K33 Research: Bitcoin ETF approval will lead to bearish trend

[ad_1]

As the Jan. 8-10 spot Bitcoin ETF ruling approaches, market analysts including K33 senior analyst Vetle Lunde are predicting a sell-off on the news.

Lund cited traders’ risk exposure and the large premiums on derivatives. suggestion The probability of this outcome is 75%, which exceeds the 20% chance of approval.

Despite signs of a bubble in the market, such as futures contango reaching 50% annualized levels, institutional players have continued to build long positions, reflecting expectations of approval. Open interest surged by more than 50,000 BTC in the past three months, driven by expectations of the ETF’s approval.

In terms of retail investors, the financing interest rate of offshore exchanges reached an annualized high of 72%, showing extreme expectations. However, given the aggressive leverage of long positions, the upcoming ETF ruling could trigger a long squeeze.

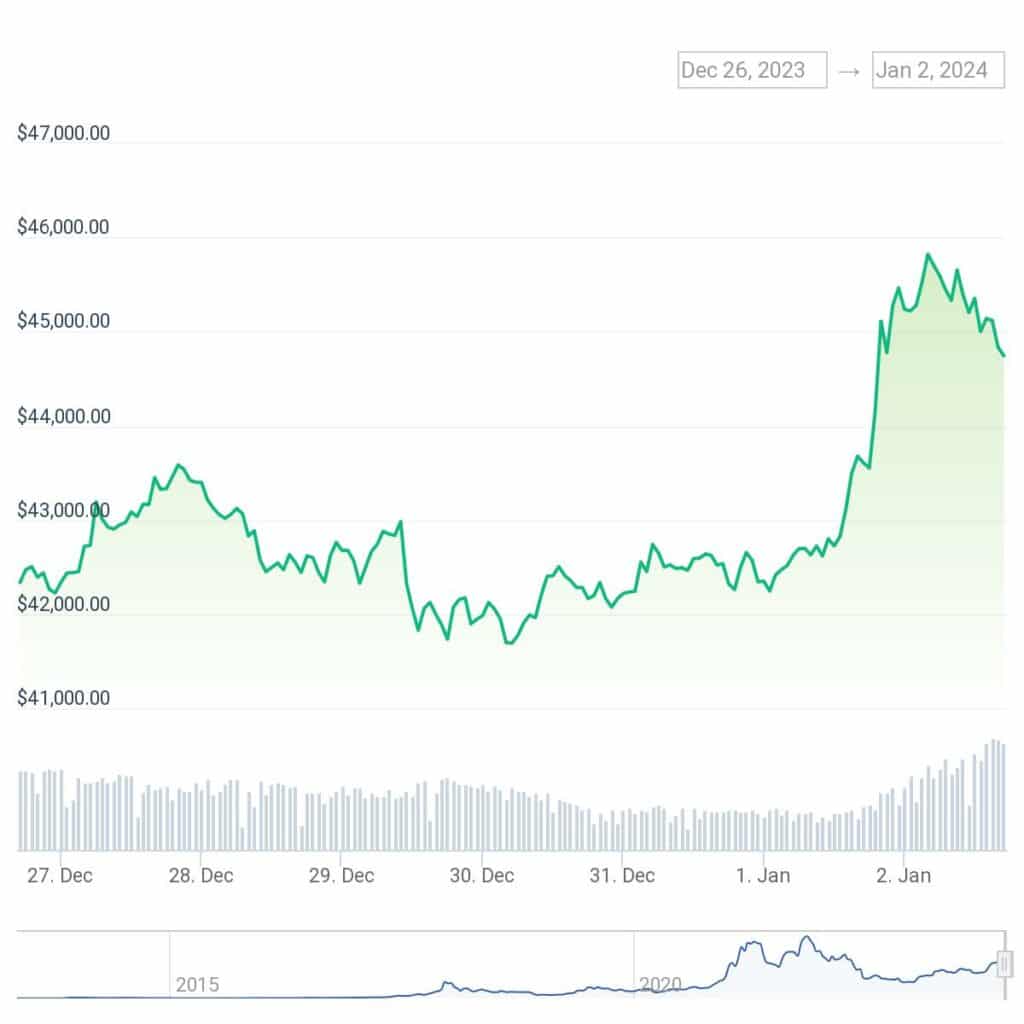

Bitcoin’s recent gains above $45,000 have been linked to growing expectations of US spot ETF approval. Analysts said the current rally could peak on verdict day due to profit-taking and unsustainable premiums.

Looking ahead, Lunde expects a net inflow of at least 50,000 BTC in January, equivalent to $2.3 billion, which will be crucial for the market to continue to grow. While sell-off news events may cause short-term volatility, the combination of potential spot ETFs and April’s Bitcoin halving event could lead to a favorable market outlook over time.