Today’s Coin Prices January 3: Bitcoin tries to hold on to $45,000, altcoins are mixed, and U.S. stocks begin to post losses in 2024

[ad_1]

Bitcoin continues to hold above $45,000, while analysts predict a sharp correction due to an overheated market.

BTC Price Chart – 1 Day | Source: TradingView

US stocks

The S&P 500 fell on Tuesday (Jan. 2), the first trading day of 2024, as bond yields moved higher and investors took profits after a strong performance in 2023.

At the close of trading on January 2, the S&P 500 index fell 0.57% to 4,742.83 points. The Nasdaq Composite fell 1.63% to 14,765.94 points, its worst trading day since October 2023. At the same time, the Dow Jones index edged up 25.5 points (equivalent to 0.07%) to 37,715.04 points. The market will be closed on Monday (January 1) due to the New Year holiday.

Apple shares fell more than 3% after Barclays downgraded a member of the market-leading Seven Group to an underweight rating. On the other hand, the Dow remains elevated amid consolidation in defensive stocks like Johnson & Johnson and Merck.

Stock markets ended 2023 on a high note, with the S&P 500 ending the year with nine straight weeks of gains, its longest winning streak since 2004. Risk assets have recovered strongly as the economy remains strong. Resilience and inflation cooled, while the Federal Reserve signaled an end to rate hikes and expected a rate cut by the end of the year. Markets are also affected by regional banking crises and conflicts in Ukraine and the Middle East.

Technology stocks, especially large-cap stocks, have been on a tear in 2023, with Apple shares up 48%, Microsoft shares soaring nearly 57%, and Nvidia shares soaring 239%. The Nasdaq Composite ended the year up 43.4%, its best year since 2020.

The Dow Jones rose 13.7% in 2023, setting multiple new records. Part of this growth was supported by changes in interest rates. In October 2023, the yield on the 10-year U.S. Treasury note rose above 5%, worrying investors, but then reversed, ending the year at 3.9%. On Tuesday, the 10-year Treasury yield rose 8 basis points to nearly 4%.

That trend reversed as big tech stocks fell as the new trading day began. Apple shares fell after Barclays gave it a negative assessment.

Barclays said Apple could lose 17% this year due to poor iPhone sales. Microsoft and Nvidia also posted losses.

Jay Hatfield, CEO of Infrastructure Capital Management, said such reversals are fairly common on the first day of trading. Hatfield remains optimistic about stocks in the new year, hoping for a rebound as earnings season begins.

Meanwhile, gold prices have faced pressure from a rising dollar heading into 2024, but have held steady amid expectations that the Federal Reserve will cut interest rates this year and growing concerns about Red Sea shipping attacks.

In late trading on January 2, the spot gold contract stabilized at around US$2,061.59 per ounce after rising 0.8% at the beginning of the session. Gold futures contracts fell 0.1% to $2,070.3 an ounce.

Oil prices fell on Tuesday (January 2) due to record U.S. crude oil production and concerns about growing demand from China.

As of the end of the trading day, the WTI crude oil contract fell by US$1.27 (equivalent to 1.77%) to US$70.38 per barrel. The Brent crude oil contract fell by US$1.15 (equivalent to 1.49%) to US$75.89 per barrel.

Bitcoin and altcoins

Bitcoin could drop as much as 30% to eliminate an “overheating” condition from one of its most reliable indicators.

exist analyze On January 1, on X (formerly Twitter), popular commentator CryptoCon believed that BTC still had the potential to return to $30,000.

Bitcoin hit $45,000 this week, but past patterns suggest a correction as 2024 begins.

According to CryptoCon’s flag, the Directional Movement Index (DMI) has reached levels that usually accompany trend reversals.

“I have been bullish on Bitcoin in 2023, but the data shows that it is time to stop and start the new year in 2024,” he commented.

Bitcoin DMI chart with legend | Source: CryptoCon

The accompanying chart shows that current DMI data is similar to mid-2019, when BTC/USD reached a mid-cycle peak.

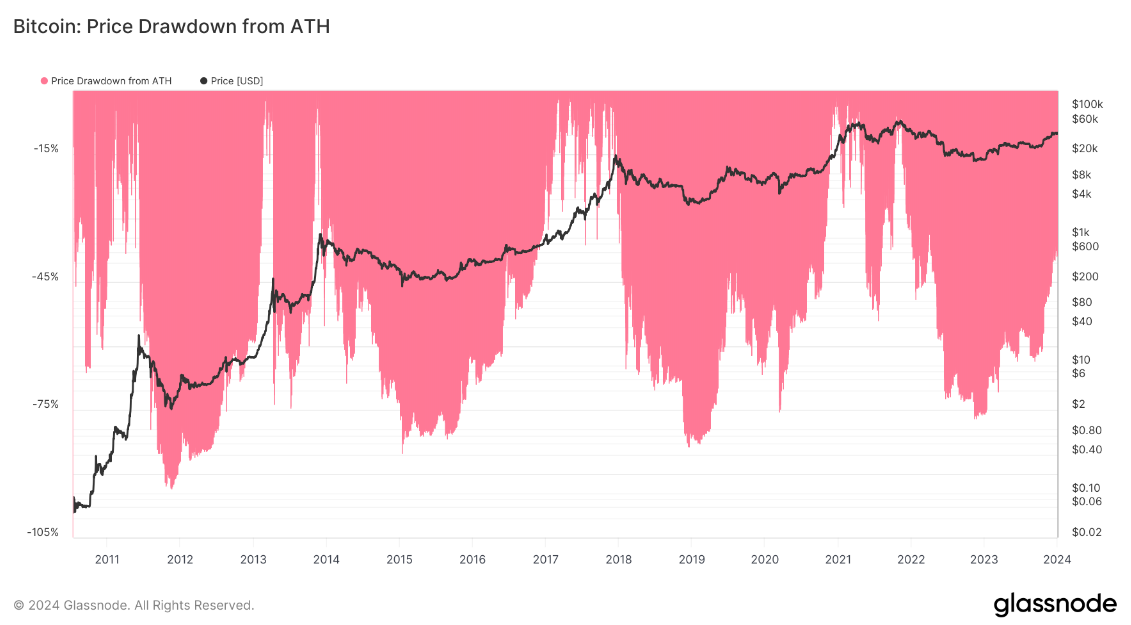

BTC pulls back from ATH levels | Source: Glassnode

At that time, BTC prices fell by more than 50% over the next 16 months, with the market crash caused by the COVID-19 pandemic in March 2020 exacerbating losses.

“The 30% correction in the overheated zone of the DMI brought us to around $30,000. And that’s at a much slower rate than previous big corrections. The data structure looks like 2019, with red double peaks.”

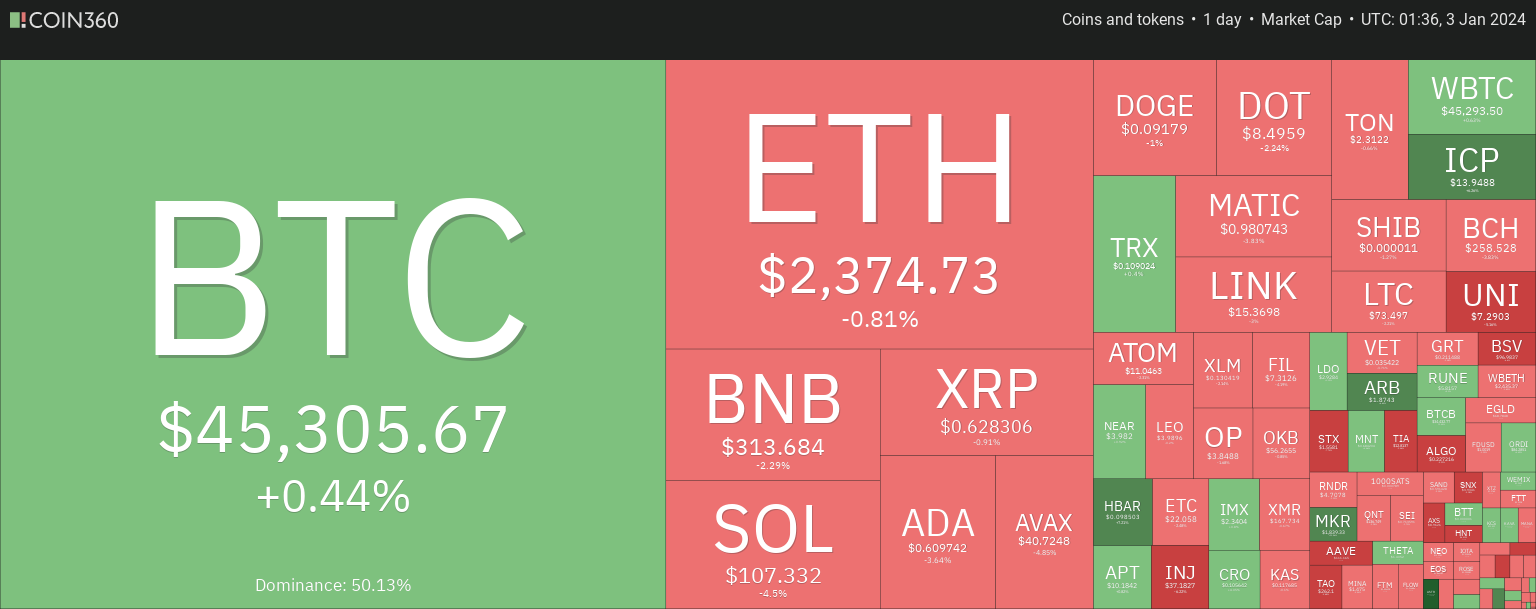

Altcoin market action has been mixed over the past 24 hours.

On the bright side, Astar (ASTR) and Maker (MKR) are both excellent projects with short-term profits of over 10%.

Some other altcoins in the top 100 include Conflux (CFX), Sui (SUI), Hedera (HBAR), Arbitrum (ARB), ORDI (ORDI), Blur (BLUR), Cronos (CRO), Mantle (MNT), THORChain (rune)… increased by 4-8%.

Meanwhile, memecoin Bonk (BONK) was the worst-performing project, losing nearly 10% of its value.

Mina (MINA), Filecoin (FIL), Bitcoin SV (BSV), Aave (AAVE), Celestia (TIA), Stacks (STX), Helium (HNT), Injective (INJ), FTX Token (FTT), Sei (SEI )), Algorand (ALGO), Uniswap (UNI)… were all rejected by 4-6%.

Source: Coin360

Ethereum (ETH) continued its efforts above $2,400 yesterday, hitting a local peak at $2,431. However, strong selling pressure subsequently pulled the price of the second-largest asset on the market back to its current level of around $2,375.

ETH Price Chart – 1 Day | Source: TradingView

The “Today’s Coin Price” column will update market dynamics at 9:00 every day, and readers are sincerely invited to pay attention.

See the online coin price list here: https://tapchibitcoin.io/bang-gia

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

The stronger

Bitcoin Magazine