CME Bitcoin Futures Hold $1,600 Premium When Spot BTC Prices Are Above $45,000 – Why?

[ad_1]

In the early morning of January 2, the trading price of Bitcoin futures on the Chicago Mercantile Exchange (CME) was $47,040, $1,600 higher than the spot market. Traders are now asking if the bullish momentum is limited to CME futures and could this be a sign of an upcoming bull run for Bitcoin?

Some analysts said the premium was due to institutional investors predicting that spot Bitcoin ETFs would be accepted, although the decision is still under review. Senior analysts at Bloomberg estimate the SEC’s approval rating at 90%, partially explaining investors’ recent optimism.

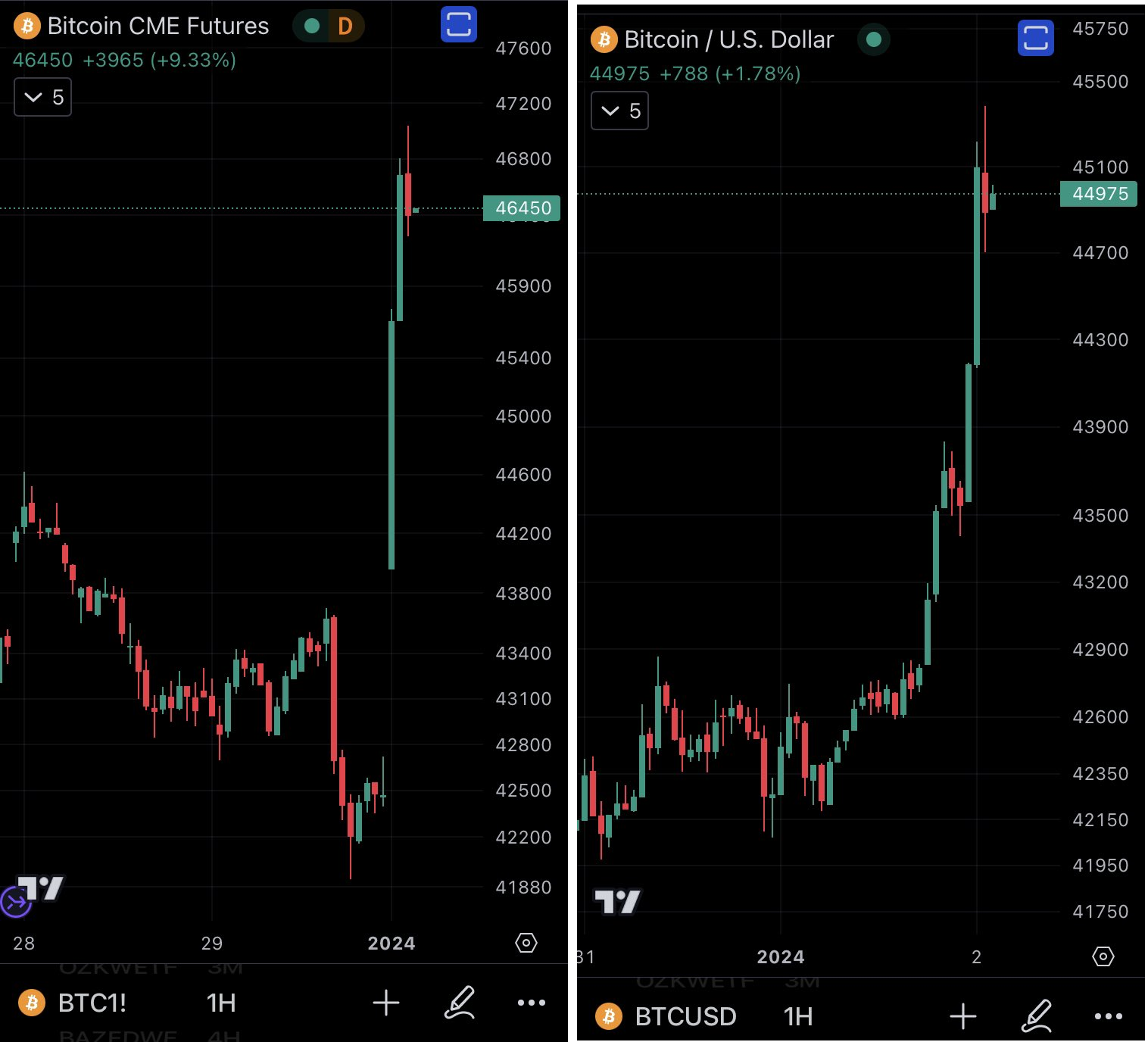

cost contract spread CME Bitcoin futures highest intraday compared to BTC spot market (Dollar)| Source: TradingView

In healthy markets, monthly futures contracts typically trade at spreads of 5% to 10% and have longer settlement cycles. This situation is called contango and is not unique to cryptocurrency derivatives. It is worth noting that from January to November 2023, CME Bitcoin futures diverged very little from the BTC spot market, with intraday highs rarely exceeding $350, or 14% on an annual basis.

This trend changed on November 24, 2023, when the CME Bitcoin futures spread rose to $900, the highest level in more than two years. Interestingly, Bitcoin price has increased by 41% in the past 40 days to $37,750. What’s more, by December 6, 2023, even though the price of Bitcoin reached $43,800, the futures contract spread had dropped to $530. Essentially, investor optimism paid off in this case, at least for those who held positions during those two weeks.

Continuing with the latest events from January 2, an unexpected surge on CME sent Bitcoin futures as high as $47,095 intraday.

Posts on social networks by user Dump Watcher. However, this did not happen, as 4,180 BTC futures contracts were traded in the first trading hour of 2024, equivalent to $945 million. This upward trend did not last long, as the premium of $1,600 (equivalent to an annualized interest rate of 53%) dropped to $500 throughout the day.

“Bitcoin futures are in very steep premium, with CME futures trading much higher than other exchanges. CME was trading higher on lower after-hours volume, as if someone knew something.”

source: dump warder

It is impossible to determine whether the spread was triggered by a stop-loss order on a leveraged short (bearish bet), but it is unlikely because as of December 29, 2023, when the contract market CME futures were closed, Bitcoin prices were up 4.6%. The main question that should be asked is does this volatility only happen on CME?

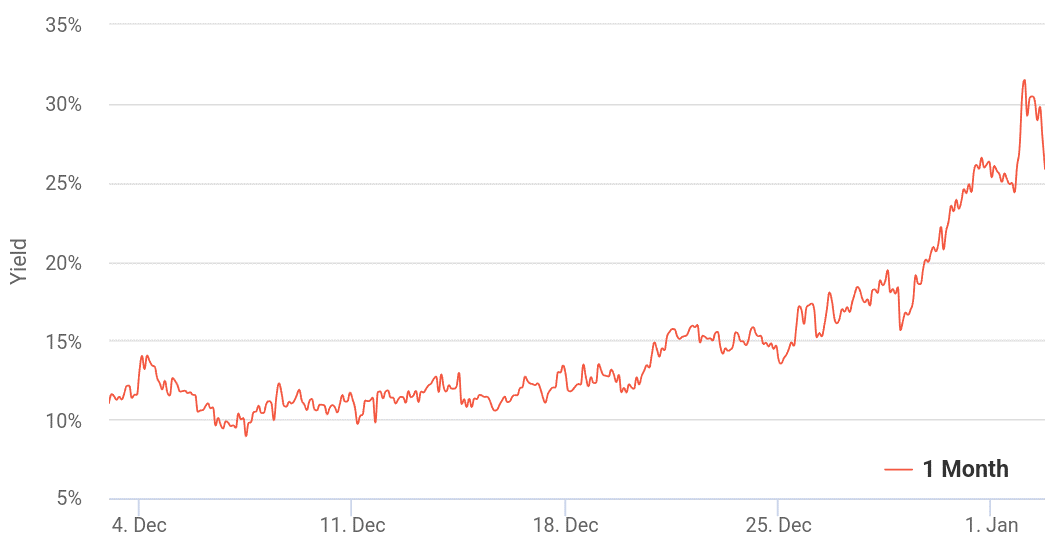

cost the difference Annual average of the exchange’s 1-month Bitcoin futures contract | Source: Lavitas

Data from Binance, Bybit, OKX, Deribit, etc. show that the annual spread of BTC futures on December 2, 2023 was 32%, the highest in more than two years. However, this is inconsistent with CME Group’s performance and suggests that the buying wave did not extend to the broader market. This discrepancy is not uncommon and may be due to differences in customer profiles, with CME requiring 40% to 50% margin while the exchange offers up to 100x leverage.

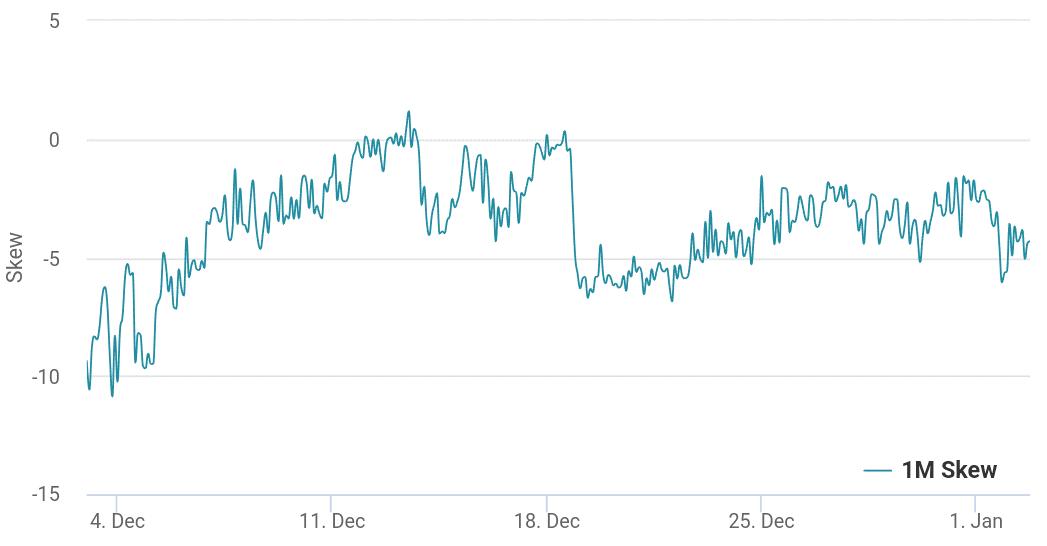

Additionally, we should further study the Bitcoin options market to better gauge market sentiment, as a 25% delta deviation can confirm whether professional traders are leaning bearish. In short, manic periods typically have a -7% bias because puts trade at a discount to similar calls.

25% Delta deviation in rights contracts choose Seconditcoin in Deribit 1 month | Source: Lavitas

As of December 6, 2023, the BTC options market maintains a relatively neutral stance on call and put pricing. The rise to $45,910 on January 2, 2024 is no exception. The data differs from the Bitcoin futures market, casting doubt on the argument that institutional traders have inside information about the outcome of spot ETF approvals.

In short, the spike in CME futures spreads does not reflect broader market sentiment, which remains bullish but is not unusual as Bitcoin prices hit their highest levels since April 2022.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to Cointelegraph