Whales holding over 10,000 BTC are entering distribution phase

[ad_1]

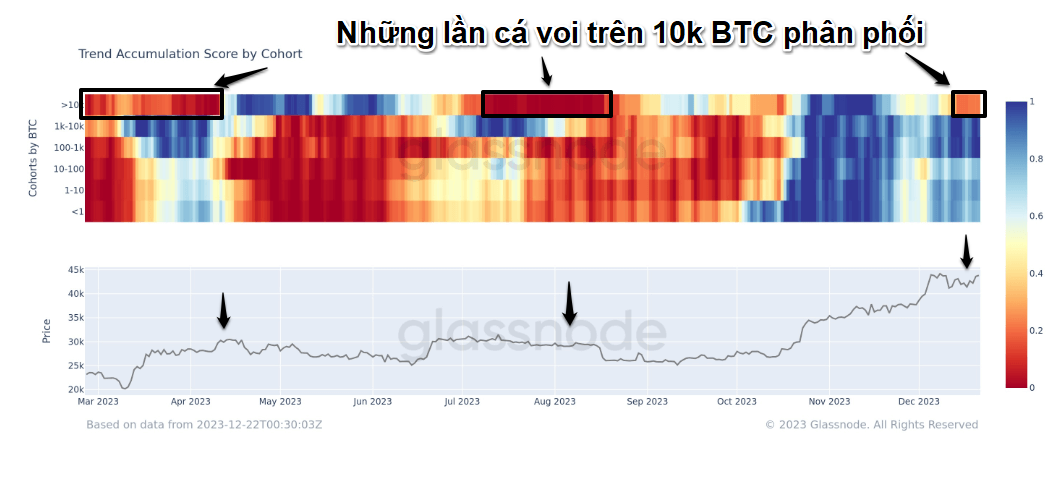

Taking advantage of Bitcoin’s wait-and-see status, whales began moving toward distributing coins. So, what happens when a Bitcoin whale exceeds 10,000 BTC and enters the distribution phase?

Since early December to date, Bitcoin prices have fluctuated 10% sideways between $40,000 and $44,000. Notably, during that two-week period of sideways activity, Bitcoin whales once again distributed coins.

Specifically, starting last week, the cumulative trend score for the wallet category with balances of 10,000 BTC and above changed from green to yellow. This indicates that Bitcoin whales have changed their strategies from actively accumulating to stopping accumulating, and may enter a selling phase.

By this week, the signals were clearer. The cumulative trend score for the wallet category above 10,000 BTC continues to shift from yellow to orange. According to predictions, regardless of whether the BTC price continues to rise, the trend point is likely to change from red to deep red.

As a result, Bitcoin whales are switching from buying for accumulation to selling for profit.

During an uptrend phase – when there are many new investors – this process does not necessarily coincide with a price decline. Because new investors will absorb all the BTC allocated by whales and push the price higher.

However, the current upward momentum for BTC comes from old investors’ inherent expectations for the upcoming Bitcoin ETF spot, which will be approved by the SEC. Apart from, According to the data from the past 2023, the periods when the cumulative trend points of wallets with 10,000 BTC and above turn red confirm that BTC has entered the peak or temporary peak area.

Tendency points accumulate based on wallet category. Source: Glass Node.

We can understand better by looking at the chart above. The chart shows that wallets with under 10,000 BTC still maintain accumulation green, albeit slightly lighter in color.

Meanwhile, recent technical analysis suggests that Bitcoin is trading in sideways territory. From a technical perspective, sideways amplitude does not favor any increases or decreases, but a breakout of the amplitude boundaries will form the basis of predictions.

Additionally, whale and investor demand can be assessed by USDT supply. Because USDT is the gateway that opens the flow of funds into the cryptocurrency market. A high demand to buy USDT proves that there is a high demand to buy cryptocurrency with USDT, and the price will rise, and vice versa.

Correlation between Tether supply and Bitcoin price.

In 2023, Tether will have two main money printing periods: the period from January to April and the period from November to December.

However, although prices at the end of the year were nearly three times higher than at the beginning of the year, the amount of money printed at the end of the year was still less than that at the beginning of the year. Additionally, the red bar chart (average daily market capitalization change) in December shows signs of tapering off, proving that the need to print more USDT is decreasing.

From the above observations on the market value of USDT, we can conclude that although the demand for USDT is increasing throughout 2023, it shows signs of cooling down compared to early November and is weaker than at the beginning of the year. From there, it suggests that upward momentum is fading.

VIC encryption compilation

related news:

![]() FOMO pervades the market, driving Bitcoin’s December volatility

FOMO pervades the market, driving Bitcoin’s December volatility

![]() The debate rages over Bitcoin’s role in the advancement of artificial intelligence

The debate rages over Bitcoin’s role in the advancement of artificial intelligence

![]() Bitcoin liquidity hits 10-year low

Bitcoin liquidity hits 10-year low