Tether mint adds additional 1 billion USDT storage

[ad_1]

Tether’s newly minted USDT will not circulate on the market, but will be stored in warehouses to prevent sudden increases in demand.

On-chain data shows that Tether, the market-leading stablecoin issuer, has just issued an additional US$1 billion stablecoin USDT on the Ethereum blockchain. The move is said to be to “replenish” stocks in response to a surge in demand.

Soon after, Tether CEO Paolo Ardoino also confirmed that these 1 billion USDT will not be issued additionally, nor will it contribute to the current total market value of USDT, but will be stored in the warehouse for use in the next issuance and on-chain. Exchange requests.

PSA: 1B USDt inventory replenished on the Ethereum network. Note that this is an authorized but not issued transaction, which means this amount will be used as inventory for the next issue issuance request and chain swap.

— Paolo Ardoino 🍐 (@paoloardoino) December 25, 2023

It is worth noting that as of December 26, the circulating supply of such USDT on Ethereum was $925 million. Tether has also seen significant growth over the past year, with its market capitalization increasing by approximately 38% from $66 billion to $91 billion. Dollar.

However, there are many factors driving USDT’s impressive growth.

- Anticipation and excitement surrounding the SEC’s approval of a spot Bitcoin ETF.

- Tether is increasingly involved in Bitcoin-related activities, including Bitcoin investing and mining…

However, despite the Tether CEO’s explanation, this stablecoin minting operation still raises many questions about the transparency and decision-making process behind these large-scale mintings. At the same time, predict its impact on Bitcoin volatility.

![]() The correlation between USDT stablecoin circulating supply and Bitcoin price performance

The correlation between USDT stablecoin circulating supply and Bitcoin price performance

On the evening of December 26 and early morning of December 27, BTC suddenly adjusted sharply from the US$43,400 mark to the US$41,600 mark. Immediately afterwards, BTC quickly rebounded to the current $42,200 mark.

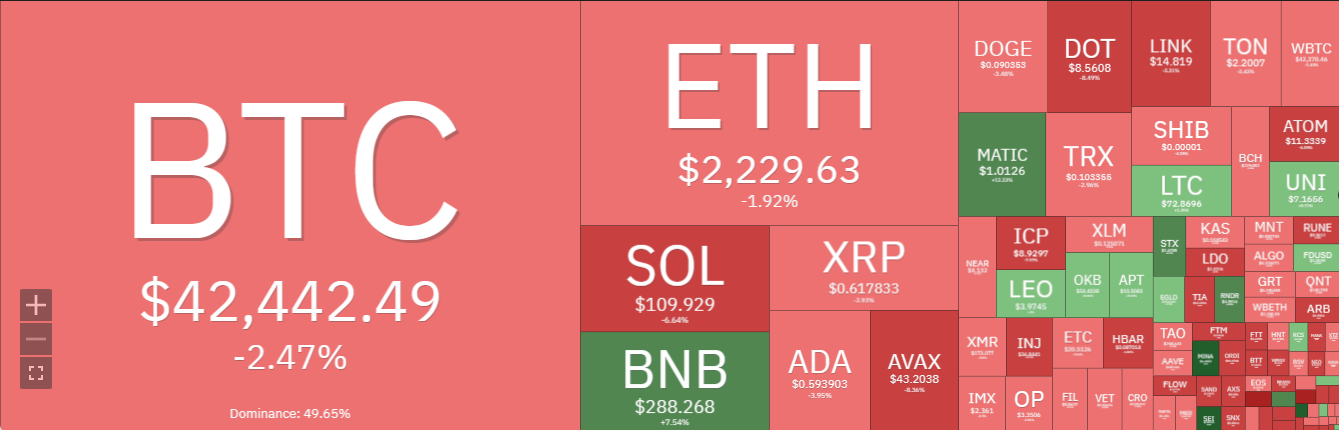

As BTC adjusts, most mid-to-high-end coins experience volatility. Over $235 million in stablecoins were withdrawn from exchanges in the past 24 hours.

Market panorama on the morning of December 27.

Current Bitcoin Price

VIC encryption compilation

related news:

![]() S&P Global releases stablecoin stability ranking: USDT ranks second from last

S&P Global releases stablecoin stability ranking: USDT ranks second from last

![]() What is the anchor currency Euro (AEUR)? What’s so special about the latest stablecoin listed and supported by Binance?

What is the anchor currency Euro (AEUR)? What’s so special about the latest stablecoin listed and supported by Binance?

![]() Investors rushed to exchange for USDR under the background of decoupling of stablecoins, and investors suffered a tragic ending – 131,350 USDR “disappeared”

Investors rushed to exchange for USDR under the background of decoupling of stablecoins, and investors suffered a tragic ending – 131,350 USDR “disappeared”

![]() Alameda’s Tips for Minting Huge Tether Numbers and Profiting from Arbitrage Trading

Alameda’s Tips for Minting Huge Tether Numbers and Profiting from Arbitrage Trading