What are the highlights of steel industry recovery in 2024?

[ad_1]

©Reuters.

©Reuters. According to Donghai

Investing.com – Petroleum Securities (HN:) comments on the steel industry suggest that steel consumer demand will continue to restrain recovery momentum in 2024. Domestic consumption remains weak, and although it improved at the end of the year, it was not enough to drive the steel industry back to growth.

After the first 11 months of this year, the output of various steel products reached 25 million tons (a year-on-year decrease of 7.8%), and the consumption of finished steel products reached 23.7 million tons (a year-on-year decrease of 5.6%).

Highlights from Steel export outputIn particular, HRC (HM:) products have made up for the decline in domestic consumption in the past year. Looking for potential markets such as the EU, especially when the ASEAN market is quiet in the second quarter, will help Vietnamese companies diversify their customer base in the context of global steel consumption demand generally remaining weak, and also show that in terms of steel consumption flexibility. Enterprise adaptability.

In the first 10 months of this year, Vietnam exported a total of 9.14 million tons of steel (a year-on-year increase of 30.74%), of which ASEAN and the EU are still the two major markets, accounting for 31.46% and 24.12% respectively.

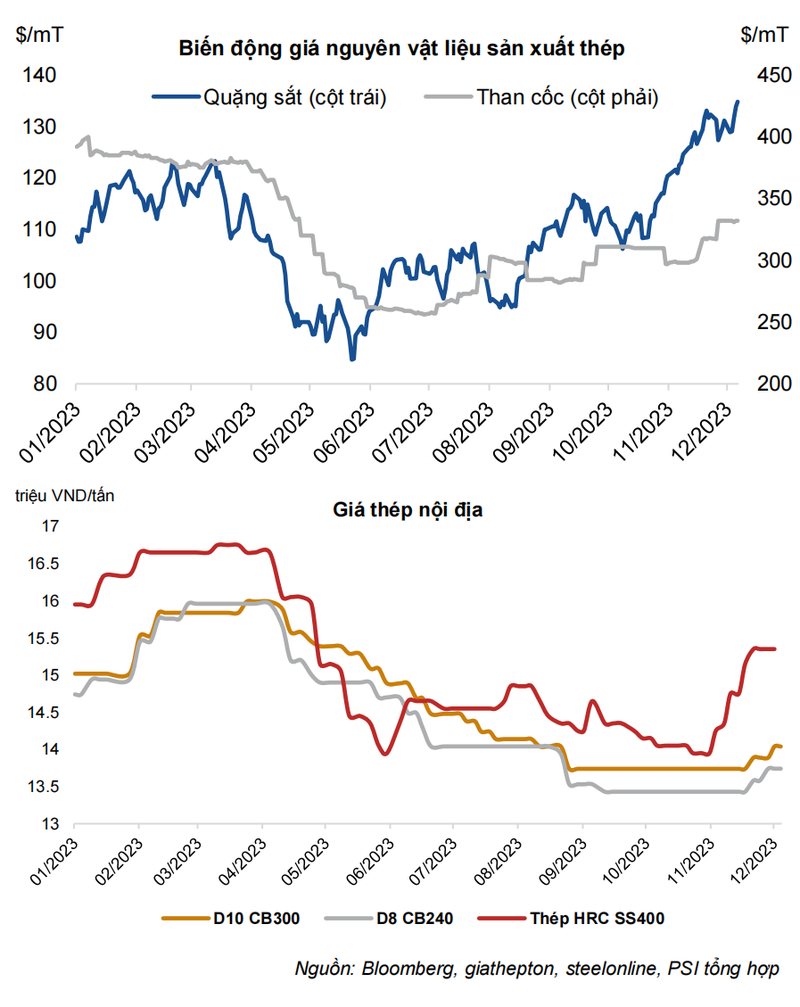

The selling price of steel fluctuates depending on the raw materials. Low consumption makes it difficult for companies to increase steel prices due to skepticism from end users. Therefore, steel sales price trends mainly rely on fluctuations in iron ore and coking coal prices to adjust gross profit margins. Iron ore and coking coal have had an unpredictable year.

In the first half of the year, limited consumption caused prices of both products to fall sharply. Many iron ore or coal mines are operating at a loss, and commercial and export activities have come to a standstill. However, ore and coal prices rose again in the second half of the year due to the following reasons: China ordered a limit on steel production equivalent to 2022 levels, and supply was strictly controlled. Monetary policies and support plans to stimulate the Chinese economy, especially real estate companies.

PSI It is believed that the steel industry still needs more time to recover after the crisis, especially domestic consumption. Export activities of steel products such as construction steel and hot-rolled coils will still be promoted. But it can also be seen that the steel industry has bottomed out and needs the boost of domestic consumption to enter the development stage of the new cycle of the industry.

In addition, some comments on leading companies in the industry:

Hoa Huat Group Co., Ltd. (HM:)

- Its industry-leading position enables HPG to set steel prices that are better than those of other companies, thereby proactively optimizing gross profit margins.

- Able to export construction steel and hot-rolled coils to foreign markets such as the United States and the European Union…

- Closed production cycles help HPG optimize costs incurred.

Huasen Group Co., Ltd. (HM:)

- Benefit from exporting galvanized steel sheets. HSG currently leads the market in consumption of this product.

- HSG’s HRC stocks have a lower price base. Due to the gradual recovery of ore and coal prices, the price of hot-rolled coils has once again shown an upward trend, which will drive up the prices of downstream products such as galvanized steel and create hot-rolled coil trading opportunities for the company.

Nanjin Steel Co., Ltd. (HM:)

- Amid limited supply, hot-rolled coil steel exports have benefited from price differences in North America and Vietnam, as well as price differences in downstream products such as steel pipes.

- Affected by the gradual recovery of ore and coal prices, the price of hot-rolled coils has once again shown an upward trend, which will drive up the prices of downstream products such as steel pipes.

- The Nam Kim Phu My steel plant (valued at VND 4.5 trillion) will be implemented in 2024, increasing NKG’s steel production capacity to 400,000 tons per year.

On the contrary, there are also common risks in the industry: the domestic market’s consumption power may slowly recover in 2024. Export activity depends on world steel demand conditions. The sales prices of steel, hot-rolled coils, galvanized steel, steel pipes, and raw materials such as iron ore and coke are often very difficult to predict and are greatly affected by market supply and demand.