Fubon FTSE Vietnam ETF Fund continues to pour trillions of dong into Vietnam’s stock market

[ad_1]

According to Lanya

Investing.com – Foreign investors returned to the trend of net disinvestment in 2023, with the entire market valued at VND 23,078 billion. Foreign investors caused widespread pressure, with net sales of 17.76 trillion VND in stocks, 516.7 million VND in domestic ETFs, and the rest in other products. The focus of foreign cash flow is still HOSE, with a scale of VND24,831 billion. The top 10 stocks with the most net sales by foreign investors on the market are all worth more than 1 trillion VND, such as EIB (HM:), VPB (HM:), MWG (HM:), VHM, VNM, STB (HM:) ), MSN, MSB, DPM (HM:) and KDC (HM:).

Statistics show that in the past four years (2020 to 2023), foreign investors have withdrawn net capital from Vietnam of nearly 75.8 trillion VND (3.1 billion U.S. dollars).

Foreign cash flows showed signs of improvement under the opportunistic risk scenario as it reversed buying in the final days of the year. Cash flow for part of the payment continues to come from a familiar organization – Fubon Fund (Taiwan).

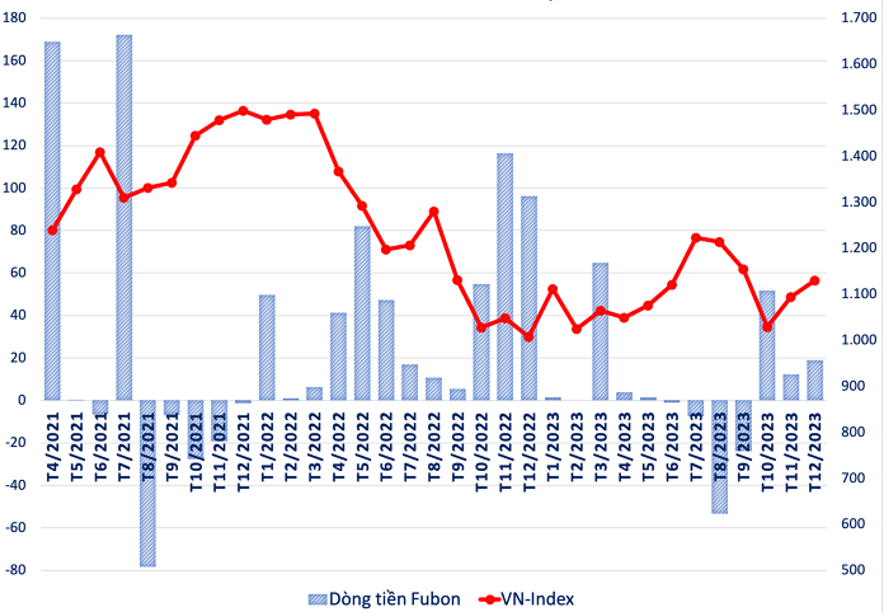

FTSE Vietnam ETF Cash Flow (USD Millions)

According to statistics, this foreign ETF paid out nearly NT$163 million (VND128.7 billion) in the last week of 2023, bringing the total net inflow in December to NT$589 million (VND466 billion). The total number of fund tokens (ccq) added in the last month of this year was 51 million.

The procurement scale in December 2023 increased slightly compared with the previous month. With the trend reversed since the end of September, Fubon Fund’s cash flow is in balance in the second half of the year, with the scale of expenses returning to almost equal to net sales in the third quarter of 2023.

Fubon’s cash flow mobilization shows that Vietnam’s stock market remains a bright spot. Experts believe that the move in the third quarter is just a short-term profit-taking decision by investors holding fund certificates to achieve “dream” performance a few months after the down payment, which is well-founded.

Throughout 2023, the Fubon FTSE Vietnam ETF is the most active institution in the Vietnamese stock market. The fund’s total disbursements throughout the year exceeded NT$2.1 billion (equivalent to US$68.6 million, VND1,661 billion).

In terms of scale, as of December 29, 2023, the number of Fubon FTSE Vietnam ETF fund certificates is at the highest level, exceeding 2.22 billion. Net assets are NT$25.92 billion (VND20,502 billion). This scale has helped Fubon Fund continue to be the largest ETF in the market, significantly increasing its customer base, which ranks second among domestic ETFs, DCMVVN Diamond with VND 17,261 billion.

However, the net asset size of Fubon FTSE Vietnam ETF is still far away from the peak of nearly NT$30.3 billion (nearly VND24 trillion) set in early August 2023. The fund achieved high performance and quickly joined the billion-dollar group, which is why some of the above-mentioned investors sold and profited.

The fund certificate net asset value (NAV/ccq) at the end of the year reached NT$11.64, equivalent to a full-year performance of 6.5%. This performance is only half that of the overall market and far behind many other domestic ETFs on the market. At its peak in 2023, Fubon Fund performance reached 29.5%.

The reason why the performance of Fubon Fund is lower than that of the general market is because the cash flow of blue chip stocks is not so prosperous, making the performance far worse than that of medium and large codes where the fund allocates funds to the market.

As of the end of 2023, the largest allocation of Fubon FTSE Vietnam ETF is (HM:) (10.82%), followed by (HM:) (8.93%), (HM:) (8.86%), (HM:) ( 8.42 %), (HM:)(8.29%), (HM:)(7.78%). Except for HPG and VCB, blue chip stocks such as VIC, VHM and MSN all fell sharply last year.