Bitcoin price could hit $50,000 by the end of the week

[ad_1]

On January 2, Bitcoin hit a 21-month high as excitement returned to the cryptocurrency market during the Asian trading session.

BTC 1 hour chart | Source: TradingView

Bitcoin Price Closes Within ETF Target Range

Data from TradingView shows that BTC price strength is building as the New Year holiday comes to an end.

Bitcoin accelerates to $45,922 amid renewed excitement over the first U.S. spot Bitcoin exchange-traded fund (ETF).

There have been a lot of rumors surrounding the ETF, including a possible decision ahead of the official approval date, which begins on January 4th.

Traders are wondering about the source of the recent surge in Bitcoin prices. In an update on X (formerly Twitter), Crypto Tony described a “prediction” for the ETF’s driven trajectory.

source: Crypto Tony

“Bitcoin is trading like an ETF about to be approved,” trader, analyst and podcast host Scott Melker concluded.

Analyzing order book changes, trader Skew notes Some sales activity is underway, but volumes remain relatively quiet.

“Prices have leveled off since spot sales began, and the previous high was a key area for price declines starting at ($44,400),” his latest X post confirms.

According to reports, around the ETF event, BTC’s gains are expected to be around $48,000.

There was no bloodbath when shorting Bitcoin

Although Bitcoin rose 8% in 2024, those who were short Bitcoin did not suffer any major losses.

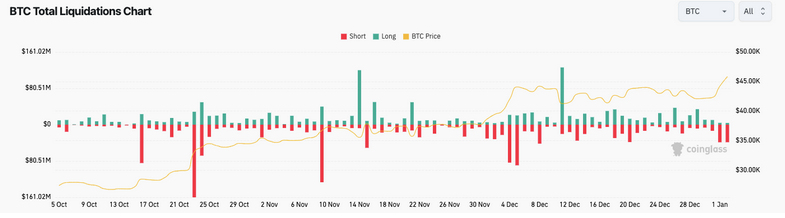

According to the latest data from statistical source CoinGlass, as of press time, only $38 million in short BTC has been liquidated.

Funding rates on exchanges are extremely high, which means that ETF events will first stimulate price increases.

Meanwhile, short liquidations across cryptocurrencies stood at $62 million.

BTC liquidation (screenshot) | Source: coin glass

However, Skew noted that bears were “previously” surprised by the price break above $45,000, as perpetual swap traders were unprepared for the price increase.

“So what’s clear here is that the perpetual market as a whole is largely unaffected by the current moves being driven by this spot, so that means that as the perpetual spot price gets pulled, “volatility is going to take a turn for the better.” The feedback loop, especially around $45.00,” he commented.

Matrixport: Bitcoin price could hit $50,000 over the weekend

according to notes A message sent to investors in digital asset management company Matrixport on January 2 said that Bitcoin prices could exceed $50,000 as early as this weekend due to widespread bullish sentiment in the market.

The anticipated approval of a spot Bitcoin ETF in the U.S., coupled with growing rates of institutional investment in the industry, coupled with reduced supply of the leading digital asset, has the market primed for a “strong early-year buying flow.” During the Asian trading session on January 2, Bitcoin exceeded the $45,000 mark.

Matrixport added:

“Institutional investors cannot afford to miss out on any potential rebound again and must buy as soon as the market opens in 2024. We expect the immediate economic recovery to once again catch investors off guard.”

The company added that Bitcoin’s funding rates remained significantly higher throughout the December holiday period as there were no sellers in the market and prices moved higher, signaling a bullish stance.

As of January 2, BTC’s funding rate has increased to 66%, meaning long traders must pay a 66% annual fee to maintain long positions. This indicator will drive Bitcoin prices higher, possibly topping the $50,000 mark later this week or before the end of the month.

Spot Bitcoin ETF attracts institutional investors

Matrixport also predicts that institutional investors will react quickly if the U.S. Securities and Exchange Commission (SEC) approves the ETF before the expected January 10 deadline.

According to the note, such approval would confirm Bitcoin as a trustworthy investment for institutions, thereby driving up its value.

However, Matrixport noted that Bitcoin may experience scarcity due to institutional capital inflows, with an estimated $5-10 billion in fiat currencies struggling to obtain sufficient assets from exchanges, in part due to Bitcoin’s turn after setbacks for the crypto industry in 2022. Cold wallet.

Halving and US election will push Bitcoin price higher

In addition to the expected approval of a spot Bitcoin ETF and subsequent institutional exposure, Matrixport predicts that Bitcoin will be on a bullish path. The Bitcoin halving scheduled for April 2024 and the upcoming U.S. election are additional catalysts that could push the asset’s value higher.

Matrixport predicts potential gains from the Bitcoin halving of up to $125,000, citing historical returns of over 192% during the 2012, 2016 and 2020 halvings.

Additionally, the firm highlighted the trend of strong election-year performance in U.S. stocks, which helps create a favorable backdrop for Bitcoin’s upward momentum. Matrixport said:

“Bitcoin’s price action this year may surprise everyone.”

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Mingying

According to AZCoin News