Coinbase, MicroStrategy shares surge on Bitcoin breakout

[ad_1]

Shares of Coinbase and MicroStrategy were up about 6% and 9%, respectively, in pre-market trading this morning as Bitcoin topped $45,000 in anticipation of U.S. spot ETF approval.

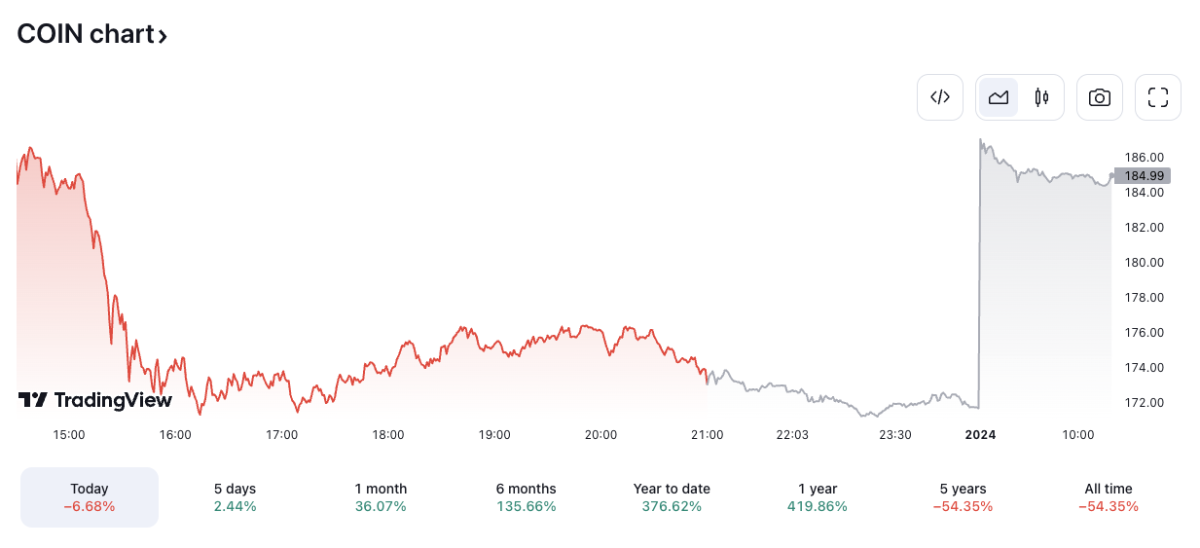

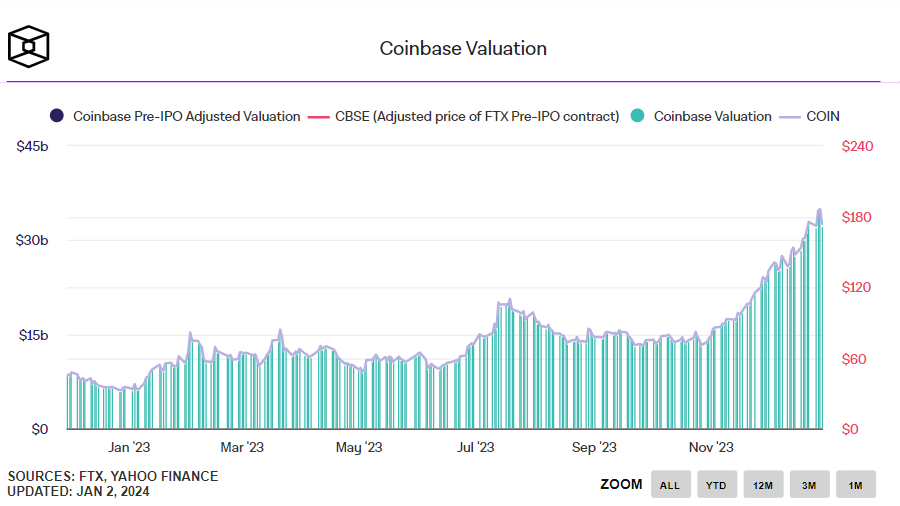

Coinbase shares rose 6.4% to $184.99 in New Year’s trading and ended 2023 at $173.92. Coinbase shares are up 36% in the past month and nearly 420% in a year, according to TradingView. However, COIN is still approximately 46% below its all-time high set in November 2021 (around $343).

COIN price chart | Source: Trading view

Coinbase is currently valued at $32.4 billion.

Source: FTX, Yahoo Finance

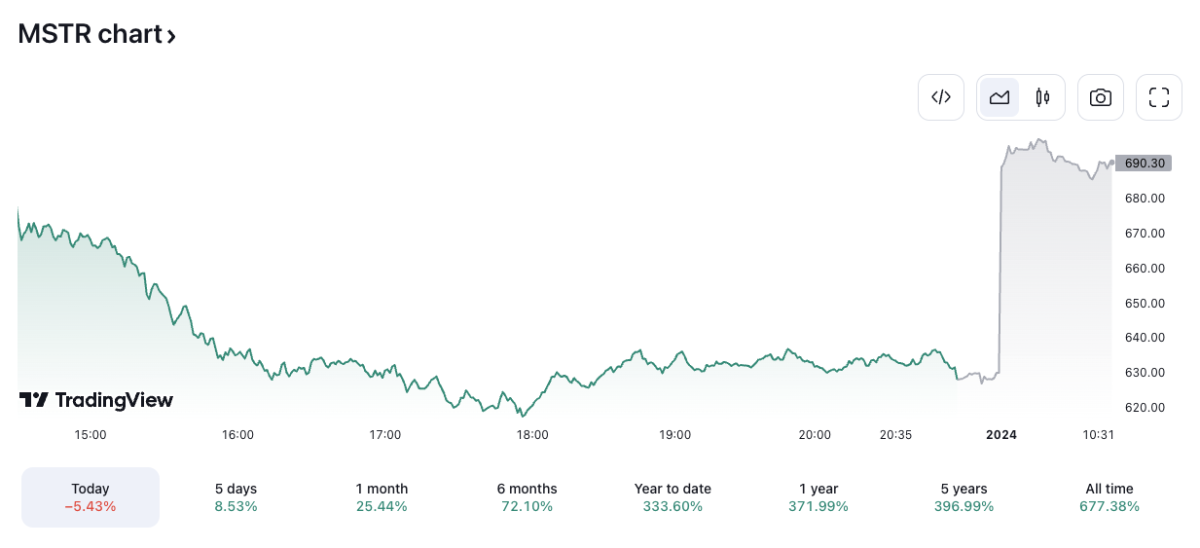

Likewise, MicroStrategy shares rose 9.3% in premarket trading today to $690.30, after closing at $631.60 last year. MicroStrategy shares are up 25% in the past month and 372% in the past year, according to TradingView. MSTR is currently down 8% from its 2021 high of $750.

MSTR Price Chart | Source: Trading View

Spot Bitcoin ETF Forecast

The moves follow a breakout in Bitcoin prices, which have risen around 7% in the past 24 hours to $46,000, with a U.S. spot Bitcoin ETF expected to be approved in the coming days. Bitcoin is currently trading at $45,472.

Bitcoin price chart 1 hour | Source: trading view

Many Bitcoin spot ETFs, including BlackRock, Franklin Templeton and Grayscale, have entrusted the Coinbase exchange to provide custody services for the funds. “We are fully prepared for the approval of the ETF,” a Coinbase spokesperson told Bloomberg on Friday. “Our systems are carefully designed and tested to handle increased trading volume, increased liquidity and overall increased demand across the system.” .”

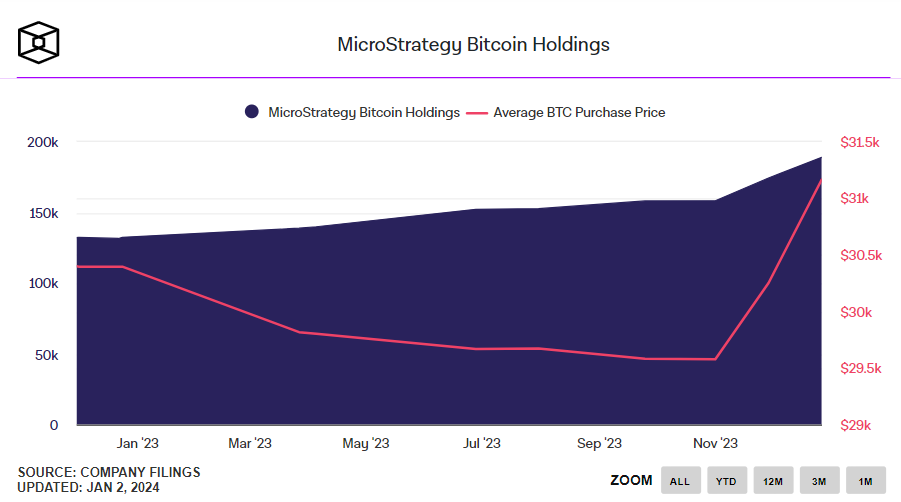

Last week, MicroStrategy, a software company known for holding Bitcoin, announced that it added 14,620 Bitcoin to its warehouse between November 30 and December 26. MicroStrategy currently holds a total of 189,150 Bitcoins, worth approximately $8.7 billion at current prices. The company’s average purchase price was $31,168 and its current book value is $2.8 billion.

Source: The Block

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to “Block”