Fidelity plans to lower Bitcoin ETF spot fees to 0.25% due to industry fee competition

[ad_1]

Fidelity disclosed in a recent S-1 filing that it aims to lower fees on its upcoming Bitcoin ETF to 0.25%.

The development marks a significant drop from the previously set fee of 0.39% announced on December 29. Additionally, as the latest report states, Fidelity intends to waive this fee for market participants until the end of July. Archive.

U.S. companies racing to launch the first spot Bitcoin ETFs are in a fiercely competitive market, slashing fees ahead of expected approval from the U.S. Securities and Exchange Commission (SEC). Earlier this week, asset managers including Bitwise, WisdomTree, Invesco and Valkyrie were known to significantly reduce fees, as seen in their recent filings.

It is widely expected that a spot Bitcoin ETF may receive approval from U.S. financial regulators in the near future, with trading expected to begin on January 11.

Jan van Eck, CEO of VanEck, another company applying for a spot Bitcoin ETF, told CNBC on January 9 that he expected trading in the company’s proposed fund to begin on Thursday.

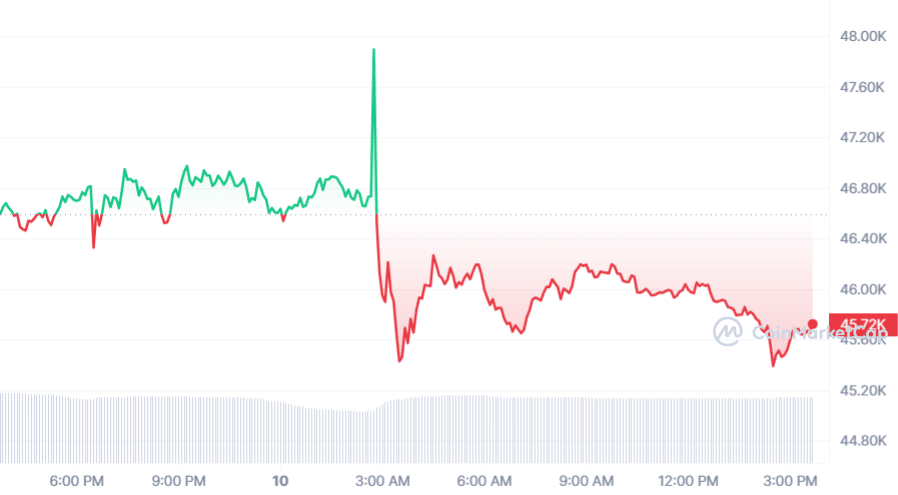

In another development, the U.S. Securities and Exchange Commission (SEC) reported a security breach in its X account on January 9. The account posted a fraudulent tweet claiming that the spot Bitcoin ETF application was approved, causing the price of Bitcoin to suddenly drop to approximately $45,723. As of this writing, the price had exceeded $47,000 on January 9.

Following the incident, SEC lawyers confirmed in a discussion with Fox Business that the regulator would conduct an internal investigation into potential market manipulation.

Despite the security breach, Bloomberg Intelligence research analyst James Seyffart remains optimistic about the ETF’s decision timetable.

In a Jan. 9 X post, Seyffart maintained expectations that the potential approval is on track, with trading likely to begin on Thursday.