Teller’s TRB liquidations surge to $70M amid market manipulation concerns

[ad_1]

Whales are said to have liquidated long and short positions in TRB, causing the coin’s price to plummet from $600 to $135 in a matter of hours.

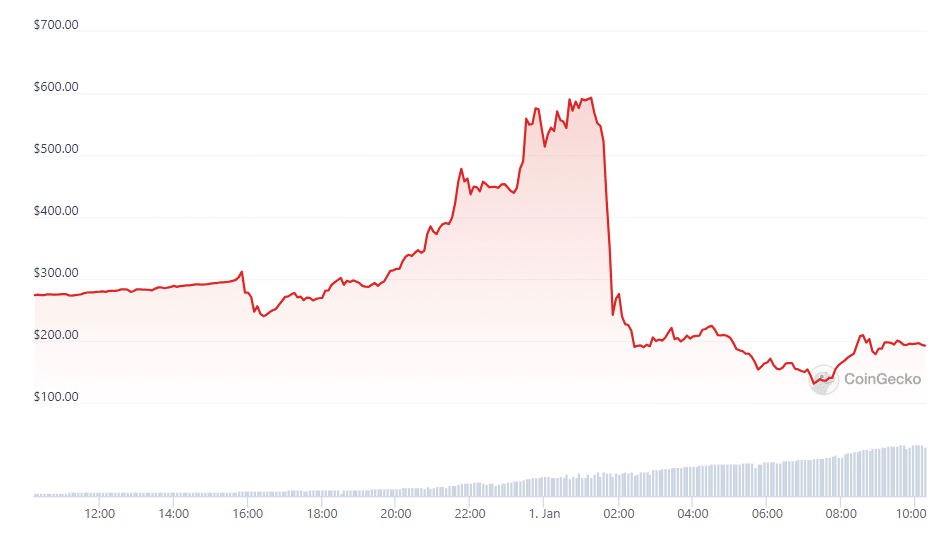

According to data from CoinGecko, Tellor’s native token TRB fell 70% on January 1 from its all-time high of $600 earlier in the day. Market turmoil ensued after whales liquidated their long and short positions en masse. report Provided by cryptocurrency tracking service Spot On Chain.

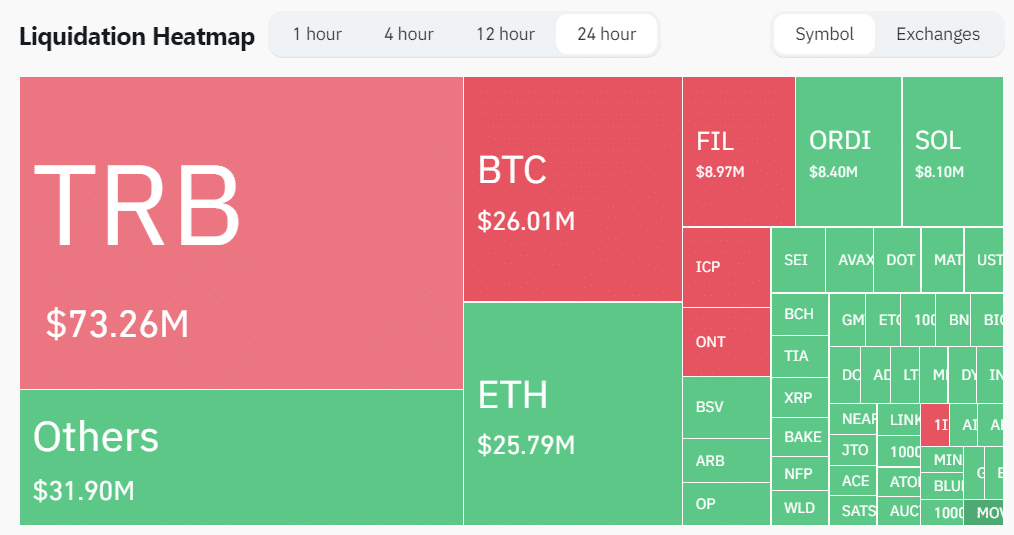

In the past 24 hours, CoinGlass recorded The total liquidation amount was US$233 million, of which TRB’s liquidation amount exceeded US$73 million.

It is worth noting that as of December 31, HTX (formerly Huobi) became the largest seller of TRB positions, opening more than $15 million in TRB short positions on the exchange. OKX and Binance follow with $12.1 million and $6.69 million respectively. Spot On Chain said such violent price swings could indicate market manipulation, noting that TRB whales controlled much of the liquidity while on-chain activity remained low during the pump-and-dump scheme.

As of press time, the Tellor team has not made a public statement on the matter.

Launched in 2019, Tellor is a decentralized oracle network built on the Ethereum blockchain, aiming to provide a decentralized alternative for obtaining real-world data that can be used by smart contracts. The Tellor network incentivizes participants, called miners, to submit and verify data through a process that involves staking the project’s token, TRB.