Bitcoin ETF Coming: SEC Meeting Points to Possible Listing on Major Exchanges

[ad_1]

The U.S. Securities and Exchange Commission (SEC) may soon begin informing the public about the results of a spot Bitcoin (BTC) ETF.

According to reports on January 3 fox businessAccording to people familiar with the matter, the first announcement of approval of the spot Bitcoin ETF may be made on January 5, with trading starting as early as next week.

Previously, a report released by Matrix on January 2 predicted that the SEC would reject the application. They believe approval will not come until the second quarter of 2024 at the earliest.

However, analysts and ETF issuers remain confident the SEC will make a favorable decision by January 10 as the agency continues to meet with key players on the issue, according to Fox Business.

Fox Business noted that the impending approval of ETFs is also reflected in the fact that in November 2019, attorneys from the Securities and Exchange Commission’s Division of Trading and Markets entered into negotiations with major exchanges including the New York Stock Exchange, Nasdaq, and Chicago Board Options Exchange. Representatives met. The ETF will be traded in it.

The meetings are seen as a positive sign that the SEC is getting closer to approving some or all of more than a dozen product applications from major fund managers and cryptocurrency companies, said anonymous sources at the companies.

However, the fate of the spot Bitcoin ETF application remains unknown. Over the past few weeks, there has been widespread speculation that a spot Bitcoin ETF is about to launch.

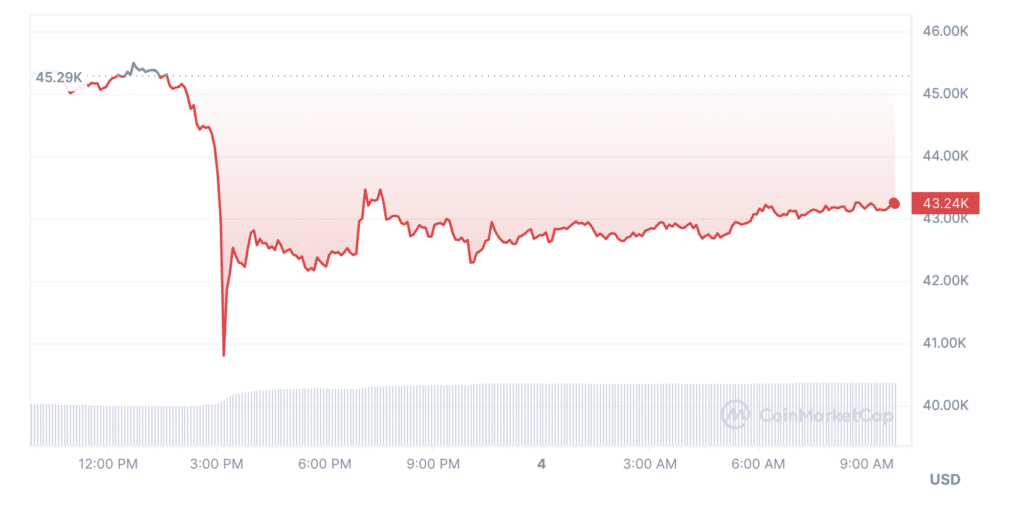

Against the backdrop of the release of the Matrix report, BTC price is down 4.5% to $43,240 at the time of writing. This happened shortly after Bitcoin broke above $45,000, its highest level since April 2022.

After the news that the spot Bitcoin ETF may be questioned, the entire cryptocurrency market also plunged 7%, losing nearly $1.7 trillion.