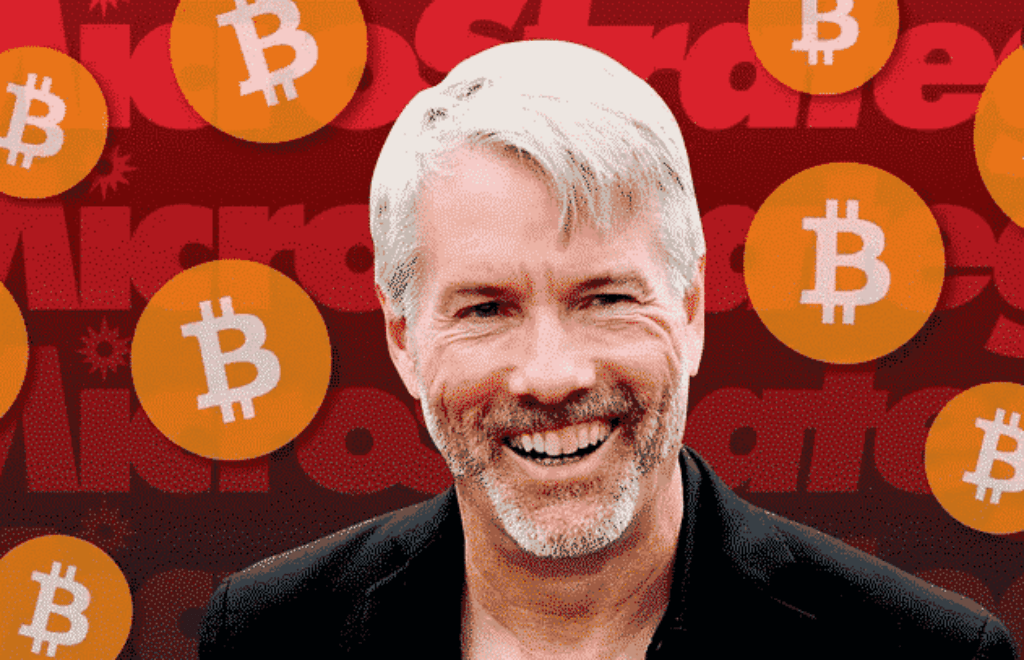

Michael Saylor: “2024 is the year of Bitcoin”

[ad_1]

As 2024 begins, the cryptocurrency space is set to see major developments, with the adoption of spot Bitcoin ETFs and expectations of the Bitcoin halving both possible. These important milestones are expected to mark the year as an indelible period in digital currency history. Michael Saylor, a well-known Bitcoin advocate, calls 2024 the “Year of Bitcoin,” reflecting the industry’s high expectations.

Welcome to 2024, #bitcoin. pic.twitter.com/wHCyH8RHJa

— Michael Saylor ⚡️ (@saylor) January 1, 2024

Particular attention is being paid to the upcoming decision on approving a spot Bitcoin ETF around January 10, 2024. Investors and market analysts eagerly await this event as it could significantly increase Bitcoin’s appeal to more investors, potentially increasing its market value and popularity, as well as stability.

What’s more, the Bitcoin halving will occur in 2024, which is a planned reduction in mining rewards for new blocks. Historically, this event has led to increased interest and investment in Bitcoin, effectively slowing down the rate at which new Bitcoins are created, thus impacting its supply.

MicroStrategy’s Bitcoin strategy accumulation

MicroStrategy, a leader in business intelligence and software, has further solidified its position as the largest institutional holder of Bitcoin. According to Bitcoin Magazine, the company made a bold move on December 27, 2023, purchasing an additional 14,620 BTC worth approximately $615 million, bringing MicroStrategy’s total holdings to an impressive 189,150 BTC.

This active investment strategy in Bitcoin highlights MicroStrategy’s confidence in the future of digital currencies. The company’s stock, which trades under the symbol MSTR, has surged 350% over the past year, significantly outpacing the 172% rise in BTC prices over the same period. This trend is likely to continue into 2024, with the dual catalysts of halving and ETF approval potential further reinforcing this trend.

Wider impact on cryptocurrency markets

Financial giants such as Blackrock and Fidelity have entered the spot ETF space, signaling growing institutional interest in cryptocurrencies. This development is likely to encourage significant inflows of institutional capital into the cryptocurrency market in 2024. The involvement of these financial institutions is not just a vote of confidence in the viability of cryptocurrencies, but could also be a potential game-changer in terms of market dynamics and influence. Invest in demographics.

However, the retail investment landscape for cryptocurrencies remains uncertain. The U.S. Securities and Exchange Commission (SEC) has yet to issue clear guidance regarding retail purchases of cryptocurrencies. This uncertainty remains despite the SEC facing legal challenges in 2023, notably the failure of the XRP case, which challenged the SEC’s stance on cryptocurrencies as contractual investments.

The approval of a Bitcoin spot ETF, which gives retail investors indirect exposure to Bitcoin, is expected to be a landmark event in the history of the cryptocurrency industry. It represents an important step towards mainstream adoption and could open the door to retail investment in digital currencies.

As 2024 approaches, the cryptocurrency market is likely to experience significant changes influenced by these important events. The ability to approve spot Bitcoin ETFs and the Bitcoin halving will play a key role in shaping the future of the digital currency, with companies like MicroStrategy leading the way in the institutional investing space. The industry eagerly awaits these events to unfold and predicts their long-term impact on the cryptocurrency investment landscape.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Itadori

According to CryptoCity