Bitcoin breaks through $45,000, and the entire crypto market is full of green on New Year’s Day 2024

[ad_1]

At the beginning of the new year, the greenery is abundant, the market is hot, and we look forward to a “big harvest” in 2024.

In the early morning of January 2, BTC suddenly surged, officially breaking through the sideways range of US$44,000, and hitting a new high of US$45,469 on the first day of 2024.

It is worth noting that on the CME Derivatives Exchange in the United States, the trading price of Bitcoin futures on the first trading day of the New Year in 2024 jumped from US$43,965 to US$47,049, equivalent to an increase of more than 10%.

It is understood that CME is one of the first derivatives exchanges in the United States to list Bitcoin futures contracts and has supported this product since December 2017. In November 2023, CME’s futures trading volume even exceeded Binance.

CME Bitcoin futures 1 hour chart.

However, the sharp increase in BTC prices may be a signal that US institutions and investors are extremely optimistic about the prospects of a Bitcoin spot ETF receiving SEC approval in the next few days (expected from the 5th to January 10th).

![]() SEC meets with Bitcoin ETF spot issuers: Is the future of fund approvals imminent?

SEC meets with Bitcoin ETF spot issuers: Is the future of fund approvals imminent?

In addition to being optimistic about BTC prices and the approval of Bitcoin ETF spot, there are also many differences of opinion and concerns about the potential impact of ETF approval on Bitcoin prices in the short term.

Analysts at crypto options trading platform Greeks.live said that Bitcoin will not see a significant rise on the day of approval as the volatility of Bitcoin options gradually decreases.

Similarly, VanEck advisor Gabor Gurbacs predicted that the early development of Bitcoin ETF Spot will be “pretty disappointing,” but ultimately he believes these products will attract trillions of dollars’ worth of capital inflows over the next few years.

On the altcoin front, many other altcoins also recorded double-digit gains compared to 24 hours ago, thanks to Bitcoin’s upward momentum.

Sei (SEI) was the best performing project of the day. The Layer 1 blockchain’s native utility token optimized for digital asset trading has rebounded more than 28% in the past 24 hours and is up 74% on the seven-day time frame.

Other projects in the top 100 such as WEMIX (WEMIX), The Graph (GRT), Mina (MINA), Celestia (TIA), Bonk (BONK), Filecoin (FIL), WOO Network (WOO) gained more than 10%.

Arbitrum (ARB), Stacks (STX), Lido DAO (LDO), Injective (INJ), Pepe (PEPE), Bitcoin SV (BSV), Avalanche (AVAX), Aave (AAVE), Immutable (IMX), Sui (SUI )), THORChain (RUNE), Tezos (XTZ), Solana (SOL), Theta Network (THETA), Algorand (ALGO), Aptos (APT)… increased by 6-9%.

Ethereum (ETH) also rebounded, approaching the $2,400 area. The second-largest asset by market capitalization is up 3.5% from the previous 24 hours and is currently trading around $2,380.

The entire cryptocurrency market on the first day of 2024.

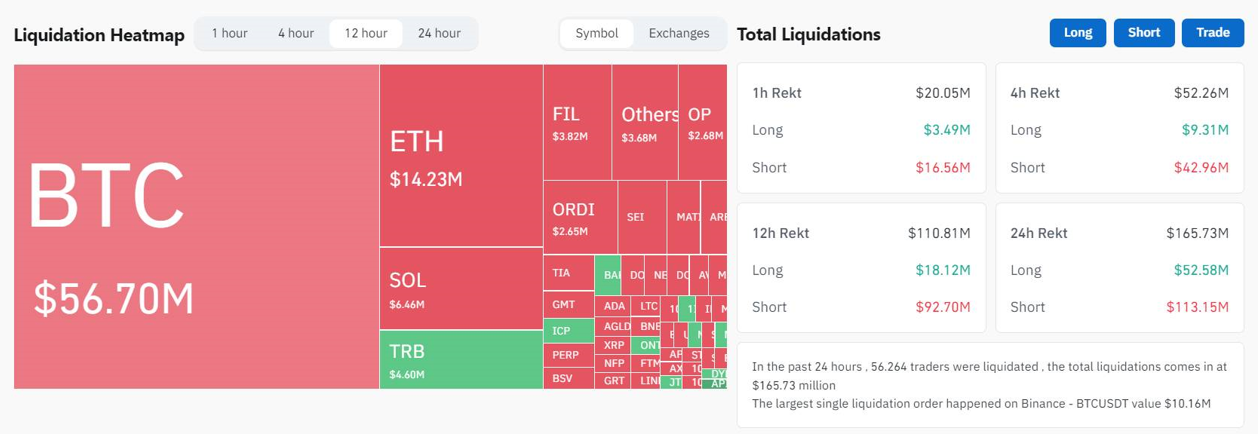

Bitcoin’s latest surge resulted in the cryptocurrency market hitting a record of more than $110 million in derivatives orders cleared in the past 12 hours, with Bitcoin accounting for more than half. The short order destruction rate is as high as nearly 84%.

Cryptocurrency derivatives order liquidation statistics in the last 12 hours.

Current Bitcoin Price

Current ETH price

VIC encryption compilation

related news:

![]() Notable Token Unlocking Schedule for January 2024

Notable Token Unlocking Schedule for January 2024

![]() A look at a series of noteworthy cryptocurrency events in 2024

A look at a series of noteworthy cryptocurrency events in 2024

![]() Fed balance sheet hits lowest level since April 2021

Fed balance sheet hits lowest level since April 2021