Bitcoin “HODL Wave” Pattern Signals Bullish Potential Driven by FOMO

[ad_1]

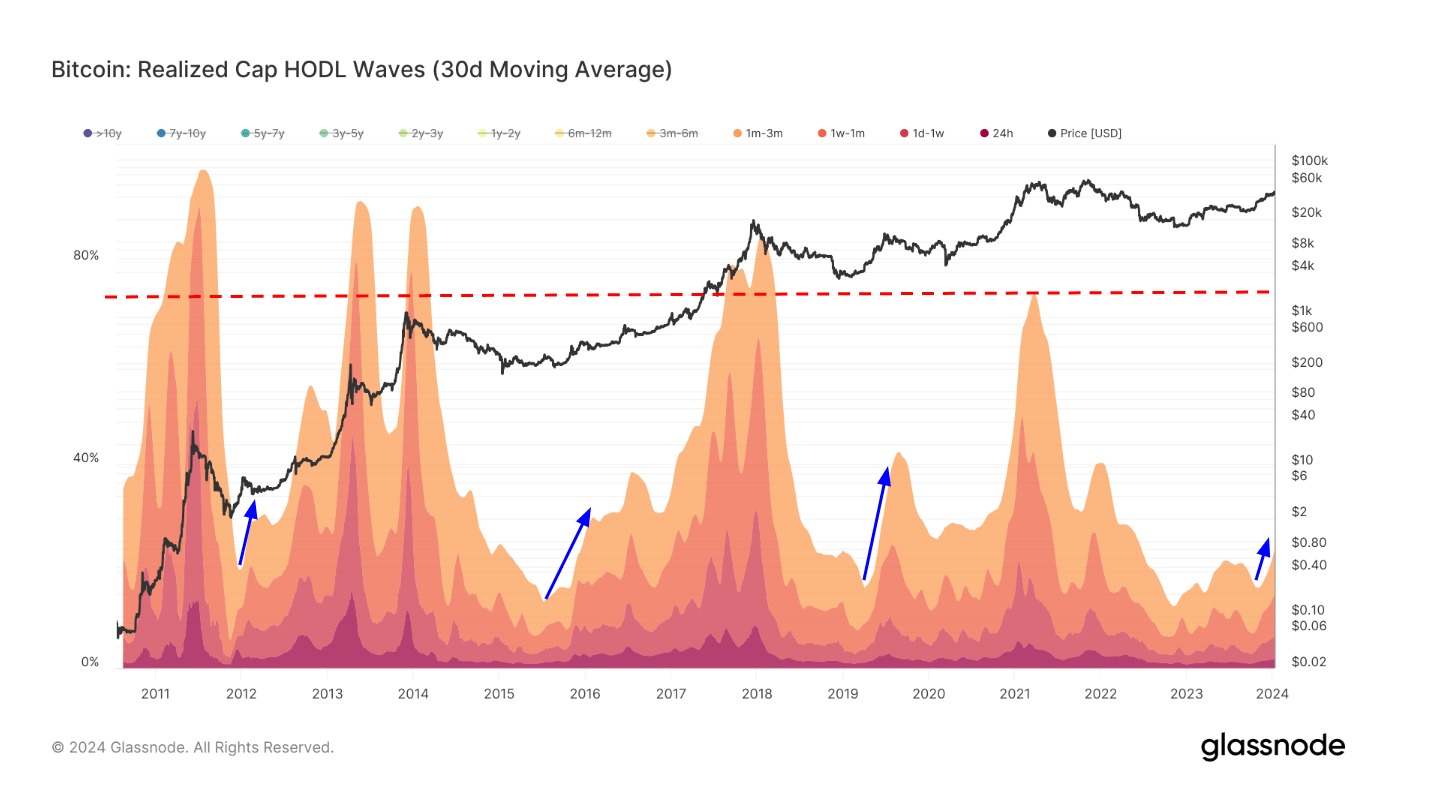

The HODL wave, a visual depiction of Bitcoin’s supply based on when it last moved, reveals an up-and-coming new army in the digital asset space.

Short-term holders are defined as those who hold Bitcoin for less than 155 days. The number of investors holding for three months or less is growing and currently accounts for 14% of Bitcoin supply. These investors (usually speculators) have the ability to liquidate their positions after a few months or become long-term holders, holding Bitcoin for 155 days or more.

When delving deeper into the HODL wave, an interesting trend emerges. When the proportion of short-term holders reaches a certain level, these investors typically switch to long-term holders, a pattern that has been demonstrated in previous cycles. This shift has resulted in these investors holding a larger proportion of the Bitcoin supply.

However, the peak of the cycle occurs when short-term holders become dominant investors, controlling approximately 80% of the supply. This often corresponds with market tops, as these investors tend to push prices higher in a state of excitement known as “fear of missing out” (FOMO) as long-term holders sell off their holdings.

Source: Glassnode

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

Anne

According to Cryptoslate