5 charts showing how cryptocurrencies will change in 2023

[ad_1]

After a tumultuous 2022 for the cryptocurrency industry, 2023 has provided some much-needed relief to participants.

From GBTC’s shrinking discount to Binance’s loss of market share, USDC’s shrinkage, Bitcoin NFT growth and the crypto market’s resurgence, here are 5 charts showing how the industry has changed over the past year.

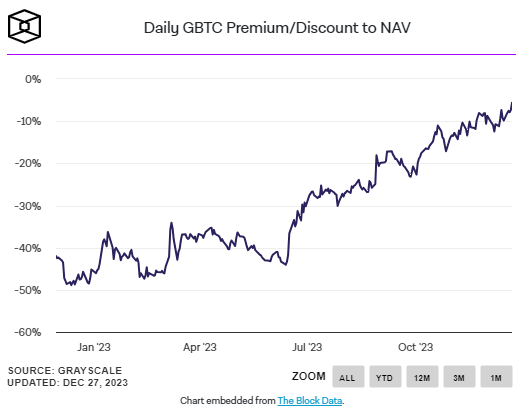

GBTC’s discount to NAV narrows

The Grayscale Bitcoin Trust (GBTC) discount fell to its lowest level in more than two years after Grayscale Investments secured an August 2023 victory over the U.S. Securities and Exchange Commission (SEC) over the GBTC product before converting its flagship product into a spot Bitcoin ETF. the lowest level.

GBTC’s discount to net asset value (NAV) represents the extent to which each stock’s market price is below the value of the Bitcoin it represents. exhibit, data This is the first time since July 2021 that it has fallen below 10%.

GBTC trades at a discount because the shares cannot currently be bought back, so the only option is to sell them to other potential buyers. However, it had previously been trading at higher levels ahead of the 2021 cryptocurrency credit crunch.

The narrowing of this trend – before BlackRock and others filed for a Bitcoin spot ETF in June, the discount had dropped from more than 40% – may indicate expectations that the SEC will approve a U.S. spot Bitcoin ETF, including GBTC. Convertibility) is growing optimism.

according to trading viewIn comparison, GBTC is up more than 320% in a year, while Bitcoin is up 160%.

Source: Block Data

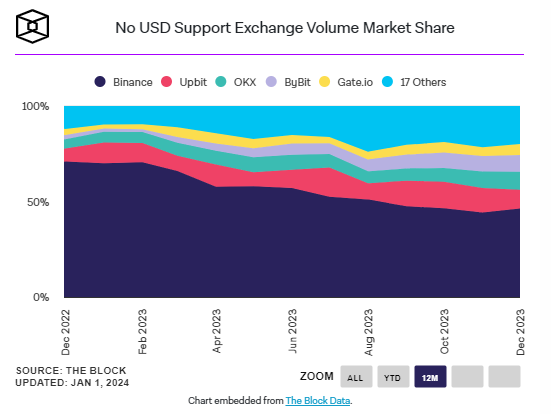

Binance market share gradually declines

Binance has had a disastrous 2023 on the legal and regulatory front.

In November, U.S. authorities, including the Department of Justice (DOJ), the Treasury Department, and the Commodity Futures Trading Commission (CFTC), reached a settlement with Binance, ending a criminal investigation into allegations of money laundering and sanctions violations, marking the beginning of a Settlement Agreement One United States History. The settlement involves a $4.3 billion fine and includes criminal charges against former CEO Changpeng Zhao. Zhao agreed to step down as CEO in a plea agreement with the Justice Department. Zhao admitted violating the Bank Secrecy Act and will pay a $50 million fine. A sentencing hearing will be held in February.

In the United States, the Securities and Exchange Commission (SEC) also filed a lawsuit against Binance in June, accusing the exchange of violating U.S. securities laws, which the regulator said would result in a ban on the company and Zhao from further business in the country. Subsequently, the CFTC also filed a civil lawsuit in March.

In Europe, Binance announced it was exiting the Netherlands after failing to gain regulatory approval. They have also applied to deregister their local entity in Cyprus and are said to be under investigation in France for alleged money laundering.

Binance.US has cut its headcount after the U.S. Securities and Exchange Commission filed a lawsuit against the company, while its business has also shrunk as customers can no longer use U.S. dollars to buy cryptocurrencies on the platform. In September, the company laid off a third of its remaining employees, and Binance.US President and CEO Brian Shroder also left the company amid business uncertainty and recession.

Binance itself is said to have laid off at least 1,500 employees, having made headlines last year with the departure of senior executives, including global head of product Mayur Kamat, Asia-Thailand director Binh Duong Leon Foong, chief strategy officer Patrick Hillman, general counsel Consultant Hon Ng and Business Director Ling Yibo.

Affected by this, Binance’s market share among non-USD exchanges dropped from more than 70% at the beginning of 2023 to about 46% at the end of the year.

Source: Block Data

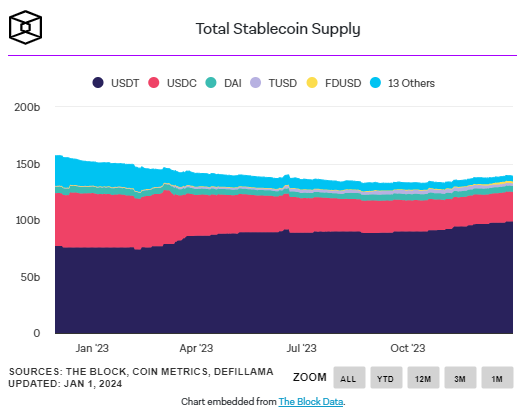

USDC market share shrinks

USDC is issued by Circle, and starting in 2023, its stablecoin market share will be 32%. This is equivalent to $48.1 billion of the total supply of $153.1 billion on January 1. At the same time, Tether issued USDT accounting for 50% (USD 75.7 billion), and the decentralized stablecoin DAI ranked third, accounting for 4% (USD 5.8 billion).

Fast forward to March, USDC fell sharply to $0.88 against the US dollar after Circle declared bankruptcy holding $3.3 billion in reserves at Silicon Valley Bank. The news triggered a sharp sell-off, with investors switching to other stablecoins, such as Tether’s USDT, or leaving the cryptocurrency market entirely – causing USDC’s market capitalization to fall by 15% after just 24 hours. The situation became even more complicated when major exchanges such as Coinbase and Binance suspended USDC exchanges amid the chaos.

Since then, USDC’s market share has continued to shrink as holders reallocated to other cryptocurrencies or switched to fiat currencies last year, with the total stablecoin supply falling to $26.2 billion (19%) and currently worth $138.8 billion.

USDT solidified its dominance in terms of percentage and value, reaching 71% market share with a supply of $98.6 billion. DAI has remained relatively stable, while newcomer First Digital USD (FDUSD) has attracted $1.8 billion, or 1.3% of the market share, since its inception. Binance ended support for Binance USD (BUSD) after issuer Paxos suspended the minting of new BUSD tokens in early 2023, with Binance encouraging users to switch to FDUSD in August.

Source: Block Data

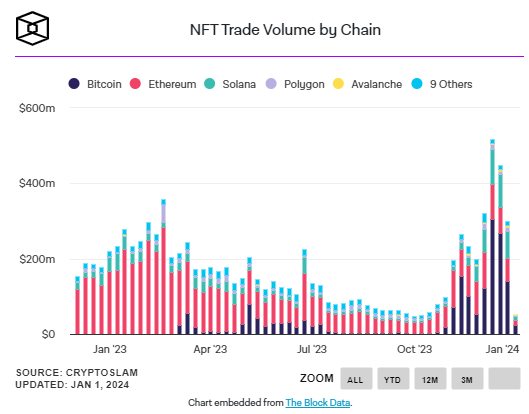

Bitcoin helps the NFT industry make a comeback

Bitcoin has not previously had any connection to NFTs, with users preferring blockchains that are more suitable for trading and minting these assets, such as Ethereum and Solana. However, until Ordinals exploded last year, it became easier and cheaper to put complete NFTs on the blockchain.

Launched in January 2023 by Casey Rodarmor, the Bitcoin Ordinals protocol provides a new way to store and trade digital assets on Bitcoin. Using satoshis (the smallest unit of Bitcoin), users can engrave NFTs, BRC-20 tokens, and other arbitrary data directly on this blockchain, making each block a unique tradable asset.

While the terms “serial number” and “inscription” are often used interchangeably, technically a serial number is a unique serialized identifier of a unique satoshi and an inscription is the content or data attached to that specific satoshi.

In recent weeks, the inscription craze has also spread to other chains, including Ethereum, Solana, Near, Polygon, Celo, and Fantom, causing a surge in transaction numbers amid the ongoing debate over the use of inscriptions. Some consider them to be “spam” that needs to be removed, while others see them as a valid use case that could help the long-term security of Bitcoin by increasing miners’ share of transaction fees rather than reducing block rewards.

Transaction volumes on the Bitcoin network have surged at various times over the last year, coinciding with an increase in inscription-related activity, reaching an all-time high of 633,000 average daily transactions in December, and NFT transaction volumes have taken a hit.

NFT trading volume has been declining since February, but the overall growth is consistent with increased Bitcoin activity. The latest surge in registration demand pushed the metric to a new yearly high in mid-December, with Bitcoin-based NFTs accounting for approximately 59% of peak weekly NFT trading volume of $518 million.

Source: Block Data

Cryptocurrency market recovers again

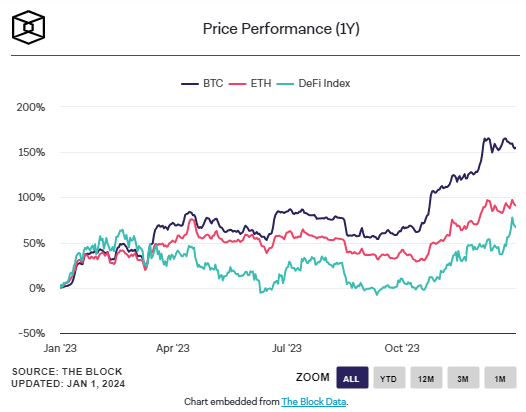

After enduring the trials and tribulations of a tumultuous 2022 for the cryptocurrency market, the market is ending 2023 in a much better place. Since the beginning of 2023, Bitcoin has gained approximately 160%, reaching $16,600. ETH’s market capitalization has lagged the top cryptocurrency since March, but is still up about 94% from $1,200 a year ago.

Source: Block Data

Although the DeFi space is off to a strong start in 2023, it has underperformed BTC and ETH since the spring. However, it was still up about 67% at the end of the year.

Solana was the biggest gainer among the top 10 cryptocurrencies by market capitalization, up nearly 1,000% from less than $10 on January 1, 2023.

Anticipating the possible approval of a Bitcoin ETF spot and the upcoming halving event, there is certainly a lot to talk about in 2024.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to “Block”