Greekslive: Spot Bitcoin ETF unlikely to be approved before second week of January

[ad_1]

Options trading analysts pointed to January 10 and beyond as the timetable for the SEC to make a decision on a spot Bitcoin ETF, amid pessimistic speculation that all applications may be rejected.

Greekslive noted that the U.S. Securities and Exchange Commission (SEC) is unlikely to agree on a spot Bitcoin (BTC) ETF before January 7, citing the stock price movements of U.S. cryptocurrency mining operations and digital asset-related companies.

Monthly puts are now cheaper, block trades are starting to see active put buying, and options market data suggests institutional investors are less optimistic about the ETF market.

Greeks continue to live X

The report was released to the market, which is filled with speculation about 14 spot Bitcoin ETF applications submitted by TradFi giants such as BlackRock and crypto-native entities such as Hashdex. Such products have historically been rejected by the SEC, although multiple meetings and updated filings suggest recent developments have fueled optimism about a different outcome in 2024.

However, some opinion leaders speculate that the SEC may delay the spot Bitcoin ETF until after January. In fact, Matrixport said that the SEC may reject all bids from funds investing in Bitcoin at spot prices, crypto.news reported.

Legal experts said the outcome could lead to lawsuits against the SEC due to the court’s ruling in the Grayscale case.

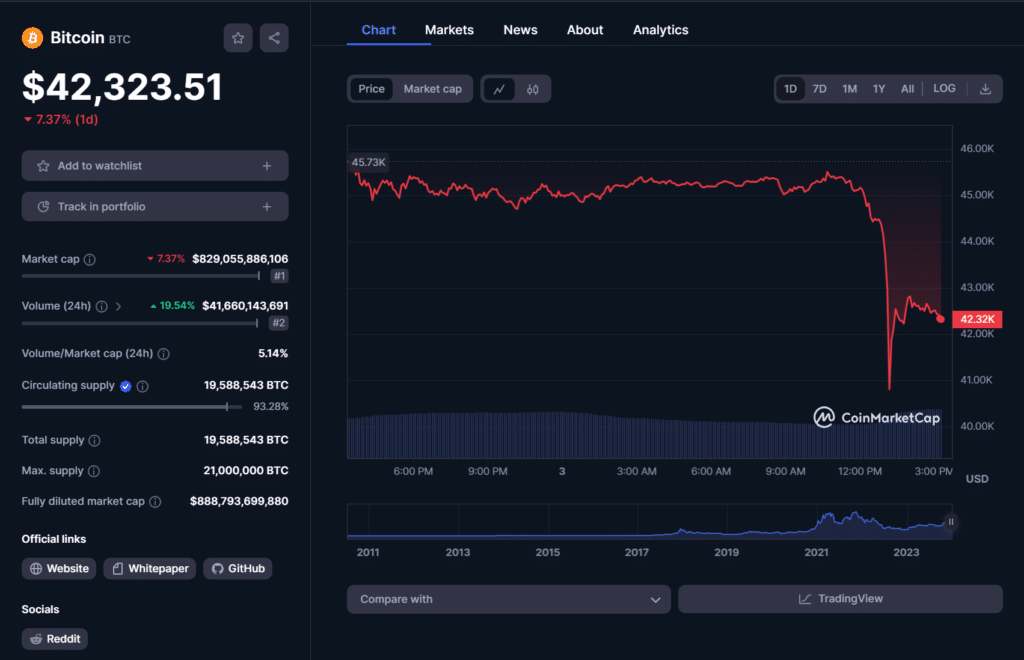

After Matrixport released its report, BTC prices fell sharply by 7%, falling below $43,000 and triggering liquidations of more than $500 million in the crypto market. At press time, these liquidations occurred in just four hours.

While Matrixport expects Bitcoin to return to $36,000, the company expects BTC prices to surge this month. Analysts at the crypto startup predict that its price will surge to at least $50,000 by February and reach an all-time high of over $125,000 by the end of the year.