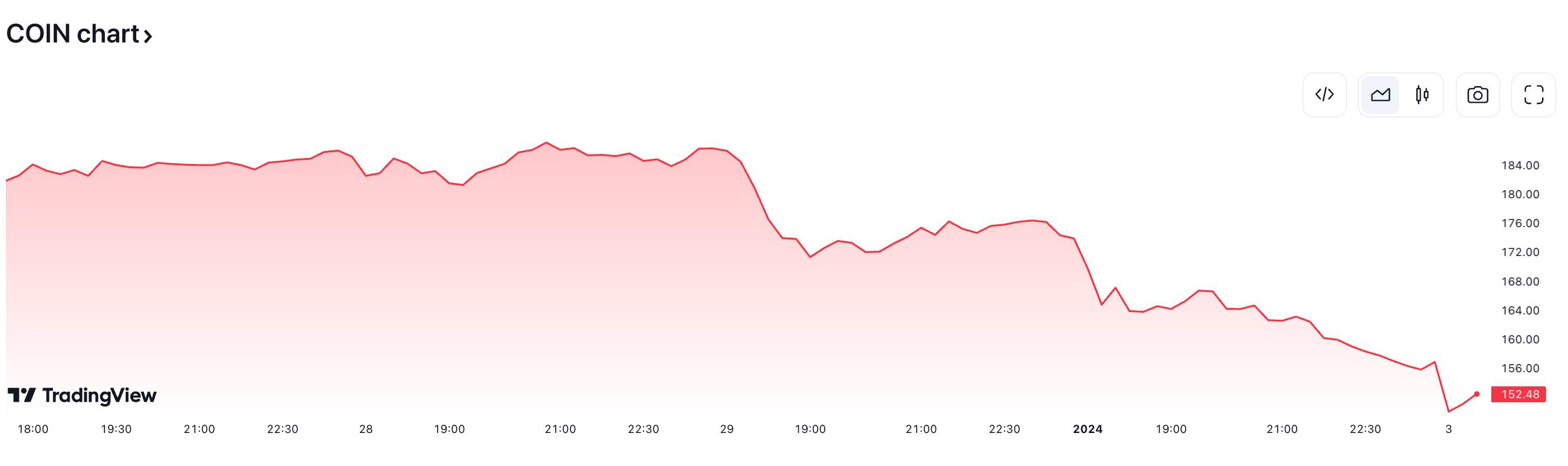

After reaching an annual peak of $187 per share in the final days of 2023, Coinbase has fallen 20% as Bitcoin prices continue to be unstable, according to TradingView.

The price of the world’s most valuable cryptocurrency has risen steadily, reaching nearly $46,000 on Tuesday, on hopes that a spot Bitcoin ETF will finally be approved and spur institutional capital flows into the digital asset. However, Bitcoin price suddenly drops It fell to lows below $40,000 on Wednesday before recovering to over $43,000 at press time.

Bitcoin price chart. Source: TradingView

Coinbase shares also fell below $150 per share in early trading on Wednesday, down about 5%. The U.S.-based cryptocurrency exchange, which has grown more than 300% in the last year, is preparing to host assets for traditional financial institutions such as BlackRock, which is one of many companies applying to deposit Bitcoin ETF spot.

Coinbase stock price chart. Source: TradingView

expected increase

While the approval of a spot Bitcoin ETF appears to be only a matter of time, expectations of when the SEC will do so continue to weigh heavily on the entire cryptocurrency industry. Investment bank TD Cowen said on Tuesday that the SEC will approve A Bitcoin ETF with physical delivery ahead of the January 10th deadline is seen as a “political necessity,” while other analysts believe negative opinion Compare.

Meanwhile, Cathie Wood’s Ark Invest has Priced at US$200 million Coinbase stock in recent weeks.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Itadori

According to “Block”