TVL Arbitrum doubles in one year – ARB prices may continue to rise

[ad_1]

Cryptocurrency market sentiment has been generally bullish in anticipation of the approval of a Bitcoin exchange-traded fund (ETF), with Arbitrum (ARB) prices surging more than 85% in the past month. Additionally, the layer 2 chain has seen its total value locked (TVL) grow steadily over the past week. ARB’s on-chain indicators are also leaning towards future price increases.

Source: Tradingview

The number of TVL Arbitrums will more than double from 2023

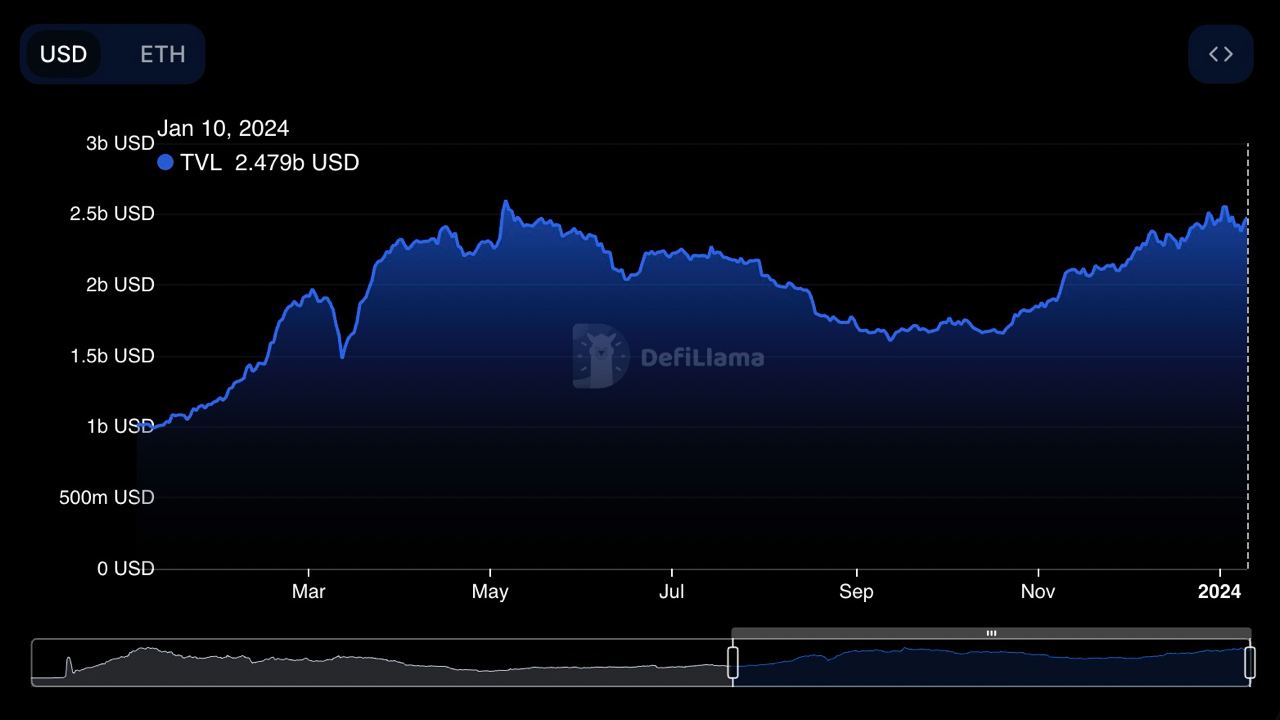

The total value locked (TVL) on the Arbitrum chain has more than doubled in the last year. According to DeFiLlama, TVL increased from $1 billion in January 2023 to $2.47 billion on January 10, 2024.

TVL arbitration | Source: DefiLlama

An increase in TVL usually indicates the level of engagement between the chain and users and the demand from market participants. Meanwhile, ARB price has increased by more than 85% in the past 30 days.

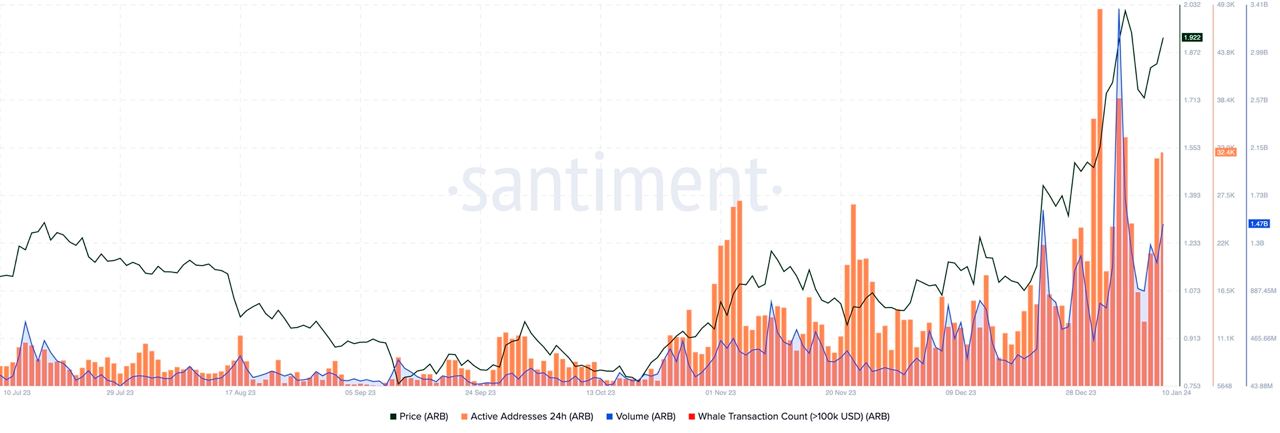

On-chain metrics such as active addresses and transaction volume on Arbitrum have also continued to grow since January 7, according to Santiment data.

Volume and address work arbitration | Source: Santiment

Arbitrum currently dominates the Layer 2 market with a 49.2% market share in an ecosystem worth $19.91 billion. L2Beat data shows that Optimism is behind Arbitrum, with a market share of 28.41%.

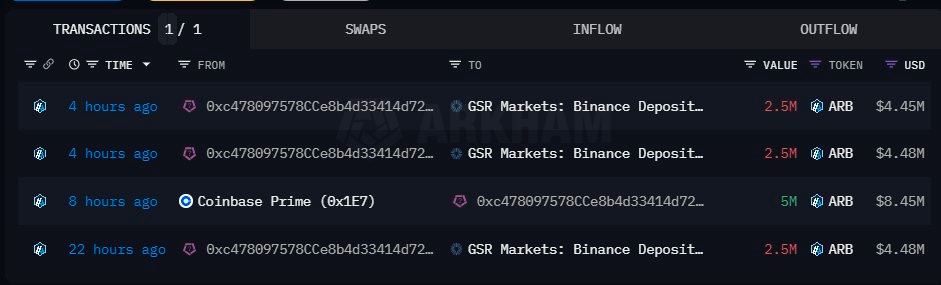

Therefore, Arbitrum’s on-chain indicators support the bullish thesis for ARB. However, it remains to be seen whether the price will correct or continue its upward momentum. Today, analyst OnChainDataNerd notes Market makers have sent large amounts of ARB to exchanges in the past 24 hours. Generally speaking, an increase in supply on an exchange is considered a bearish signal as it is more likely to be sold.

Market makers GSR and Wintermute sent 7.5 million and 4.78 million ARBs to the exchange respectively. These deposits total more than $20 million ARB. It is unclear whether the tokens will be sold or held in exchange wallets.

Market Maker Trading | Source: OnChainDataNerd

If market makers “run out” of inventory, it could increase selling pressure on ARB and negatively impact prices.

You can check coin prices here.

Join Bitcoin Magazine on Telegram: https://t.me/tapchibitcoinvn

Follow on Twitter (X): https://twitter.com/tapchibtc_io

Follow Douyin: https://www.tiktok.com/@tapchibitcoin

HomeHomepage

According to FXStreet