Polymarket investors confident in spot Bitcoin ETF before January 15th

[ad_1]

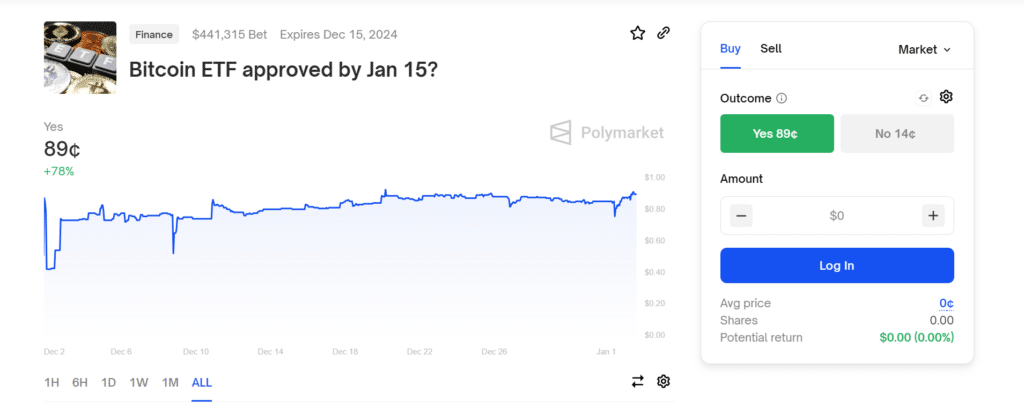

Traders betting on the platform predict a 90% chance of the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF by mid-January, while a handful of traders are hedging against the opposite outcome.

Shares of the “Bitcoin ETF Approved on January 15” contract on decentralized forecasting platform Polymarket are trading at 90 cents as speculation about an imminent decision by the U.S. Securities and Exchange Commission (SEC) dominates market sentiment.

As of press time, contract Attracting $441,315 worth of “yes” bets, only 10% of traders chose “no”. These investors also acknowledge that their opposition option is a means to hedge their bets and profit if the SEC delays beyond January 15th.

I don’t doubt the inevitability of a Bitcoin ETF, but I doubt the SEC’s ability to approve it quickly enough before January 15th.

General Market Trader

Reuters reports that the SEC may announce approval as early as January 3 for 14 issuers to list their products in the coming weeks. However, Fox News reporter Eleanor Terrett said that this scenario is extremely unlikely as updated S-1 filings are being reviewed by companies such as Hashdex and VanEck.

While no one knows when the SEC will make a decision on a spot Bitcoin ETF, experts and cryptocurrency proponents expect an outcome could come on January 10. The date coincides with the deadline for ARK 21Shares to submit joint documents.

Ark Invest chief executive Cathie Wood also expected a decision to be made by then. Wood believes the approval will support Bitcoin (BTC) and cryptocurrencies through Wall Street, a sentiment shared by MicroStrategy founder and BTC maxi Michael Saylor.