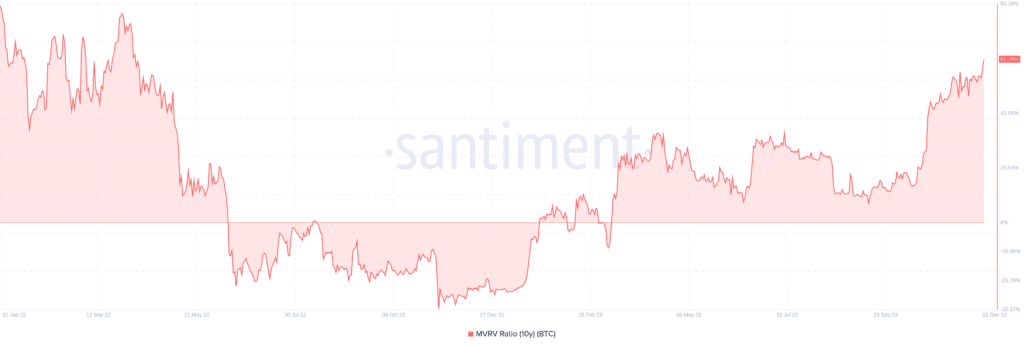

Bitcoin MVRV reaches highest since April 2022

[ad_1]

Bitcoin’s market capitalization to realized value ratio has climbed to its highest level since early April 2022, which may indicate that a long-term bottom has been formed for the cryptocurrency.

Bitcoin’s (BTC) market cap to realized value (MVRV) ratio currently stands at 61.3%, the highest level since April 2022, according to on-chain analytics firm Santiment. At the time, Bitcoin was trading around $43,000 after pulling back from local markets. The peak was around $48,000.

The MVRV ratio calculates Bitcoin’s market capitalization relative to its realized capital and represents the total value of all coins based on their last traded price. High MVRV levels indicate that Bitcoin’s market value is much higher than its realized value, indicating that it may be overvalued. Conversely, a lower MVRV level indicates that Bitcoin is trading below its realized value, indicating that it is undervalued and presents a potential buying opportunity.

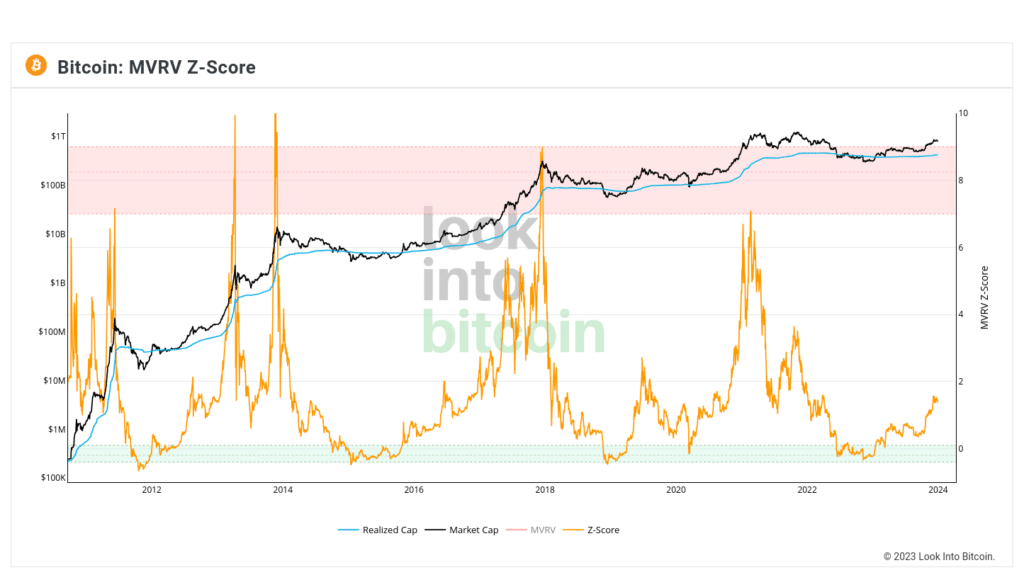

In addition to the rise in MVRV, the Bitcoin MVRV Z-score currently stands at 1.53 after leaving the “buy zone” in January. The MVRV Z-score uses standard deviation to identify extreme differences between Bitcoin’s market value and realized value.

Historically, Z-score levels consistently above 1 are consistent with cycle tops, while entering negative territory is consistent with market bottoms. The current rise in MVRV combined with the Z-score moving away from oversold levels means a bottom may have been established. However, as with any indicator based on historical data, past performance is no guarantee of future results.