Strike CEO Jack Mallers goes all-in on Bitcoin, abandons U.S. dollar

[ad_1]

Strike CEO Jack Mallers is an ardent advocate of Bitcoin (BTC) and has announced that he is abandoning fiat currencies in favor of investing fully in Bitcoin.

In a Jan. 3 post, Bitcoin enthusiast and visionary Jack Mallers announced his complete divestment from the U.S. dollar, stating: “I no longer own any U.S. dollars. Not even a penny. .”

Marlers made the decision because he was concerned about the state of the U.S. economy and currency depreciation. He expressed his love for the United States but criticized the country’s monetary policy, especially since it abandoned the gold standard in 1971.

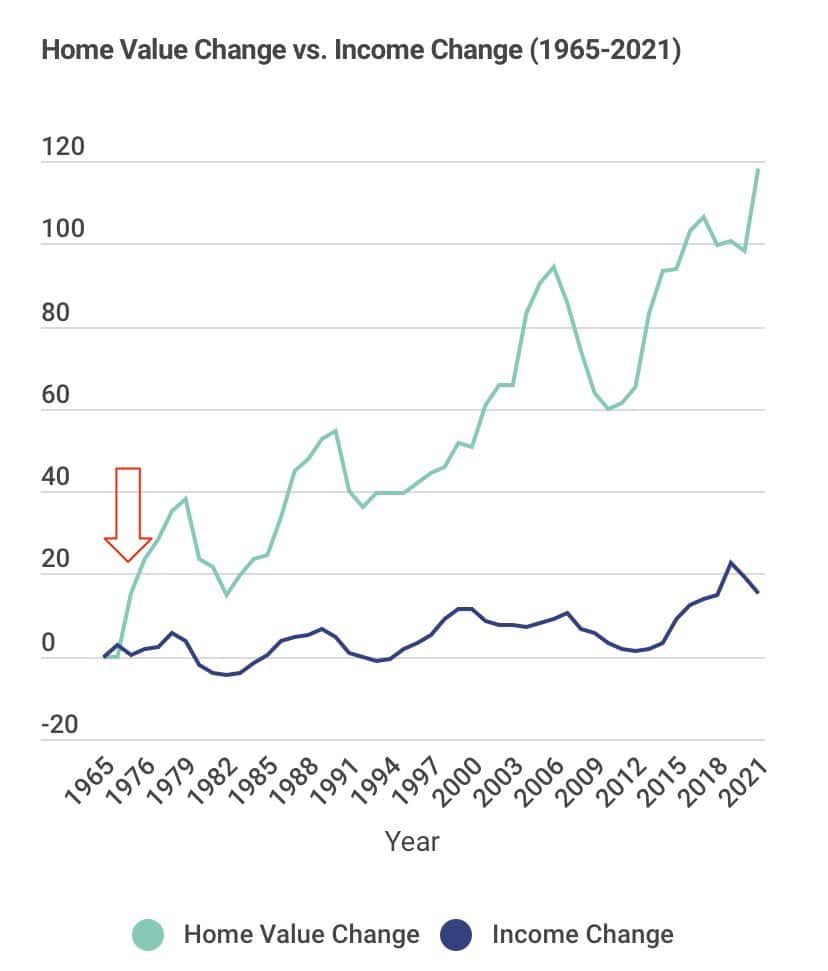

Since then, the country has faced excessive financialization and excessive asset inflation, which has widened the gap between rich and poor and stoked social discontent, Mallers said.

He argued that as the dollar depreciates, individuals are forced to invest in wealth assets such as real estate and stocks, causing prices to rise and exacerbating the gap between rich and poor.

Mallers added, “Printing money makes those who own assets richer and those who cannot afford them poorer.”

Malles emphasized in the post that Bitcoin, with its fixed supply and decentralized nature, is the best countermeasure against the devaluation of fiat currencies. He believes that Bitcoin embodies American values such as individual freedom, equal opportunity and innovation.

“Bitcoin is the currency of the place of freedom, opportunity, democracy, rights and equality.”

Jack Mallers, CEO, Strike

Malles’ stance raises questions about actual financial transactions, such as paying bills and taxes, given Bitcoin’s limited acceptance in everyday use.

Bitcoin remains a store of value and a vehicle for speculation. Despite its growth, there are still very few places on Earth where you can pay for it.

Mallers believes BTC will hit $1 million

In March 2023, during an appearance on CNBC’s Power Lunch, Malles highlighted Bitcoin’s role in the global financial crisis and predicted that its price would soar to $1 million due to global hyperinflation.

He criticized the Federal Reserve for damaging its reputation by excessively printing money, and claimed that Bitcoin’s fixed supply of 21 million units supported its value.

Malles also commented on other cryptocurrencies, acknowledging their speculative nature and viewing them as a means to accumulate more Bitcoin.

“The goal of the game is to accumulate as many Bitcoins as possible. The alternatives are fun, but they involve greater risk. I use them to increase my Bitcoin holdings.”

Jack Mallers, CEO, Strike

As U.S. national debt hits record high $34 trillionTwice as likely as a decade ago, Malles’ decisions and views resonate with a growing number of individuals and investors who view cryptocurrencies as a potential hedge against the instability of the traditional economy.